Reminiscent of Paul Revere’s great ride through Boston, in mid-January 2018 the media exclaimed, “Rents are dropping, rents are dropping!” It seems there was a lull in North-Korea-versus-Trump news that week, and an exaltation of “significantly dropping” rental rates was the news du jour.

The Seattle Times reported (and I quote), “Rents are dropping significantly across the Seattle area for the first time this decade.” Yes, 2.8% is now significant in our 24-hour news cycle.

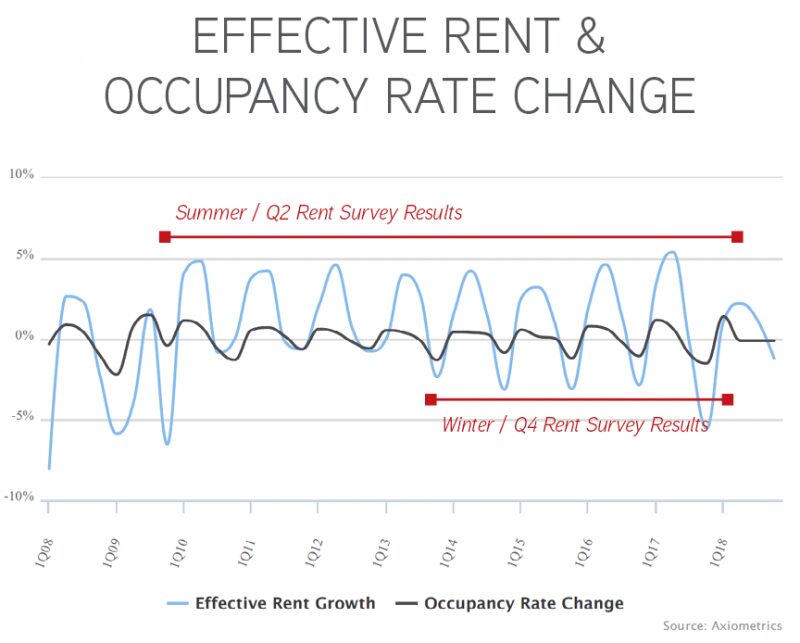

This bold statement was followed by a graphic literally showcasing that rents dropped at this time last year, and nearly every other year at this time since 2012. I am the last one to proclaim “fake news,” but folks, can we proof our stories beyond our own graphics?

Although, according to the data, rents did dip 2.8%, they did so after nearly the strongest spring the market has experienced all decade. In fact, if you look back over the last four years, rents consistently dip in the winter months. Media, you can dismount your sturdy steeds, put down your lanterns (hopefully tune-up your research departments) and give it a good couple of months to renew the fear mongering.

The point? Measuring rental rates in January is worthless.

Seasonality: not thy Landlord’s Friend

My least-favorite news story of the last month was from the Puget Sound Business Journal, in which I was the lead source. They were kind enough to post a massive photo of me next to the attention-grabbing headline, “Apartment landlords are dropping their rents in Seattle” (so says Dylan Simon, one would think).

Despite my mother being pleased to see her son in print – and my wife having to hear my rants all weekend (sorry, Dear) – the headline belied the story. Nice “gotcha” journalism, huh?

For those who hazarded to get to the third paragraph (about 50 words later – this piece was no journalistic triumph), you’d learn my take that this “news” was not in fact newsworthy, nor worthy of mention at all.

The story failed to focus on the only interesting point: the Seattle apartment market suffers from massive, and consistent, seasonality.

The following graphic provides an excellent look at times year-over-year that rental rates increase and decrease in the Seattle market.

The “dark months,” as I like to call them, are very poor for leasing and, accordingly, rental-rate growth. Generally, October 15th through February 15th exhibits lagging leasing velocity and accelerative rental-rate characteristics compared to the other eight months of the year.

So, what do January rental rates tell us about the overall apartment market? Nothing. Seriously, nothing.

What to Watch

As one might expect, the performance of the apartment market typically follows simple, economic principles of supply and demand. Sometimes it takes patience to allow one to catch up to the other, but inevitably – like gravity – supply and demand prevail.

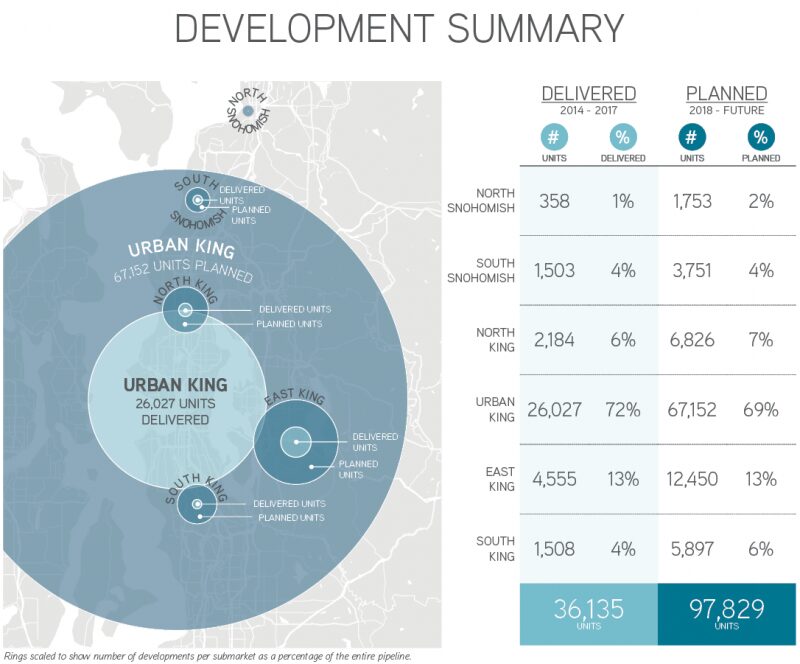

Supply – What to Watch: There are a lot of cranes in the sky. The metamorphosis of dirty, noisy construction site to beautiful, new apartment building leads to new units on the market. The Puget Sound market received approximately 11,000 new apartment units in 2017, and is on track to deliver more than 10,000 units each year for the next three years.

Where apartments are being developed, what types of developments (and units) are being built, and where they are located will all play a critical role in the supply-demand equation. The above graphic is taken from our latest research, which is forthcoming – stay tuned!

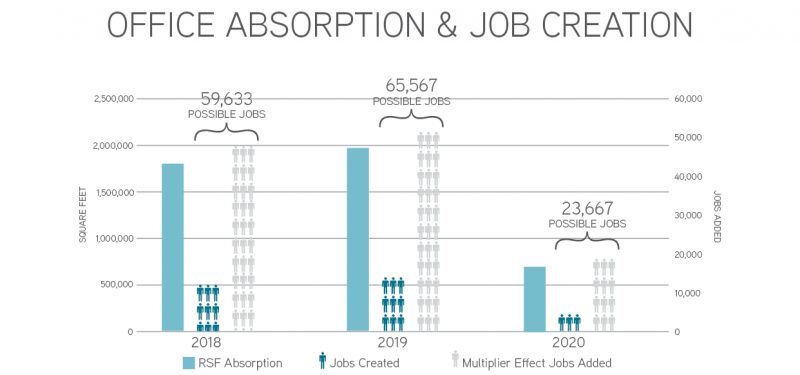

Demand – What to Watch: The apartment market, as well as all commercial real estate classes, is critically dependent on population growth, job growth and wage growth. As I often say, job grow is the panacea for all that may ill a commercial real estate market.

As with supply, understanding where people are moving, what jobs they are taking and how their income may increase (or decrease, for that matter), are critically important factors to understanding and quantifying demand.

Our research not only looks at occupancy of office buildings in Seattle and the Puget Sound for the last 10 years, but also studies newly-signed leases for existing buildings and new construction, drawing conclusions from future planned absorption – which equates to job growth and, based on types of jobs, wage growth.

Making Educated Investment Decisions

As a student of economic markets for the better part of several decades, I can safely say that few sound investment decisions were formed based on catchy headlines. The current economic expansion cycle is admittedly a bit long in the tooth. Opportunities exist, and now is the time to analyze markets carefully and make wise investment decisions.

As I noted above, we are on the eve of releasing our volume of research to clients. Please give us a call to discuss your plans and goals in 2018. Whether you are considering selling your apartment building, buying more apartment buildings, or simply trying to optimize the portfolio of apartments you currently own, we can help.

Call us for a valuation and to discuss how we can work together.

Allow us to Turn Our Expertise into Your Profit!