Humans (and, for that matter, computers programmed by humans) are horrible at predicting the future. When it comes to underwriting and valuing commercial real estate, we tend to overestimate upturns (expansion cycles) and, while we are in them, overestimate downturns (contraction cycles).

How can we better underwrite apartment buildings over hold periods? When human intervention fails, I often look to Mother Nature, as she seems to have some experience.

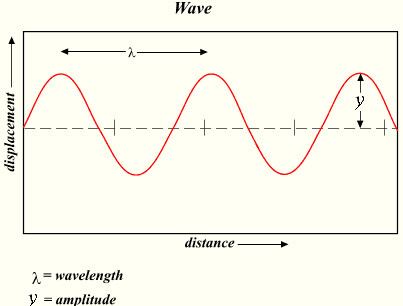

Movements in economic cycles occur in waves, much like movements in nature – and much different from the patterns that our “tried-and-true” modeling practices predict.

So how should we resolve these differences?

Introduction to Modeling

My introduction to real estate analysis was much like others’: 10-year modeling. As I modeled more investments over time (and over market cycles), and gained further exposure to the modeling of others, I noticed the following trends:

When all is rosy, everyone is bullish.

Turning to the less-optimistic times in the real estate market cycle:

I understand the pessimism, but is this how markets and cycles really work?

We tend to get it wrong in both upturns and downturns.

The Real Estate Cycle

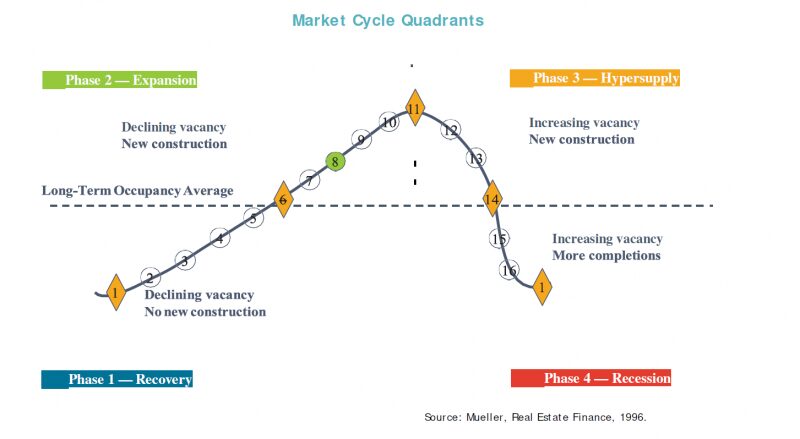

For the avoidance of argument, I will use a model created by Glenn Mueller, Ph.D. I don’t know Dr. Mueller personally, but both he and his research on market cycles are widely recognized and regarded.

Better articulated than my above “wave” graphic, viewing Dr. Mueller’s “Market Cycle Quadrants” we once again arrive at a wave. Not quite a sine wave, but close.

When real estate markets expand, they enter hypersupply. When they contract, they enter recession.

Then, magically, they recover!

Interestingly, our modeling of how our real estate assets are predicted to perform do not follow the same cycle.

How can this be?

(HINT: one of these models is wrong!)

The Seattle Market Cycle

Not all markets behave the same. Differences usually emerge when looking at the amplitude of both peaks and troughs. As real estate investors, we like high peaks and shallow troughs.

Whether by birth, design, or accident, you landed in the Seattle real estate market – consider yourself lucky. For the last 30 years, we’ve had exemplary peaks and kind troughs.

Valuation of real estate is very complicated, yet when distilled down to the basics, if you measure two metrics you can both understand and predict future valuations.

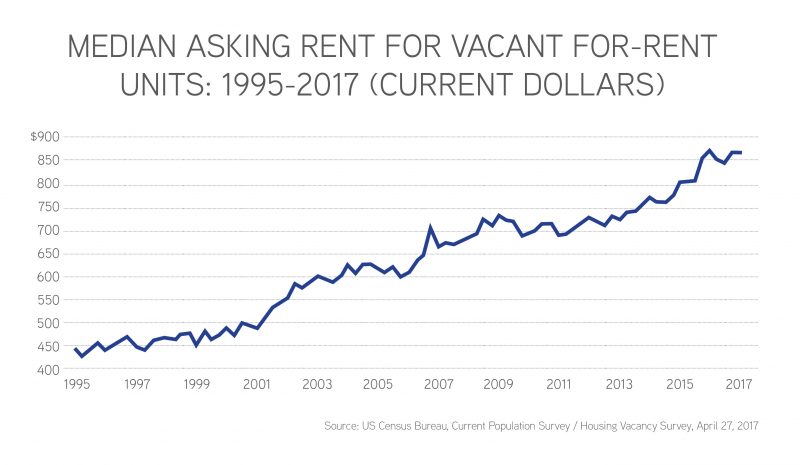

Rental rates – if they rise over time, that is good.

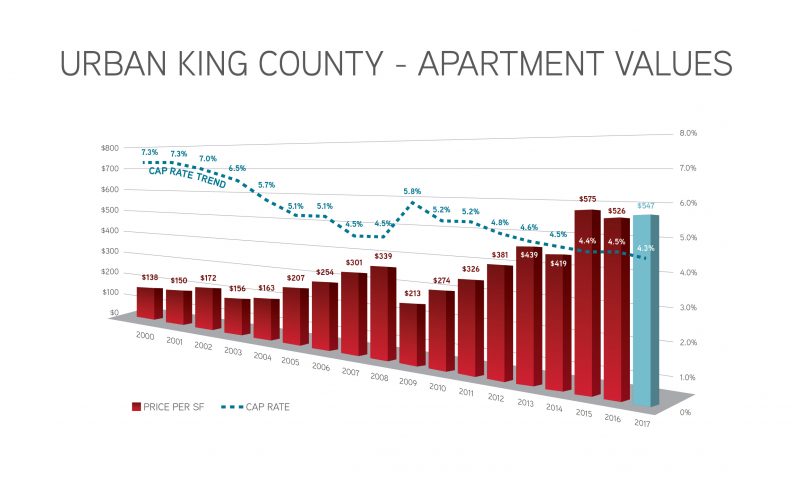

Capitalization rates – if they fall over time, that is good as well.

As you can see from this graphic, capitalization rates follow a “cycle” over time, which has trended downward in our market. Values continue to trend up over time.

Again, not surprising considering capitalization rate compression and rental-rate growth over time.

STAY TUNED – although the above graphic demonstrates data through 2017, we will have our 2018 sales research available next month.

Where ARE We?

(More importantly, where are we HEADED?)

I don’t believe I’ve been shy to say that we will see some softening in our apartment market. We’ve been on a bull run since 2012 and trees don’t grow to the sky.

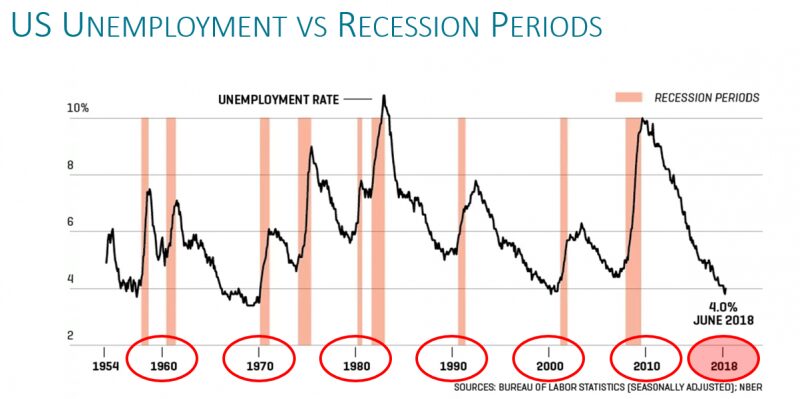

Going back to our waves, we tend to have recessionary periods every decade or so – I argue they tend to occur on or near decennial anniversaries.

If we are heading into a recession, aren’t rents going to drop and cap rates predicted to rise?

Sure, of course.

So how do I model what is going to happen to my apartment investment over time?

How I Draw It

Again, not all markets behave the same. And even within Puget Sound, each market, submarket, and micro-market will behave differently over the next 5 years.

Generally speaking, I predict the following:

Getting back to the point of this newsletter – why is our economic modeling so wrong?

People and investors are generally risk adverse. There are “tried-and-true” methodologies, and whether they are actually “true” seems of far less concern then making sure what is used is well “tried” over time.

From a collective experience perspective, it seems that we’d rather have mediocre results than take the risk of being more wrong than “the other guys”.

I’d prefer sticking with decades of evidence that market cycles never match our underwriting. I argue we take a step in a different direction. I argue that we adjust our modeling to match what history has taught us.

What if being “right” about the future was both more predictable and more profitable?

Follow the cycles and outsized investment returns will follow!

Whether you are considering selling your apartment building, buying more apartment buildings, or simply trying to optimize the portfolio of apartments you currently own, we can help. Call us for a valuation and to discuss how we can work together.

Allow us to Turn Our Expertise into Your Profit!