Whether rental rates are shooting through the roof or dropping like a lead balloon, journalists are busy in the news room churning out sensationalized headlines. And in the ever-watched Seattle apartment market, no audience is more poised to stand at the ready for sensationalism:

“Seattle rents continue to skyrocket!”

“Apartment rental rates fall for the first time in a decade!”

What these articles earn in catchiness, they lack in both depth and substantive analysis. Markets rarely shift all at once, nor do they do so in such uniform fashion. In fact, a deeper look exposes fragmentation in the overall performance of the apartment market. Rental rates in certain segments of the market struggle to reach the year-over-year growth achieved in the last several years—yet, some segments of the market continue to boast impressive growth.

Diving into the location of apartment buildings and the make-up of unit types in each building reveals both past performance and continued performance. Pick the right location and mix of units, and you might pick a winner today—and in the long run!

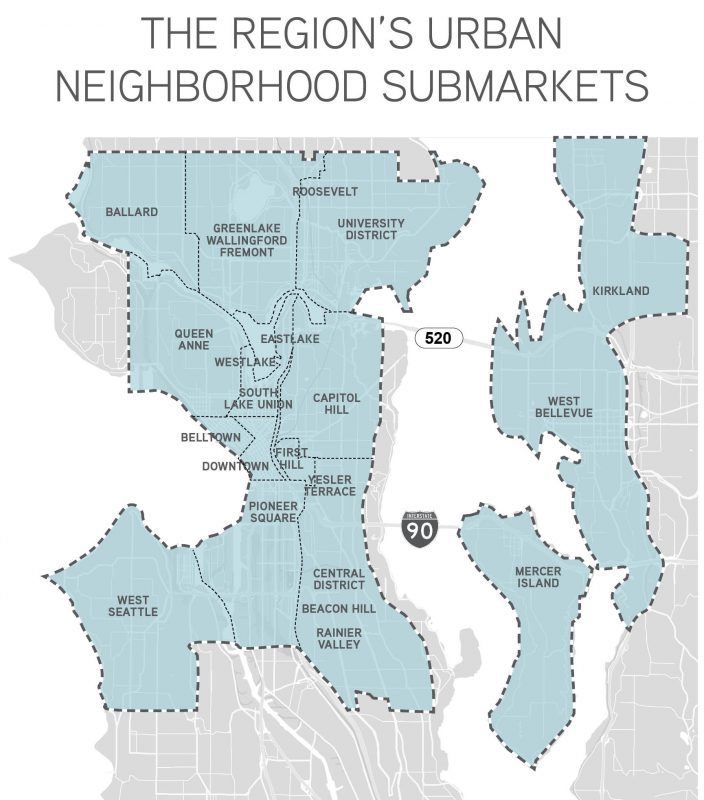

Location: Some Neighborhoods Hot, Some Pause to Absorb Growth

The Seattle region certainly has its apartment market darlings. Urban neighborhoods in Seattle experienced the greatest measure of rental-rate growth at the beginning of the market cycle. As early as 2012, close-in neighborhoods, such as Capitol Hill and Queen Anne, experienced pronounced rental-rate growth, whereas there wasn’t much to talk about in ailing suburban submarkets.

In the ensuing years, developers were quick to build apartment buildings in these urban markets—with 90% of all regional development slated for urban-located submarkets. From 2015 on, the balance shifted closer to 70% urban development and 30% suburban development, but not without first adding tens of thousands of units to urban neighborhoods.

So where do rental rates remain hot and growing?

Namely, submarkets and neighborhoods that didn’t receive as much supply from 2012–2017 are the benefactors of continued rental rate growth. And yes, some of them are still considered urban neighborhoods.

Most of these markets have few available development sites—or preclusive zoning—both of which put a governor on new supply, thereby placing upward pressure on demand. Green Lake, Kirkland and Upper Queen Anne all have such dynamics at play.

Other urban markets simply have not yet been favored by developers, and as a result continue to see rapid rental rate growth. Beacon Hill is a perfect example of a close-in, urban market (with transit access to boot) with tremendous apartment rental-rate appreciation.

Outside of core-located urban markets, rental rates continue to grow—subject to localized dynamics.

Nearly the entirety of what we refer to as South King County (Burien, Renton, Des Moines, Kent and Federal Way) continues to see an upward trajectory in apartment rental rates. Lack of development and renters fleeing urban markets seeking affordability continue to shape rental rate growth in these markets.

Conversely, if you travel too far north—namely Everett—and try to increase rental rates too much, renters move just a few miles further out to take haven in lower rental rates in markets such as Marysville or Lake Stevens. Head too far east to a developer-friendly market like Redmond and you face similar dynamics proven in densely developed urban markets.

There is little doubt that time will surely cure a current pause on rental rate appreciation in supply-rich markets. Underwriting the duration of such a pause must factor volume and duration of the current development pipeline, as well as availability of favorable development sites and zoning, which continue to contribute to the current development pipeline.

Unit Mix: Not All Units are Built the Same

The arbiter of rental rate growth is not solely location. As it turns out, not all units are built the same!

Nearly a year ago, in our August 2017 blog post $6.00 per Square Foot Rent in Seattle, we launched the industry’s first publication discussing the Efficiency Unit market, which includes unit types such as Micros and SEDUs. Some may have missed it, others scoffed and many others simply didn’t pay attention.

Well, it’s nearly a year later and small unit types continue to outperform the market. And yes, especially in urban markets with huge development pipelines.

As it turns out, renters are cost sensitive. Given a choice, most everyone will choose the best value—at the high-end and at the low-end of the market.

In my view, the interplay of supply and demand is as inalienable as gravity (as an engineer by training, I can’t help myself!). For the last several years, residents fought to rent apartment units in an environment of scarcity. As a result, rents rose. Supply is catching up with a near-insatiable renter demand, but not at all price points.

In the market of $1,000/month to $1,500/month rental rates, the options for cost-sensitive renters continue to dwindle. Nearly all costs of development are on the rise: land costs, soft costs (architecture and engineering) and especially hard costs (actual construction). Continual cost escalations result in a rise of the price floor for a new apartment unit.

What options are left for renters in middle- and lower-income brackets?

Thanks to NIMBYs and the Seattle City Council, it is now all but impossible to build Micro Apartments anymore. The result? Essentially a government issued monopoly at the sub-$1,200 price point for owners of Micro apartments. Zero developers, or developments, can compete with buildings contributing rental rates at this price-point.

Forever.

If that is not a recipe for continued rental rate growth, I don’t think one exists.

Similarly, SEDUs (Small Efficiency Dwelling Units) are doing well in increasing rental rates year over year. Yet, SEDUs need expensive traditional studio units with which to compete to prove an attractive option to renters. These units are performing fantastically in most markets, but not all.

What is performing below Efficiency Units? “Open one bedroom” units.

In a rapidly-rising market with pent-up demand since the Great Recession, renters were rushing to rent one bedroom units sans having an actual door on their bedroom. Why? Quite simply … they needed a place to live.

Well, it turns out when renters are paying for a one-bedroom, they want an actual door on their bedroom. We saw this coming, others did not. Open-one-bedroom units are struggling to keep up with the broader market of more traditional units.

In all market cycles, we favor small, efficient units, as well as moderately-sized two-bedroom units. These unit typologies are both inflationary and deflationary hedges to renters who may have trouble competing in an expensive market and paying rent in times of economic slow-downs. We are “full-cycle” thinkers!

They Aren’t All Winners … Forever

The last seven years since the end of the Great Recession proved handsome returns for nearly all players in the apartment investment market. This deep into an economic cycle, the market is “priced perfectly,” with little room to err for investors and renters alike. Not since 2007 was there a time to make really good investment decisions.

How you define a “really good investment decision” is much harder given the introduction of some mild turbulence in the market. In my opinion, now is the time where true investment acumen is proven. Understanding the market at a granular level—even down to exact location in a market and the unit mix in a building—is truly essential.

Week over week and year over year, we continue to study the apartment market at a level of detail beyond most others for the sole purpose of helping our clients make the best investment decisions.

Give us a call and Allow us to Turn our Expertise into Your Profit.