Puget Sound Employment Forecast Supports Continued Apartment Development

40,000+ New Apartment Units Needed to Support a Projected 200,000 Jobs

Seattle, May 23, 2019 – Colliers International’s Seattle Multifamily Team released the second issue of its 2019 Apartment Market Study, analyzing employment trends and the current development pipeline for 10+ unit apartment buildings in King, Snohomish, Pierce, and Kitsap Counties.

“Why pair employment and development data? The interplay between job creation and both apartment demand and absorption is fundamental to any sound investment thesis,” Dylan Simon, Executive Vice President, explained.

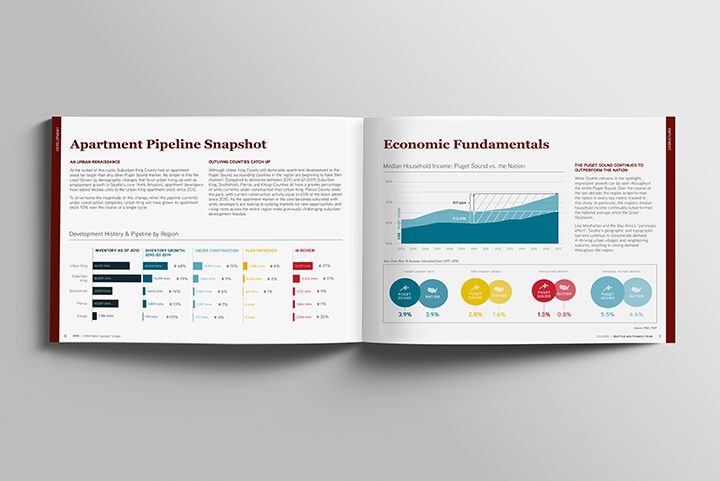

Since 2010, the region experienced a staggering 30% increase in apartment inventory, with 62% of those new apartment units delivering in Urban King County alone. This amount of new supply was necessary to keep up with record-setting job growth driven by the tech sector.

“As the current market cycle matures, investors are considering future growth in our region over the next five to seven years,” commented Simon. “Employment fundamentals indicate that the Puget Sound is well positioned to absorb the 33,000 apartment units currently under construction, and the pipeline for future development beyond that.”

Based on current office leasing activity in Seattle and Bellevue alone, a projected 200,000 professional and support jobs will be created in the next several years. Estimating that every five new jobs in turn creates demand for one new apartment unit, the region will require more than 40,000 new apartment units to maintain equilibrium with job creation and in-migration.

Development Trends

Despite the heavy concentration of new developments in Urban King County, developers are finding opportunities in suburban nodes and along transit lines, both existing and future. Within high-demand neighborhoods such as Ballard and Fremont/Wallingford, we are seeing future developments migrate north along key corridors. Previously overlooked neighborhoods are also gaining favor, including the Central District, which now boasts a larger apartment development pipeline than Capitol Hill.

Outside of the urban core, factors such as transit expansions, Opportunity Zone designations, and cost of living are drawing the attention of residents — and prescient investors.

“South Snohomish is a prime example of this trend. Rising home prices in Seattle continue to drive renters north, and per-capita population growth in Snohomish County outpaced that of King County in 2018,” Simon reported. “Developers are preparing for an even greater surge of renter demand in Edmonds and Lynnwood when the Link light rail extension arrives in 2024.”

Even activity in previously underserved apartment markets, such as areas of Kitsap County, are on the rise. With the introduction of the Fast Ferry, the 30-minute commute from Bremerton to Downtown Seattle can be quicker than the Shoreline commute. Coupled with a limited development pipeline and Opportunity Zone status, expect areas like Bremerton to see strong population growth and increased private investment over the course of the next several years.

A digital copy of the full study is available for download at www.SeattleMarketStudy.com.

In the News:

- More Apartments Are Coming to Seattle and Bellevue – Seattle Business Magazine