Several years ago, Seattle gained fame as the “Micro Apartment” capital of the nation. However, once a fast-acting City Council plugged what was considered a loophole in the building code, most all the buzz faded. All the while, a market of micro-apartment units continued to perform—err, outperform—amidst a sea of market-rate apartment units, the darling of the investment community.

With barely any new development of micro apartments permissible under the building code post-2015, NIMBY neighbors rested well (read How Seattle Killed Micro-Housing). All the same, uninitiated investors speculated that such small units must run high vacancy, high turnover, and surely wouldn’t survive a downturn.

Wrong.

Micro apartments were born of a downturn, with the first project delivering in 2009, assuredly the darkest time for apartment investors this millennium. Not only did micro apartments “survive” the Great Recession, I make the argument that they will outperform the market straight through the next market correction.

Here are four common “Micro Myths” that are easy to bust:

- Micro Apartments Won’t Survive the Next Downturn

- Micro Apartments Run High Vacancy

- Micro Apartments Run High Expenses

- There are Too Many Micro Apartments

1. Survival of the Fittest

From 2012 – 2017 Seattle’s apartment market produced nation-besting, envy-inducing, year-over-year rental rate growth. For the better part of the last five years, 6% to 8% rental rate growth remained the norm. For apartment investors, the sky was the limit.

All the while, many skeptics proclaimed the “fad” of micro apartments would fade. This is our first myth to bust.

When introduced to the market in 2009, average rental rates for micro apartments were $558/month. How do I know? I reviewed the actual rent roll of the very first micro apartment building. Fast forward nine years, and average micro-apartment rental rates hover around $1,000/unit. That represents 80% cumulative rent growth and 8.8% sustained year-over-year rental rate growth for nearly a decade.

Yes, that includes the Great Recession!

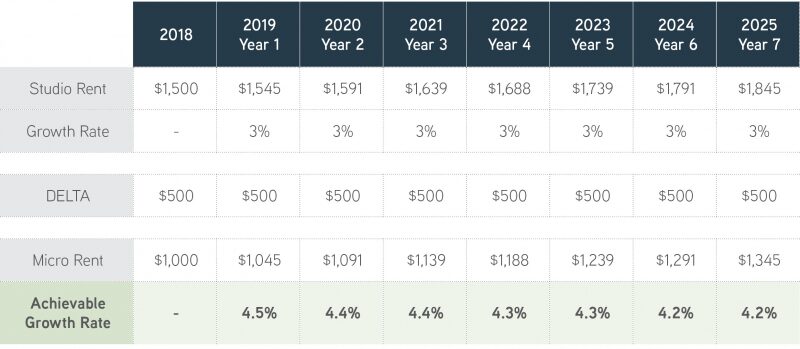

To further illustrate the point of outsized rental rate growth potential, let’s measure a $1,000/month micro apartment against a $1,500/month market-rate studio. For the sake of this analysis, we’ll increase the rental rate of the studio 3% year-over-year and maintain the $500/month delta between the cost of each.

This analysis shows that for a seven-year hold period, micro apartments can maintain a $500/month advantage over a traditional studio unit while maintaining 40% to 50% greater rental rate-growth every year for seven straight years. If studio rental rates grow faster than 3% year over year, micro apartment owners can grow rental rates even faster.

2. Micro Apartment Vacancy is High

Wrong again. The numbers are in, and empirical data proves otherwise.

I am often not sure which is worse, statistics or rumors. In most cases both are often more wrong than right, and the originators of both have an agenda: to prove a point they wish were true.

Dupre + Scott, our region’s gone-but-not-forgotten expert data provider, fastidiously tracked market-rate apartment data. They did so granularly, expertly and precisely. However, they never tracked micro apartment data. So, in 2017, we went off on our own and did some data collection.

In Fall 2017, we launched the SMT Report: 2017 Efficiency Market Study, tracking data for both micro apartments and SEDUs (Small Efficiency Dwelling Units). The results were both interesting and consistent. Of the hundreds of units tracked, micro apartments had an average vacancy rate of 3.9%. At that time, market vacancy in Seattle (perDupre + Scott) was nearly the exact same.

In a balanced real estate market, apartment vacancy should run around 5%—which is considered “economic vacancy”—produced by pushing rental rates enough to test the limits of the market, yet not so far as to lose too much occupancy.

This year we reviewed data from the operations of more than half of all micro apartments in the market and the average vacancy rate was around 5%.

Turning to market-rate apartments, many data providers are reporting much greater than 6% vacancy in Seattle right now. Although I don’t support the fear-mongering perpetuated by articles with titles like “Is this going to crush rents in Seattle?” there is no doubt that vacancy rates for market-rate apartments are no longer bouncing between 3% and 4% like they have for the last seven years.

Will micro-apartment vacancy rates rise faster than market-rate apartments? Not a chance.

Why?

I’ll elaborate on “Price Point Monopoly” further in a moment, but simply put: nearly 30,000 market rate apartments are under construction and another +40,000 are in planning, and you are no longer able to build any additional micro apartments. You do the math!

3. Micro Apartments Run High Expenses

Comparisons are tough, especially between two items that operate differently, yet may achieve the same average results.

Yes, a freight train burns more fuel per mile than a Honda Accord, but which is more efficient?

Your average micro apartment has a bit higher turnover than most apartments (surprisingly, compared to brand-new, market-rate apartments, it’s not much different). But you can also do a turn on 250 square feet in a few hours. No oven to clean, less wall space to paint and not a lot of furniture gets moved in/out.

Is management more intensive? Sometimes yes, sometimes no. Can you imagine the level of care and attention a resident that pays $4,000/month requires? That is intensity!

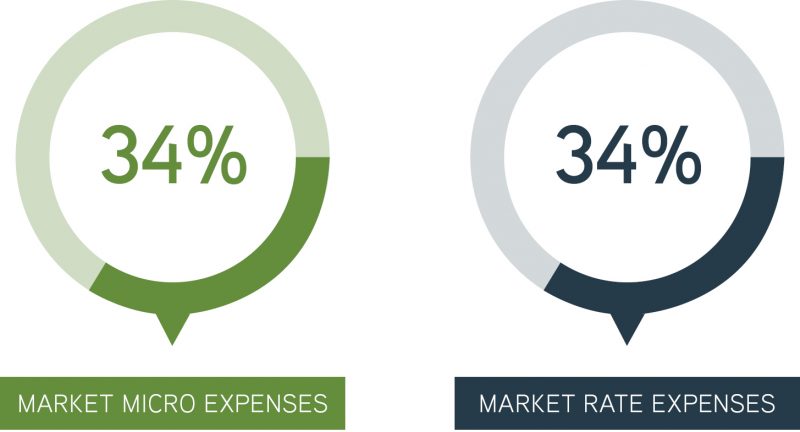

Going back to the data provided to us on thousands of micro apartment units, the average expense load (total expenses / effective gross income) is about 34%. Guess what the average expenses are for a market-rate apartment building…

You guessed right, both average 34% of EGI.

In some cases, both product types run leaner expenses—down to 25% of EGI—and in some cases they run much higher, in excess of 40% of EGI. Yet on average, there is little to no difference.

If how you get to a conclusion is more important than the conclusion itself, then yes, micro apartments operate differently on the expense side. If you care about your bottom line and a profitable investment at the end of the day, then stay away from myths, as this one is busted!

4. There are Too Many Micro Apartments

It was once thought that there would be “too many” micro apartments in Seattle. Call it NIMBYism at its finest, but despite indisputable evidence that Seattle needed an urban-located, affordable housing solution, the ability to build micro housing was blown out like a candle.

It came and went quickly, and there is no product type or solution to replace it. From social, political and economic angles, it’s a shame. Tens of thousands of workers, students and price-sensitive, would-be residents—those enabling the delicate ecosystem of cities to function—need economical housing.

The quick flash of development produced about 5,000 units—roughly the amount of market-rate housing that will be delivered in and around downtown Seattle between now and the end of this year.

As a result of changes in zoning and permitting, owners of existing micro apartments were handed a monopoly—a perpetual patent if you will—at a price point no one else can touch.

When building small studios or even SEDUs, unit sizes will, on average, always be 30% to 40% larger than micro apartments—and correspondingly, 30% to 40% more expensive for renters.

Although it was a great myth for some time, its irrefutably untrue. Development of micro units, in their most basic form, is dead—and by that virtue, fear of surplus quickly morphed into scarcity and unmet demand.

Check the City of Seattle’s Planning Office—the permits will prove that the NIMBYs just provided a group of micro apartment owners the most valuable right one can ever have: a complete monopoly over a segment of the market.

And if you’re a student of economics, then you know the best dollars invested are those placed into a scarce resource with unending demand. If you have a monopoly over that scarcity, then you hold a golden ticket!

Nothing New Under the Sun

Although each innovative generation claims its uniqueness over the previous, oftentimes we find there is precious little new under the sun. This New Yorker cartoon, seemingly mocking the sartorial indulgence of an efficiency dweller, was published in the 1920s.

Small, efficient units existed in urban downtowns far before Seattle stole national headlines in 2009 for its latest “innovation” of micro apartments. Nearly 100 years passed between the publishing of this comic and the recent “flash” of micro apartments in Seattle. Most apartment investors think in 5-, 7-, or 10-year time periods. Having 100 years of runway sounds good to me.

Micro apartments of today are poised for a bull-run as Seattle continues to grapple with unaffordable housing (with no good solutions on the horizon), mounting traffic in and out of urban centers, and continual barriers to entry for desirable and well-amenitized urban neighborhoods.

What opportunities exist for investors who see through the myths and want to capitalize on owning a monopoly of housing at a +30% discount to market-rate housing?

Keep an open eye on your email inbox.

Whether you’re planning to sell or hold your property in 2018, we encourage you to contact us to discuss how this year’s outlook will impact your investment.

Give us a call to Turn Our Expertise into Your Profit!