As our new parent firm, Kidder Mathews, celebrates its 50th anniversary, I’m celebrating a somewhat smaller milestone: five years of blogging about commercial real estate.

Inspiration may elude me some weeks, this unprecedented market cycle, the ever-outperforming Puget Sound market, and the shock-and-awe real estate headlines from our local news sources have kept the ink flowing steadily from my pen.

And while I’m always ready to weigh in on the latest real estate trends and predictions, ultimately, I continue to write this blog to go beyond just representing clients in the purchase and sale of multifamily properties. It is our team’s “true north” to provide granular market insights that better help clients grow their real estate businesses and success.

For today’s post, in honor of this five-year milestone, I revisit my top five most read blog posts:

- Carbon Fiber

- 5 Predictions for the Seattle Apartment Market

- $6.00 per Square Foot Rent in Seattle

- Predictions for Job Growth in Seattle

- Seattle Ranked #1 for Investment in 2018

Join me as I analyze which predictions rang true, what we got wrong, and even my biggest blog flop.

1. Carbon Fiber

First, kudos to my readership’s willingness to read about a topic so tangentially connected to rent, vacancy, sales, development, et cetera.

Second, does one of my first blog posts – way, WAY back in 2014 – hold water?

I’d say so. The connection between Washington’s carbon-fiber production and growth in our region as an industrial and innovation powerhouse ring even clearer today.

Carbon fiber production is not necessarily a linchpin for apartment lease-ups in and around Puget Sound, yet the intersection of carbon fiber and our industrial base is undeniable. Boeing’s 787 plant is firing on all cylinders. The Everett market is so strong it “landed” a new commercial airport. Blue Origin has hundreds of high-paying aerospace jobs available in otherwise “blue-collar” Kent, WA.

As one of the longest real estate cycles in history wages on, margins thin and risk mounts. Seattle / the Puget Sound is a dollar-cost average market, so you must stay in the game, yet its critically important to make informed, prescient bets. Understanding growth for our region is key to picking the right investment bet today, for outsized returns in the future.

And as a final word on this post, I continue to recommend Enrico Moretti’s book, The New Geography of Jobs (available on Amazon.com).

2. 5 Predictions for the Seattle Apartment Market

Predictions. Readers love to read them, and prognosticators love to make them to sell newspapers, so to speak. Revisiting them to assess accuracy, however, is a rarer beast.

This post was written nearly 2 ½ years ago (March 2017), so it’s had some time to age – at least enough time to see if we are trending towards cabernet, or more towards vinegar.

Prediction 1

Urban Core Rent & Vacancy: Older, smaller buildings will experience +6% rent growth until they close $350-$400 gap with new buildings

Short Answer: True

Longer Answer: Sorta true

The thesis was that rent growth would taper off for newer buildings as demand caught up with supply, while at the same time older building’s owners would begin to increase rents (both to combat rising costs and because more small buildings were beginning to trade hands).

What really happened?

Older buildings did experience phenomenal rent growth, and rents in these buildings are still trending up. The “control group” (aka newer buildings) would need to have flat rent growth for this prediction to remain completely accurate, and I’d say in 2017 and 2018 rent growth was relatively flat. Yet, 2019 has shown massive absorption – evidencing that demand continues to outstrip supply.

I guess its time for an updated prediction.

Prediction 2

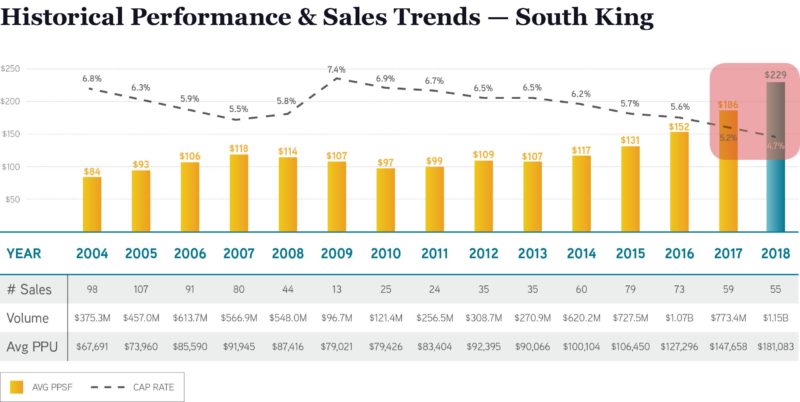

Sales: Suburban markets will continue to outperform urban markets for the next 24 months

Given that this was a 24-month prediction, timing is perfect to assess whether its destiny is manifest.

Looking at urban sales trends, pricing (gauged on both PPSF and cap rate) remained fairly flat the last two years.

Using South King as a proxy for suburban sales, it’s safe to say that sales in suburban markets outperformed!

Prediction 3

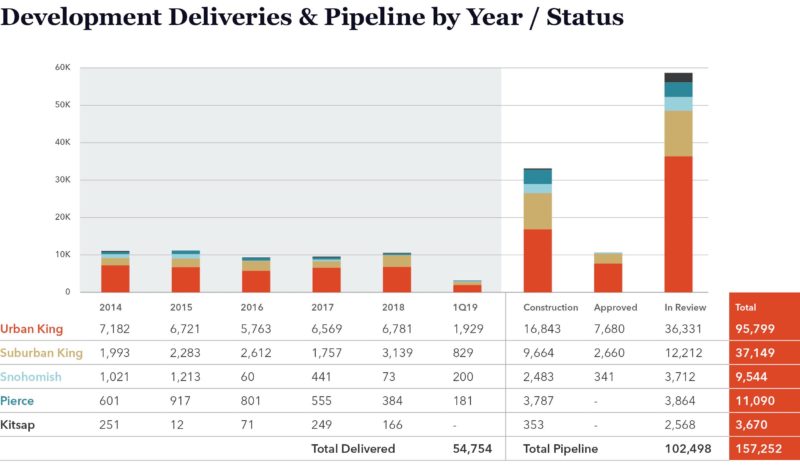

Development: New development will correlate more directly to higher vacancy than it has for the last 4 years

The region experienced an unprecedented volume of apartment development over the course of the last 5 years. In total, more than 55,000 new apartment units delivered since 2014.

Although vacancy is no longer at historic lows of sub-3%, across the region, apartment vacancies remain a healthy range of around 5%, which most consider economic vacancy.

Prediction 4

Development: We will see A LOT of new buildings opening, but fewer new construction sites

This prediction was based on (1) rising construction costs, (2) constrained construction lending, and (3) HALA/land costs.

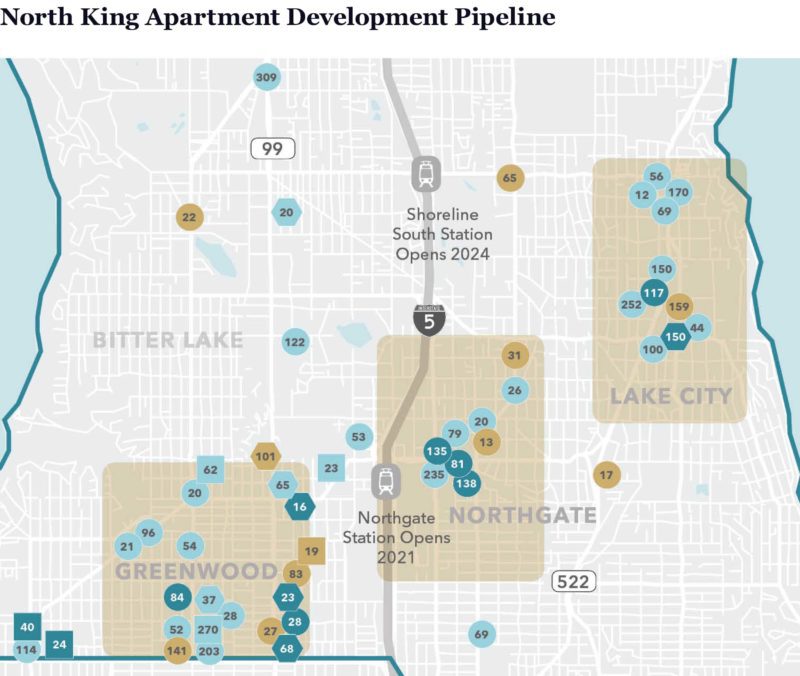

On balance, this prediction is mostly accurate. My analysis needed more granularity to provide for a slow-down in new construction starts in core, urban markets, but a rise in starts in less-urbanized markets (e.g., Greenwood, Northgate, Lake City).

Development Map from our Employment & Development Market Study

Prediction 5

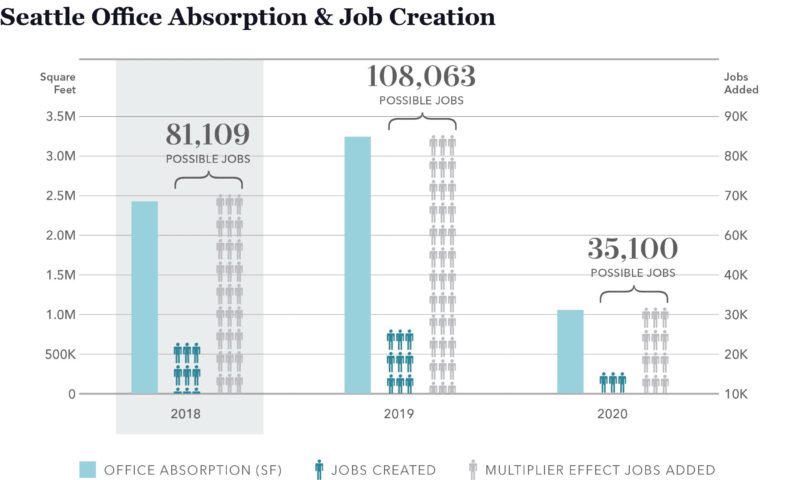

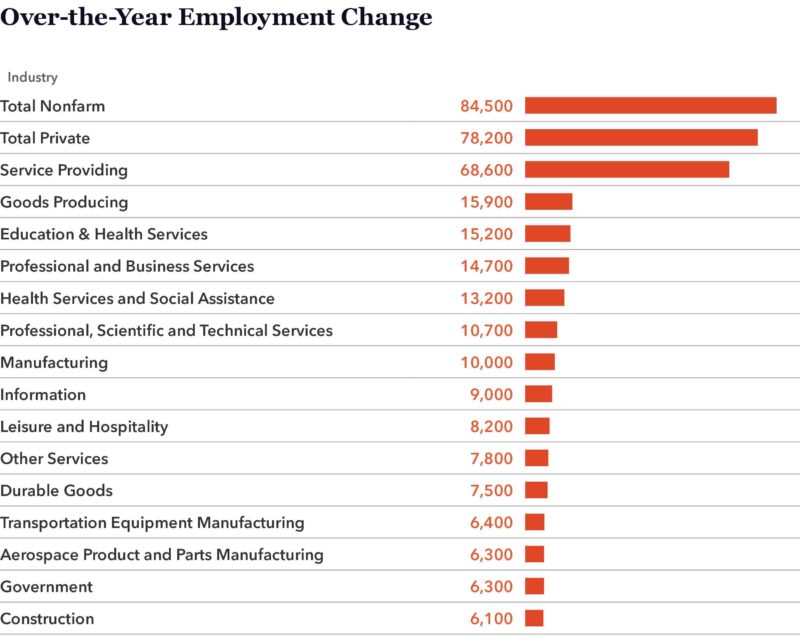

Employment: Job growth will beat all expectations

This prediction knocked it out of the proverbial ballpark!

The best-of-the-best, global-leading technology firms continue their hiring frenzy in our region. Job growth in high-wage sectors reinforces the multiplier effect on hiring in most all other service sectors – fueling stability for all segments of our commercial real estate market.

3. $6.00 per Square Foot Rent in Seattle

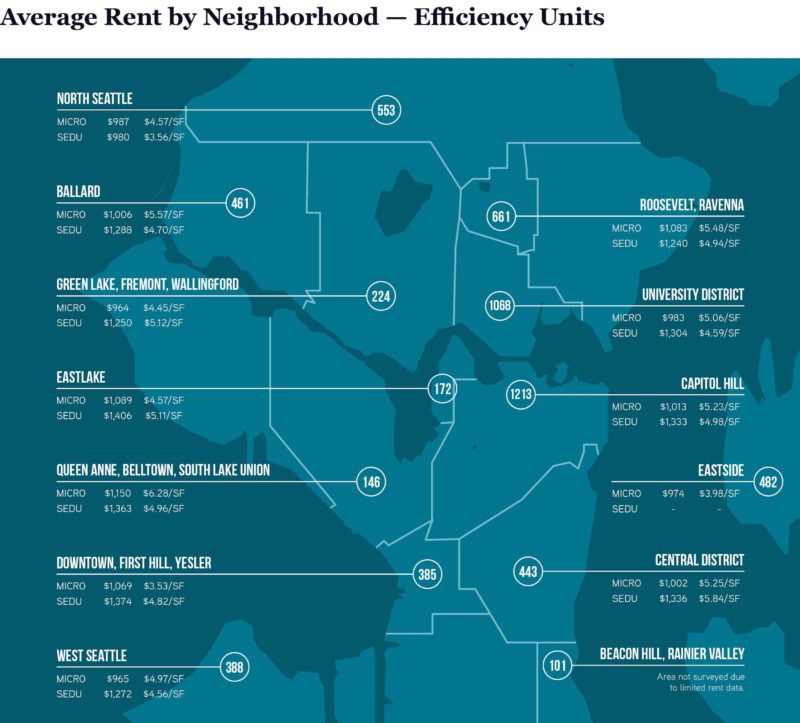

This post from 2017 wasn’t forecasting a new rental-rate ceiling for luxury units in glossy, high-rise apartment towers, but actual rental rates in Efficiency Units.

Our 2018 Efficiency Unit Study, penned by my partner, Jerrid Anderson, provided the data behind micro and SEDU units, demonstrating rental rates cresting $5.00/square foot as of Summer 2018 – with select markets, like Capitol Hill and Ballard, inching towards $6.00/square foot.

A year post publication of this study, we have seen steady rent growth year over year, making $6.00/square foot a benchmark in plain sight for Efficiency Units.

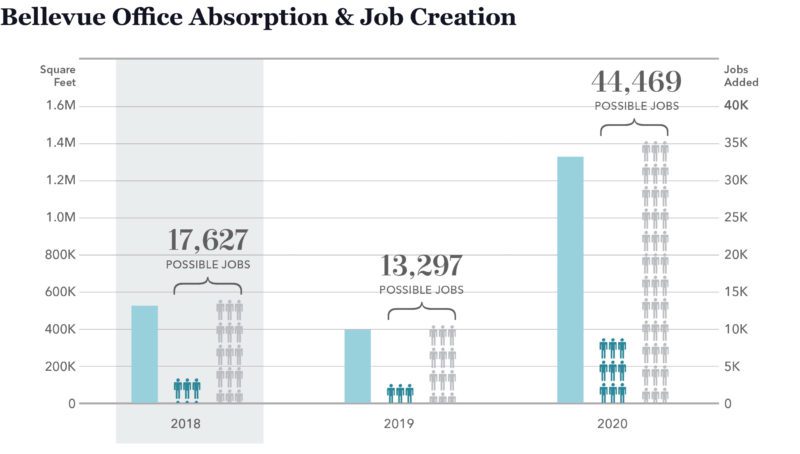

4. Predictions for Job Growth in Seattle

Job growth remains the number one predictor of economic vitality of any commercial real estate market – and, accordingly, a key reason to click to read a blog post. Back in March 2018, Community Attributes was kind enough to allow us to share its insights and forecast on our blog.

How are we doing then versus now, you ask?

A quick visit to Washington State’s Employment Security Departments Job’s Report demonstrates year-over-year job growth is nothing short of phenomenal.

Just when nearly all economists predicted that job growth would taper after banner years from 2014 – 2017, the region not only outperformed the rest of the nation, it outperformed predictions!

5. Seattle Ranked #1 for Investment in 2018

Almost two years ago, the Urban Land Institute named Seattle the Top Investment Market for 2018. Just one year later, in October 2018, ULI came back with its 2019 ULI Emerging Trends in Commercial Real Estate – dropping Seattle to a lowly #16 spot.

Time to hang up the HP 12C and start speculating on tech stocks versus Seattle commercial real estate?

I think not.

What could happen in a year warranting a fall from #1 to not even breaking into the top 15?

An absence of outsized opportunity. Seattle finally made its way into the “Sexy Seven” – a grouping of Tier 1 markets topping every global investor’s radar.

It wasn’t so much that opportunity evaporated from Seattle, but opportunities presented themselves elsewhere – mostly in secondary and tertiary markets.

Regardless of the rankings, both my near-term and long-term bet is that Seattle will have the last laugh. The region’s fundamentals are so darn compelling – and advantageous over cohort markets – that our run to #1 in 2018 is just the beginning.

What dare ULI say about Seattle in their 2020 Emerging Trends Report? We will find out in October!

BONUS: Follow the Fork

This post gets the award for my favorite blog flop. As it turns out, most apartment investors like to read about the Holy-Quintuple: rent, vacancy, sales, development, and jobs.

Reading about food? Not so much.

In this blog post, I correlate burgeoning “foodie” designation neighborhoods to up-and-coming real estate markets – a trail of breadcrumbs, if you will.

I mentioned Beacon Hill as an up-and-comer, and I might have been early in 2015, but I don’t think I was wrong. I also mentioned Georgetown – another neighborhood to which I remain committed.

A few others on my list: Greenwood, Bothell, White Center, and Burien.

Check back in another 4 years and let’s see where the cookie crumbles!

And a special shout-out to my mother, Gayle. I think she is the ONLY person who read this post back in 2015!

We look forward to the next five years of real estate blogging. And if you think that writing does not go hand in hand with investing, maybe you haven’t picked up your copy of The Intelligent Investor lately.

Please give us a call to discuss your goals – whether buying, selling, developing, or investing in apartment buildings.

Allow us to Turn Our Expertise into Your Profit!