Puget Sound Apartment Rents Maintain Steady Growth as the Market Absorbs 60,000+ New Units Delivered this Market Cycle

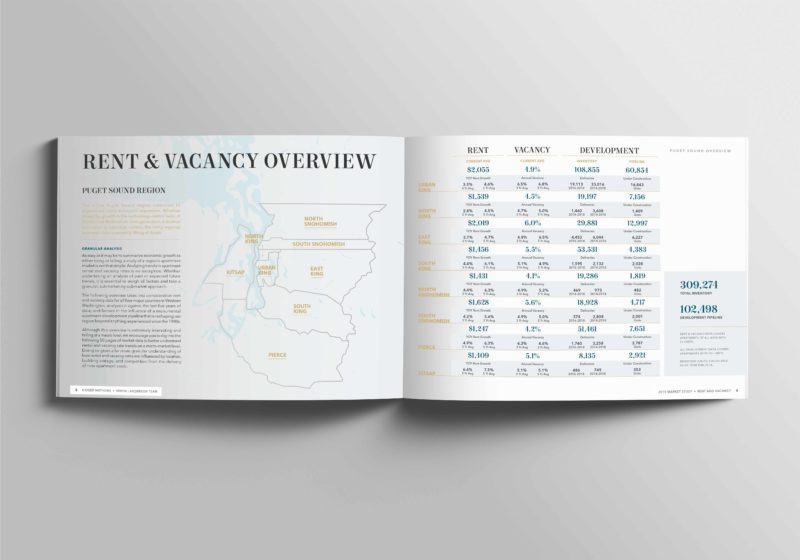

Third quarter rent and vacancy data, released by the multifamily investment team led by Dylan Simon and Jerrid Anderson of Kidder Mathews, demonstrates continued healthy rental rate growth and sustained low vacancy rates for apartments in King, Snohomish, Pierce, and Kitsap Counties.

The 2019 Apartment Rent & Vacancy Market Study analyzes this data by submarket and building vintage, and compares rent and vacancy over the last 15 years to development deliveries to illuminate the strength of rental rate growth and changes in vacancy.

A digital copy of the full 2019 Rent & Vacancy Market Study is available for download at DylanSimon.com/Research.

Urban King County Leads the Market in Rental Rates

The biggest takeaway, that is hardly surprising to anyone who knows the Puget Sound market, is that current average rents per unit are the highest in Urban King County at $2,055. Concurrently, these urban neighborhoods are balancing rental rate growth with vacancy maintaining in the 5% range.

“When we’re analyzing rent and vacancy, the question is two-fold: how much has pricing increased while absorbing the delivery of new apartment units?” reasons Dylan Simon, Executive Vice President with Kidder Mathews.

Among apartments located near Seattle’s urban core, sharp increases in property taxes and expenses force landlords’ hands to increase rental rates, and average rental rates are further pushed based on the delivery of new construction of primarily high-end product.

Seattle is also experiencing a phenomenon witnessed in the San Francisco Bay Area as residents fled from San Francisco proper looking for affordability, livability, and more space. With expanding light rail access, urbanizing nodes, and investment from tech firms outside of the urban core, attention from both renters and investors is now trending suburban in the Puget Sound.

Developers and Investors Taking Note of Growing Demand and Constrained Apartment Supply in Suburban Markets

Puget Sound’s suburban market metrics vary greatly, with East King County leading in current average rent of $2,019 per unit – not far behind Urban King – and Pierce County offering the most affordable average rents of $1,247 per unit.

South King County, which comprises Renton and Tukwila down to Federal Way, offers one of the most compelling stories in the region currently. A rapid decline in vacancy post-recession, and impressive rent growth and average rental rates for units built prior to 2011, are testaments to the strength of these markets.

“What we’ve been saying for years is the renters in Renton used to be in Bellevue,” notes Simon, “and the renters in Kent used to be in a Renton, and they’re moving on down the line. Yet, very little new development occurred in South King over this market cycle.”

And while 40% of development activity across the Puget Sound is now in suburban markets – compared to approximately 10% just four years ago – South King’s development pipeline represents only an 8% increase to existing apartment stock.

Seattle Remains a ‘Safe Bet’ for Multifamily Investment

The Puget Sound is on the path to hit another peak in apartment sales in 2019. While this is partially driven by the excise tax increase effective January 2020 and interest rates dropping, one of the primary factors is that investors recognize that as the market cycle comes full term, Seattle remains a safe, stable, and profitable market.

“In a market that used to supply about 3,500 units a year on average for the last 30 years, we’ve averaged about 10,000 units a year for the last several years,” Simon calculates. “National headlines do a good job of saying we’re oversupplied, but without a more granular analysis, it’s hard to assess what’s actually happening with this new supply.”

Seattle ranks third in the nation for apartment absorption according to CoStar, and with 30,000 units delivering in the next three years, the market appears to be very well balanced for both short- and long-term stability and growth.

“Competition is the new normal. We’re not a continually ascending market without a huge quantity of competition, so understanding how to compete with newly delivery apartment units, both from a physical and operations perspective, is going to be critical to apartment developers and investors in this next market cycle.”

Office absorption is also a key factor for the success of the Puget Sound multifamily market. In the last year, nearly three million square feet of Class A office was rapidly absorbed, and committed leases in Seattle and the Eastside may ultimately create over 250,000 new jobs for the region in the next several years.

Estimating that every five new jobs created in turn creates demand for one new apartment unit, our region will require over 40,000 new units simply to maintain equilibrium with job creation and in-migration.

A digital copy of the full 2019 Rent & Vacancy Market Study is available for download at DylanSimon.com/Research.