The fourth quarter of 2019 is upon us and the starting gun for the race to year-end (and a new decade ahead) sounded! Fourth quarters are book-ended by planning for both endings and new beginnings: working to close out the current year and planning for the year ahead.

Taking stock should be an easy task. Yet, as apartment investors and developers, we operate, transact, and plan in an opaque environment. Our world is equal parts signal and noise, information and obfuscation. Truly understanding job growth, rental rates, vacancy, sales pricing, and the like – all indicators upon which we rely – takes a deft mind and more information than is generally available.

The ability to gather, synthesize, plan around, and execute on key metrics for our businesses defines our future success. Economic and financial markets are complex, and our success is dependent upon making them less so – a process of distillation of information and insight into theses and action.

In our world, that of apartment investments – or as my wife conjugates into “apartmenting” – such distillation results in what I call “The Five Horsemen of Apartmenting”:

- Job Growth

- Development Pipeline

- Rent Trends

- Vacancy Levels

- Sales Pricing

Looking at the state of these metrics is essential to both taking stock of where we are today, conquering the quarter ahead, and preparing for 2020, which is nearly upon us.

Job Growth

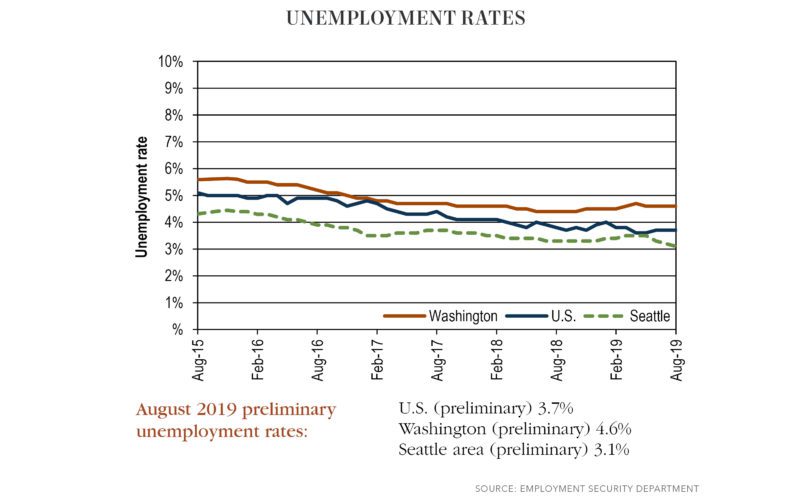

Regional job growth continues to impress. Year-over-year, the Seattle-Bellevue-Everett metropolitan area added approximately 42,000 jobs, compared to 39,000 the previous year – the trend we want to see. As a result, unemployment currently resides at an impressively low 3.1% for the Seattle area.

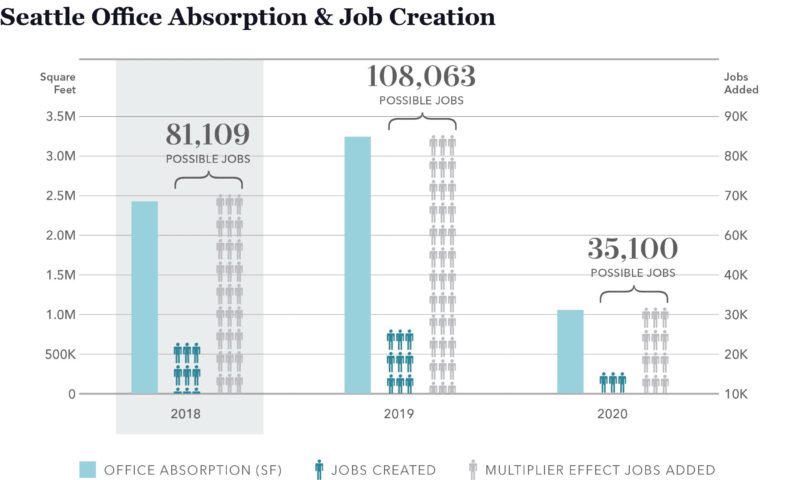

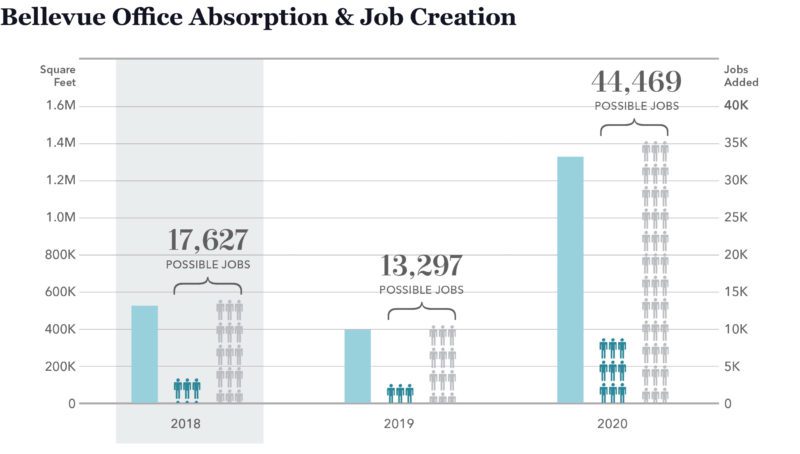

Economists predict that our area will continue to experience strong job growth for the foreseeable future, which is well supported by office absorption in both Seattle and Bellevue. Measuring from 2018 through pre-leased spaces in 2020, companies leased 8.5 million square feet.

To access this data, download our 2019 Employment & Development Market Study.

Estimating 150 square feet per employee and a multiplier effect of 1:4 (four “support” jobs for one high-salary job), lends support for the creation of 200,000 jobs in our region – which comfortably equates to +40,000 jobs a year for the next 4-5 years.

Development Pipeline

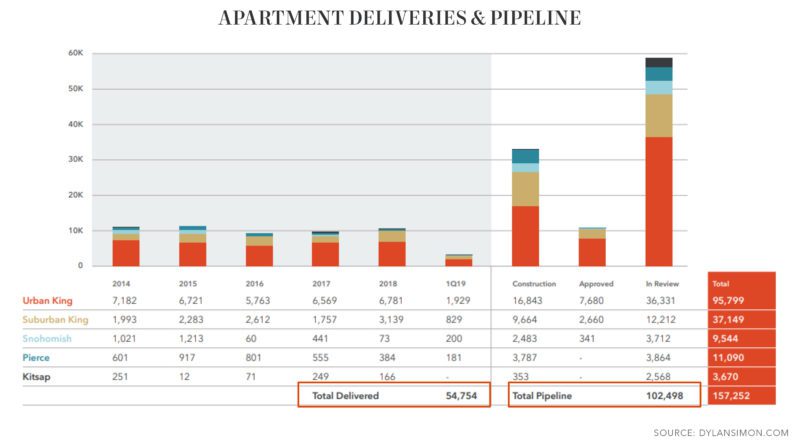

Apartment developers continue to add projects to the regional apartment development pipeline, yet they are becoming more spaced out in both time of delivery and location. We are currently in the highest period of deliveries, averaging approximately 10,000 units delivered each year.

To access this data, download our 2019 Employment & Development Market Study.

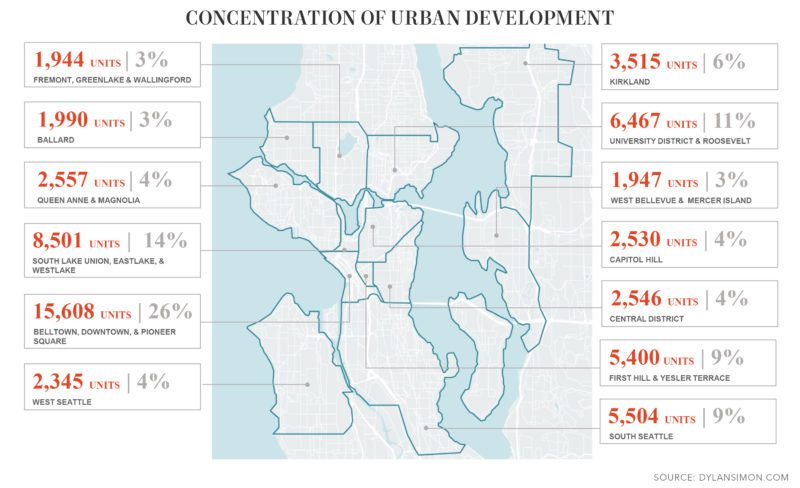

After we crest this peak in 2021, the number of units delivered each year will taper. As well, in previous years of this market cycle (2012-2016), over 80% of new apartments were built in urban locations. Currently, the development pipeline is around 100,000 units with 60,000 units planned for urban neighborhoods – demonstrating that this percentage shifted to about 60% urban / 40% suburban as developers expand to more suburban markets and pursue transit-oriented development sites.

No. Units in Pipeline | Percent Increase of Current Inventory

The development pipeline remains robust; however, understanding the impact of new development in the quarter and year(s) ahead requires a much more granular analysis of individual submarkets and date of delivery / required time of absorption. Currently, absorption is keeping pace with deliveries at a macro-market level, yet understanding rent and vacancy trends in each submarket demonstrates the interplay between demand/absorption and new deliveries.

Rent Trends & Vacancy Levels

We are excited to share that we are launching our latest research report on Rent & Vacancy on October 18th, providing a very detailed market-by-market analysis. The following overview highlights headline trends in the market.

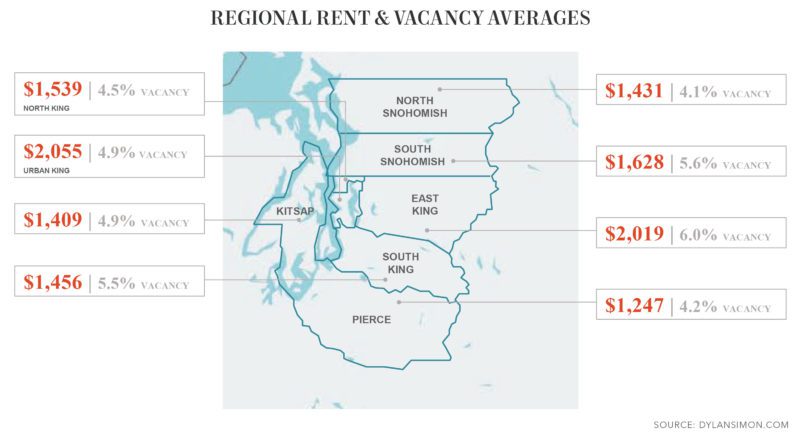

At the regional level, rental rates are bound by market averages from approximately $1,250/month to $2,000/month. These rental rate levels correspond to vacancy rates of 4.0% to 5.9%.

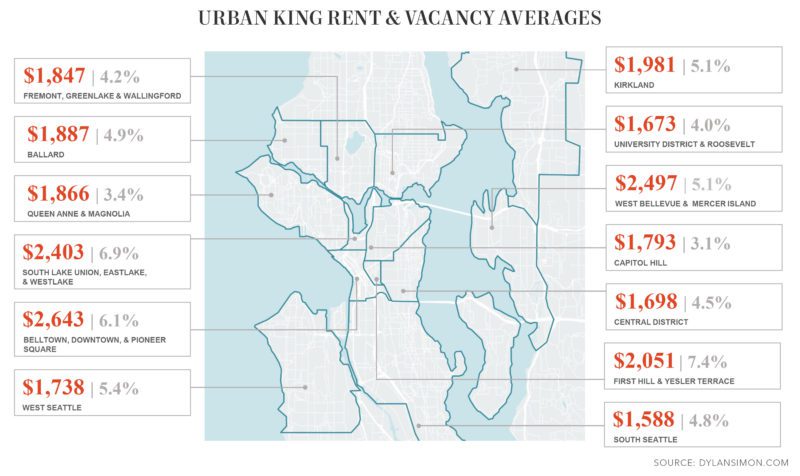

Turning to the region’s urban neighborhoods, the spread in rental rates and vacancy rates widens – explained by the aforementioned interplay between demand/absorption and delivery of new apartment units.

In our research report, we provide 15 years of rent and vacancy trends by region, market, and submarket. The data shows that our region continues to demonstrate an impressive level of year-over-year rental rate growth and stable vacancy rates. A more granular analysis at the submarket level provides insightful data on the interplay of rent growth and vacancy rates – often a trade-off – and how the concentration of delivery of new apartments are impacting particular markets.

Sales Pricing

Sales prices are a terrific bellwether for the health of the apartment investment market. Interestingly, sales pricing trends we are seeing in the local apartment market are both an indication of the health of the local market and a testament to lack of confidence in other capital markets, both geographic and asset-class specific.

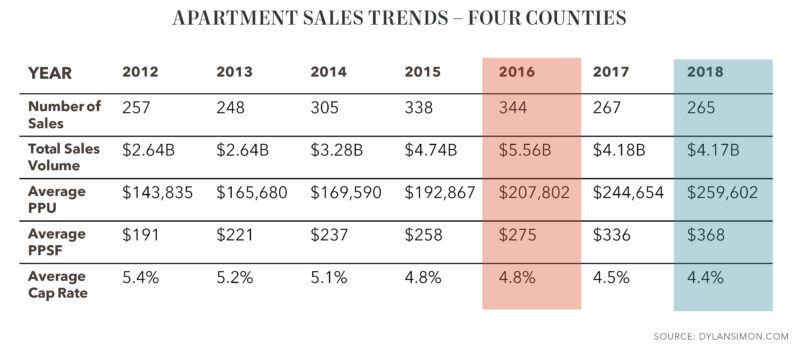

Looking back over this current market cycle, clearly 2016 was the peak in sales volume, yet since that time sales prices continue their upward velocity measured in price-per-unit, price-per-foot, and capitalization rates.

To access this data, download our 2019 Puget Sound Apartment Sales Market Study.

Year to date 2019, our region crested just over $4B in sales volume and 250 buildings sold. With the impending excise tax increase effective January 1, 2020, we expect to see a massive number of sales in the fourth quarter, possibly pushing 2019 sales volume past that of 2016.

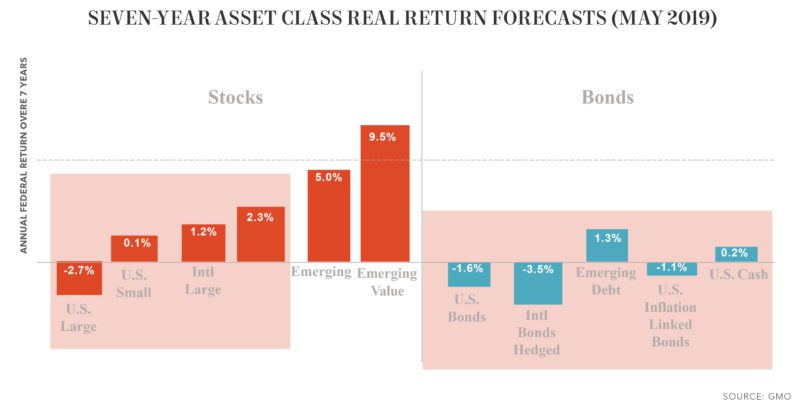

Capitalization rates continue to hover around the mid-4 cap range and given the strength of our market, low treasury rates / cost of capital, and the dearth of stable/predictable alternative investment options, we see the low cap rate environment continuing through 2019 and well into 2020.

Looking to predicted returns in the stock and bond markets, it’s no surprise that capital continues to find a home in commercial real estate – specifically apartment investments.

Our Look Ahead

It’s interesting to think that a century has passed since the Roaring 1920s. What will the year 2020 and coming decade of the ‘20s hold for us?

We’re certain that Seattle and the Puget Sound region will outperform both the nation and global markets. We’re also certain that it’s not all calm seas and fair winds.

We are conquering the uncertainty of investment markets by doubling down on market search (expect several research reports from us in the coming months) and outperforming for clients by remaining the most active investment sales brokers in our market segments. Learn more about our extensive expertise here: What We Do.

We are squarely focused on the success of our clients. Please give us a call and Allow us to Turn Our Expertise into Your Profit!