It’s December and time to take stock of 2018 – another year that came and went in a flash. This past year was notably one of highs and lows, and in the apartment market, as of late, we are not used to hearing of lows.

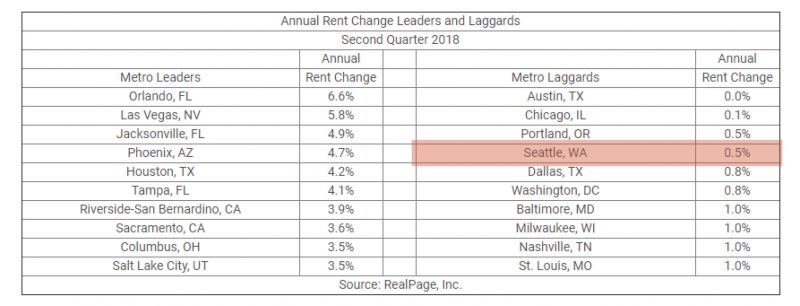

Seattle was named the nation’s fastest growing tech hub, yet, at the same time, there were reports abound of rental-rate growth tapering. Not to mention, just a year ago Seattle was the nation’s hottest single-family market, only to see that trend quickly reverse in 2018. Seattle still ranks as the Decade’s Fastest-Growing Big City in all of US, so the bloom is not quite off the rose!

What does 2019 hold for Seattle and owners of apartment buildings? Assuredly, there will be more ups and downs, but we can expect the following trends to permeate headlines throughout the year:

- Supply & Demand Battle for Equilibrium

- Rent Control is a Real Threat

- Expense Growth Chases Income Growth

- Technology to the Rescue

- Can’t Outrun Father Time

1. Supply & Demand Battle for Equilibrium

Throughout 2018, we heard stories of record-setting job growth in Seattle. From September 2017 to August 2018, the region added 67,000 new jobs, setting a record for the last 20 years.

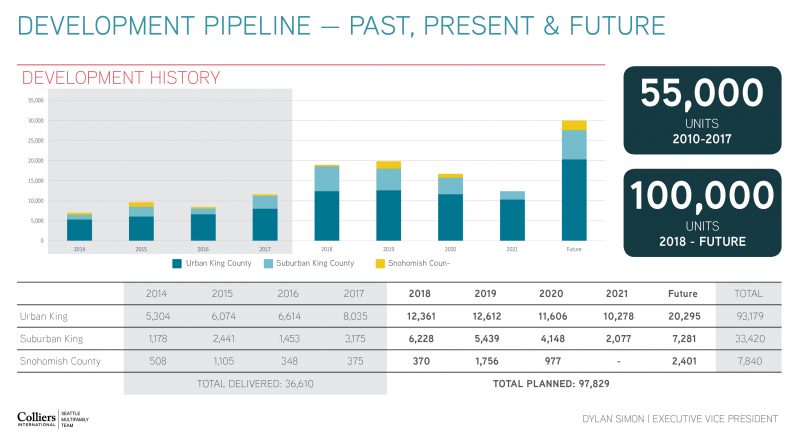

At the same time, Seattle’s apartment development pipeline is the largest in its history.

Contemporaneous, record-setting demand and supply began with demand outstripping supply for many years – leading to our record rental-rate growth from 2012 – 2017; however, the tide shifted in 2018 and Seattle’s rental-rate growth tempered in the last 12 months.

Nearly 75% of all development in the Seattle region is occurring in urban areas, leaving more suburban markets supply constrained. Accordingly, don’t expect bad news in the form of slowing rental-rate growth in all Puget Sound markets. In the coming year, some markets will struggle to even maintain current rental rates, while others will see continued rent appreciation.

2. Rent Control is a Real Threat

The 2019 legislative session in Olympia begins January 14, and rent control is on the ballot.

In 2018, HB 2583 and SB 6400 were introduced. HB 2583, which would allow local authorities to address affordable housing needs through the regulation of rent and associated charges, was introduced in the House Judiciary Committee, while an identical bill, SB 6400, was introduced in the Senate Financial Institutions & Insurance Committee.

These bills would repeal the 1981 state preemption against rent control, and allow cities and counties to regulate your rent in any way that they would like.

Although neither passed in 2018 and the Seattle City Council is not yet able to enact rent control, another fight in 2019 is imminent.

3. Expense Growth Chases Income Growth

Although rental-rate growth in Seattle began to temper in 2018, that doesn’t mean the region’s economy slowed. In fact, it was quite the opposite, and as the region’s economy surges, inflation comes into focus.

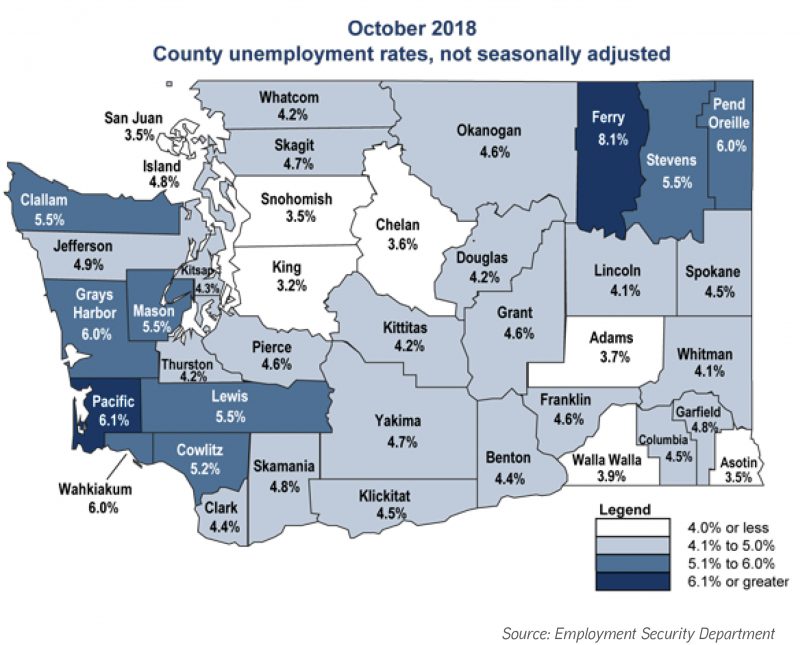

If you’re in the market to hire anyone, you know exactly what I mean. Whether you are simply trying to retain a property manager, hire a leasing agent, or contract for landscaping, expenses are rising. Unemployment in King and Snohomish Counties are at record-low levels, resulting in a very high demand for qualified workers – and, accordingly, the labor pool has pricing power.

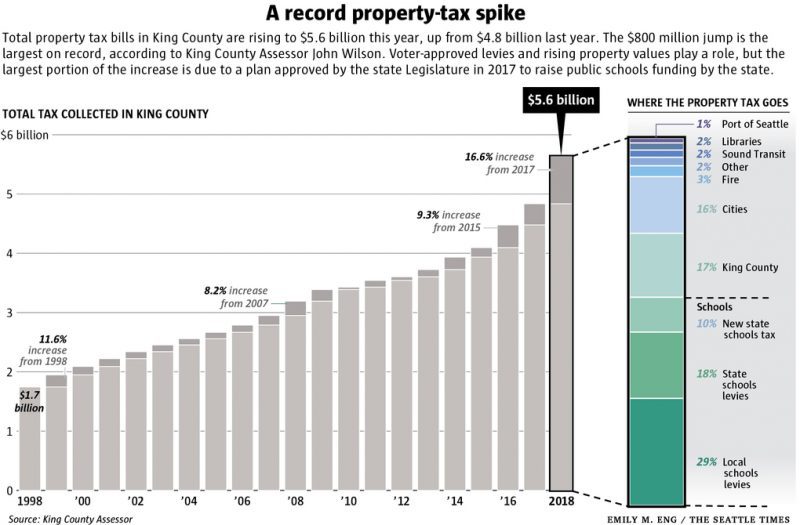

Outside of labor costs, the largest culprits of runaway expense growth are property taxes.

Our region remains at what economists call “full employment,” so don’t expect anyone – or anything – to get any cheaper in 2019. Controlling expense growth is the name of the game in 2019, and having the tools and tricks to do so will be essential to preserving net operating income.

4. Technology to the Rescue

The introduction of PropTECH or CRETech could not come at a better time. There are technological solutions to everyday problems abound, and although data-enabled coffee pots and refrigerators are “cool,” the technology that floats my boat is all about creating efficiencies and, in turn, cost savings.

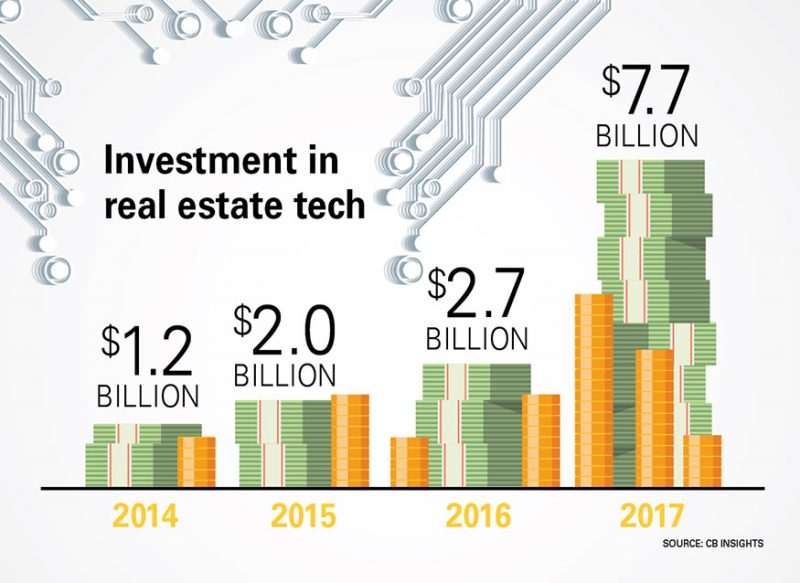

The real estate sector is awash with new technological tools to make us more efficient, competitive, and profitable. Not only is demand for solutions driving the advent of new technologies, but venture capital is also pouring into this space.

Separating “inventiveness” from “effectiveness” is the first order of business – what do I really need?

Tools for operational management, like AppFolio or Rentlytics, can create operation efficiencies and help drive bottom-line NOI, while leasing software solutions, like Knock, help convert prospects to renters with greater time savings. Engrain masterfully tells the story of your property and available units through floor-plan visualization, while listing website aggregators like TurboTenant and PadMapper allow you to showcase your listings on more than 50 different sites.

The year ahead is a great time to create efficiencies and optimize operations. The use of technological solutions – and exploration of new ones – is a recurring theme to expect in 2019.

5. Can’t Outrun Father Time

Finally, 2019 will be the last year that we ask, “What inning are we in?” or “How much longer will the cycle last?” I think we are all certain that the peak of the current expansion cycle is behind us.

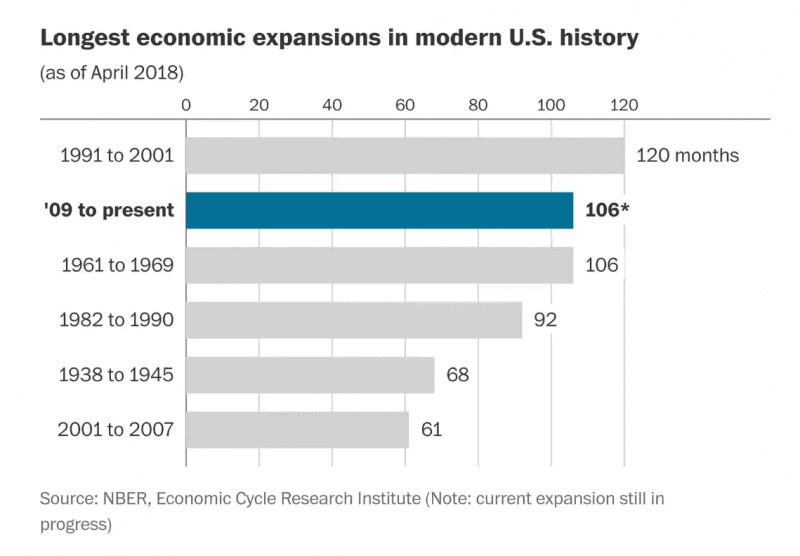

Now 115 months into the current expansion cycle, we must ask the question, “Will trees grow to the sky?” We all know that the answer is “no,” yet economic indicators show that our economy is both healthy and on track for further growth.

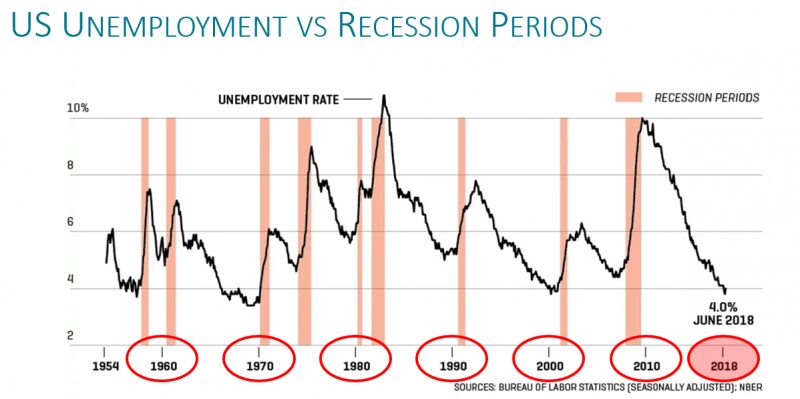

As of December 2018, the national unemployment rate rests at a historic low of 3.7%. More than 60 years of modern history inform us that long periods of economic expansion effectually result in very low unemployment rates that somewhat paradoxically lead to recessionary periods.

In 2019, the economy will face the music that expansionary periods do not last forever. Expect conflicting news that the economy is strong, even though true economic growth is hard to sustain. The stock market is already telling this tale.

Before calling the end of the game and preparing to hunker down through a recession, realize that what lies ahead for the next 24 – 36 months will be a very mild business slowdown with winners and losers. Yes, there will be winners.

There are pockets of our economy that grew disproportionately during the last six years, yet others are just on the brink of transformation. While some hunker down, now is the time to capitalize on opportunities that will not be known to the many – the herd, if you will – and produce “winners” in the next economic cycle, which we already see on the horizon.

Moving Forward

As you strategize for 2019, reach out to us to talk about your play for the next 12 months, our latest market research, and the services we provide for owners whether you plan to sell, hold, or buy.

Allow us to Turn Our Expertise into Your Profit!