There is simply so, so much noise in any given marketplace – especially those involving financial markets. Given the quantum of information available for consumption, we’ve trained ourselves to skim headlines, and from there glean conclusions – often to our detriment (or at least to the detriment of an objectively, predictably accurate conclusion).

For example, on April 24, 2018, you may have seen the headline: Seattle-area home-price growth from current boom has surpassed last decade’s bubble. The article concludes “There are no clear signs that we’re in another bubble”.

Well, four months later, the attention-grabbing headline Seattle home prices drop by $70,000 in three months as market continue to cool appeared. Are we to believe that the economics of any entire market turned on a dime?

In reality, the fundamentals driving 2018’s mid-year slow-down in residential real estate were born of increased development that began over 2 years ago.

If you rely only on splashy headlines, any given market is either surging or crashing – and headlines shouldn’t be used to inform investment decisions.

That said, in the last week, 3 important headlines backed by trended data, that when properly analyzed, can assist in making educated investment decisions in Seattle’s multifamily market.

These headlines discuss the following topics:

- Stellar Job Growth

- Remarkable Tech Job Growth

- Mediocre Investor Sentiment

1. Stellar Job Growth

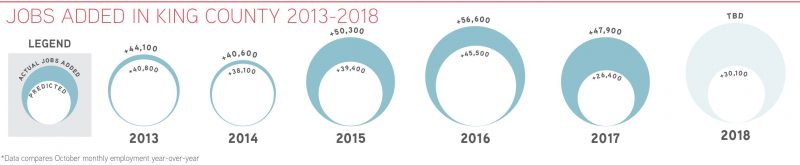

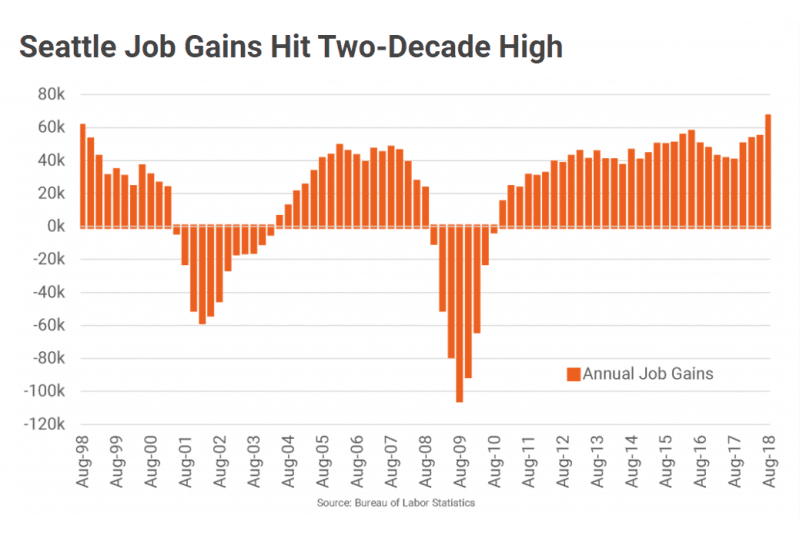

The broadest predictor of demand in commercial real estate is job growth. And on that front, the Seattle/Puget Sound region is firing on all cylinders, and beyond. Despite truly stellar job growth from 2010 – 2017, August 2018 year-over-year jobs numbers hit a two-decade high of nearly 67,000 jobs created.

As we prepared our 2018 Seattle Apartment Market Study we were not sure that the Seattle region could maintain the current trajectory of job growth of 50,000 to 60,000 jobs y-o-y, yet once again the region’s technology ecosystem outperformed recent history as well as the nation (see next section, Remarkable Tech Job Growth).

There is no better bellwether for growth and stability in Seattle’s commercial real estate market than job growth—especially high wage jobs. As reported by RealPage, growth in Manufacturing; Information; Trade, Transportation and Utilities; and Professional and Business Services, particularly, aerospace manufacturing (Boeing), software publishers and computer systems design (Microsoft), and retail trade (Amazon) are rebounding or expanding.

The data backing a headline of record job growth provides key information in understanding how the Seattle real estate market is currently performing and forecast to perform in the future. Breeze past the headlines and understand the data!

2. Remarkable Tech Job Growth

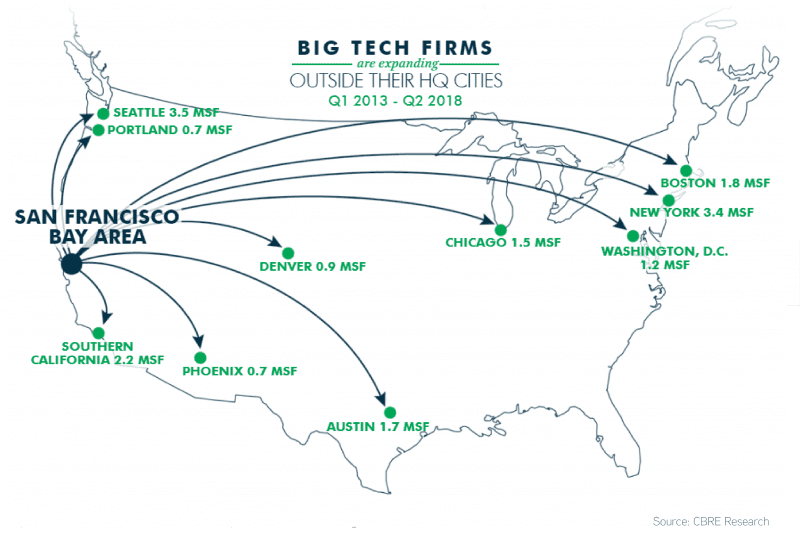

If Seattle wasn’t already the envy of the nation (world?) with its expanding tech job ecosystem, CBRE’s recent 2018 TECH-30 report will not help cohort markets’ self-esteem.

Seattle’s pace of adding tech jobs bests all other markets in the nation, with a growth rate for 2016 – 2017 of 25.7%. Silicon Valley couldn’t even hold a candle to tech job growth in Seattle. Further, Seattle is the largest net benefactor of technology firms fleeing SF/Silicon Valley.

As recently reported in GeekWire, Seattle is the nation’s fastest growing tech hub. Citing CBRE’s report, GeekWire writes, “The Seattle area supports 165,264 high tech software and services jobs, a figure that accounts for 42% of all office jobs in the area. With wages of $130,915, Seattle software engineers command more than counterparts in all other markets in the report except San Francisco and Silicon Valley.”

Adjusting for SF/Silicon’s Valley’s cost of living, and California’s state income tax, Seattle’s tech worker salaries far outpace all markets.

Tech job growth and income growth are the penultimate metrics for multifamily and CRE investment.

3. Mediocre Investor Sentiment

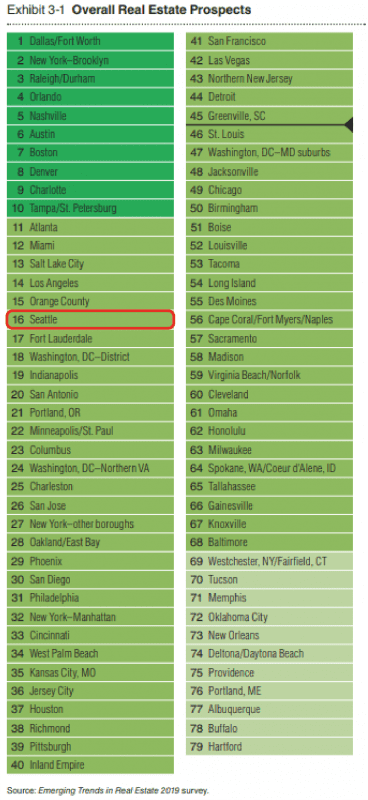

ULI Announces Seattle Slips to #16 in Rankings

Oh how the mighty have fallen – one might exclaim in reading ULI’s 2019 Emerging Trends in Real Estate report. For 2019, Seattle earned itself a not-so-impressive #16 Ranking.

In 2018, Seattle earned itself top billing as the #1 market – and Seattle was safely ranked in the Top 10 for the previous 10 straight years (2017: #4; 2016: #4; 2015: #8; 2014: #6; 2013: #7; 2012: #6; 2011: #6; 2010: #8; 2009: #1; 2008: #1).

What say you reporters – the sky is falling?

First, a bit about ULI’s annual report. According to ULI, it and PwC researchers “personally interviewed 750 individuals and survey responses were received from more than 1,630 individuals”. Therefore, ULI’s conclusions are accurately described as a “survey of market participant sentiment”.

You can download the entire 116-page report here: ULI: Emerging Trends in Real Estate — United States and Canada 2019

As a report on sentiment, we must take such news that the overall sentiment on Seattle’s prospects as an investment market must have fallen from stellar (#1) to meh (#16).

On February 4, 2016 the Seattle cloud computing and data analytics company, Tableau (DATA) lost 50% of its value overnight. Why? The sentiment of analysts on what “might” happen with the company caused investors to doubt Tableau’s value. I bought. Immediately. Cloud computing, data analytics at a 50% discount? Yes please, I am IN!

Fast forward 18 months and the value of the company doubled from $41/share to $81/share. Today, Tableau is trading near $110/share.

Sentiment, even the sentiment of “experts” is a dangerous metric for investment purposes.

Are ULI’s survey respondents wrong when it comes to predicting the prospects for investing in CRE in Seattle? We don’t yet know. Are you wrong for downgrading your sentiment in Seattle by following such a headline? Most likely so.

How to Invest

Investing in any market takes an extremely measured approach. Undoubtedly, charting a path to move forward when investing in multifamily in Seattle is more difficult to predict than it was when all news was good news (or more aptly, terrific news). Yet, that is the nuance of opportunity.

I argue that there is greater opportunity today than 12 months ago – arguably even 3 months ago. Spotting what others in “the pack” don’t see is the key to outsized returns. When others pull-back, charge-in.

Look out for more data and insights from our team and give us a call to discuss your plans and goals for 2019. Whether you are considering selling your apartment building, buying more apartment buildings, or simply trying to optimize the portfolio of apartments you currently own, we can help.

Call us for a valuation and to discuss how we can work together.

Allow us to Turn Our Expertise into Your Profit!