This past week, the National Multifamily Housing Council (NMHC) held its 2019 Annual Meeting in San Diego, CA. Considered the “Super Bowl” of networking for the apartment industry, this event draws thousands of apartment owners, investors, developers, lenders, brokers, and other industry professionals.

Beyond the keynotes, panel discussions, and educational sessions, the real meat and potatoes of the event is hyper-connecting with people looking to get deals done. In just 44 hours on the ground in San Diego, we had 20 sit-down, face-to-face meetings with groups focused on buying apartments and/or development deals in Seattle and the Puget Sound region.

What did we distill from these meetings?

The following are the thematic ABCs learned in less than 48 hours at NMHC:

- Aggressiveness

- Bullishness

- Cautiousness

Aggressiveness: Investors are Aggressively Raising Capital

Each year, it seems that real estate investment companies raise larger and larger funds to buy apartment properties – and 2019 is no exception! One may think fundraising would pull back this late in the real estate cycle, but that simply is not the case.

Why are these funds getting so much bigger?

First, success in returns begets success in funds raised. Investment returns hauled in for investors over the last 5 – 7 years of this real estate cycle are nothing short of phenomenal. Such track records make fund raising that much easier.

Second, reinvestment remains strong. Many companies that planned to return proceeds to investors found those proceeds reinvested because clients were impressed by returns and found few alternatives in other markets.

Finally, not only was 2018 a tough year for equity and bond markets, but predictions and prognostications are for 2019 are underwhelming.

True, economic slowdowns impact commercial real estate and apartment investments, yet several factors can outweigh these concerns: stability of apartment buildings’ cash flow in both up and down markets, protection against inflation, and tax advantages of investments in real property.

What does this mean for owners of apartment buildings looking to sell in 2019?

Lots of capital chasing deals. But don’t start planning on how you are going to spend your well-deserved sales proceeds. It won’t be that easy, so keep reading!

Bullishness: It’s not just Millennials still Bullish on Seattle, Investors are Too

We know it’s not the weather, so why are apartment investors so focused on Seattle?

I call it “A to Z” (Amazon to Zillow), others call it FANG (Facebook, Amazon, Netflix, and Google). Whatever acronym or mnemonic is your fancy, it all equates to jobs. Jobs, jobs, jobs!

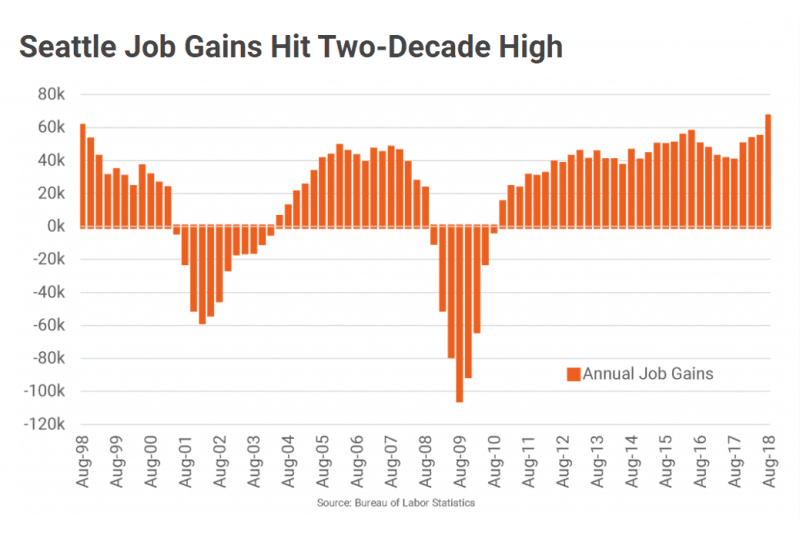

Often, I’ve written about job growth in our region, but it can’t be punctuated enough. Despite any concerns of an economic slow-down, our region continues to add high-paying jobs at a record pace.

As of August 2018, year-over-year job growth hit a two-decade high of 67,000.

So, whether you are from San Francisco, Los Angeles, Chicago, Boston, or New York, getting in on this action is exciting. We met with real estate firms from each of these markets and despite the NYC firms thinking that we are still fur-trappers out in Seattle, they want in!

Cautiousness: Pump the Brakes, we Know that Trees Don’t Grow to the Sky

Yesterday, we sent our 7th Annual Seattle Apartment Market Study to the printer (you can access archived 2013 – 2018 versions HERE). In this study, we analyze sales metrics for more than 4,000 apartment sales in our region, spanning 15 years.

What does the research tell us?

First, trees do not, in fact, grow to the sky and markets still work in cycles (sorry to bum you out on a Friday).

Second, peak sales volume occurred in most all markets in 2015 – 2016, nearly three years ago.

Third, pricing continues to accelerate in some markets, yet year-over-year appreciation slowed in most others.

Look out for the publication of our 2019 Market Study on February 15

Investors are projecting what they believe are realistic growth assumptions for the next several years – and this will impact pricing.

Such assumptions are heavily dependent on each market, submarket, and micro-market. In areas most impacted by deliveries, growth assumptions are modest at best.

Investors are more aggressive in markets where they see room for income growth. In these markets, scant new development is skewing the supply-demand balance, supporting stronger growth assumptions.

Interestingly, many groups are pivoting to focus on upgraded buildings that were marketed as “value-add” opportunities in years past. This opens a new(ish) category of capital not otherwise bound for Seattle/Puget Sound.

Ready, Set, Go!

January is generally a slow month for the launch of new opportunities to purchase apartment investments. As the Great Northwest begins to thaw in February, March, and April, so does the investment sales market.

Give us a call to discuss your apartment portfolio and investment objectives. If you are considering a sale this year, now is the perfect time to talk, plan, and decide how best to position yourself and your investment portfolio for an active year ahead.

Allow us to Turn Our Expertise into Your Profit!