Dylan Simon, Jerrid Anderson, and the Seattle Multifamily Team kicked off the month of March with a bang, hosting their sixth-annual Spring Investor Forum in conjunction with the release of their 2018 Seattle Apartment Market Study.

Speaking to a packed room, the forum began with a crucial update on Seattle’s Office Market from Greg Inglin, Executive Vice President at Colliers International, whose team focuses on Institutional Office Landlord representation in Seattle.

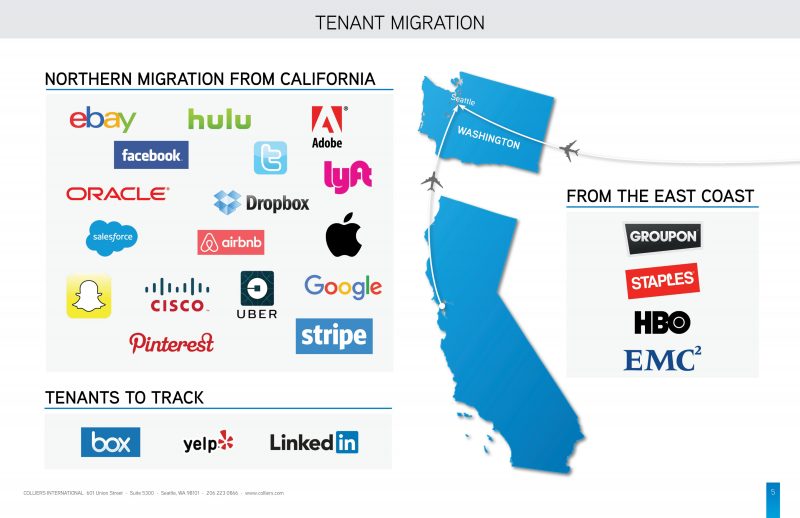

It likely was no surprise to hear that 65% of those actively seeking space in the market are tech firms; however, the dynamic that will be most impactful for the multifamily industry, Inglin explained, is the fact that this demand primarily comprises out-of-state entities.

“These groups are coming here because they like the environment, they can recruit people to work here, and the cost of living is more competitive than California,” said Inglin. “There is 4.5 billion SF of space that needs to be filled by new people—not just someone local moving from Microsoft to Amazon—which adds up to about 30,000 new jobs that need to be filled.”

Inglin also touched on some of the looming questions about one of our region’s largest employers, and their search for HQ2.

“If Amazon truly needs to hire another 50,000 people beyond their current staff, they probably couldn’t do it here, based on housing, infrastructure, office space. And so we don’t see any pullback from them at all. They will slow down eventually, but they are currently occupying space as quickly as they can get it.”

Analyzing what these impressive Office Market stats mean for Multifamily, Dylan Simon began his presentation highlighting what we need to watch most closely:

- Job Growth vs Wage Growth: Jobs maintain occupancy, wages support rental rates

- Delivery & Absorption: Built-to-Suit / Spec Office Space

- Available Sublease Space: San Francisco as Comparative Metric

- Wage Growth Bellwether of Employment Demand

- Consistent Wage Growth = Inflationary Concerns / Fed & Market Response

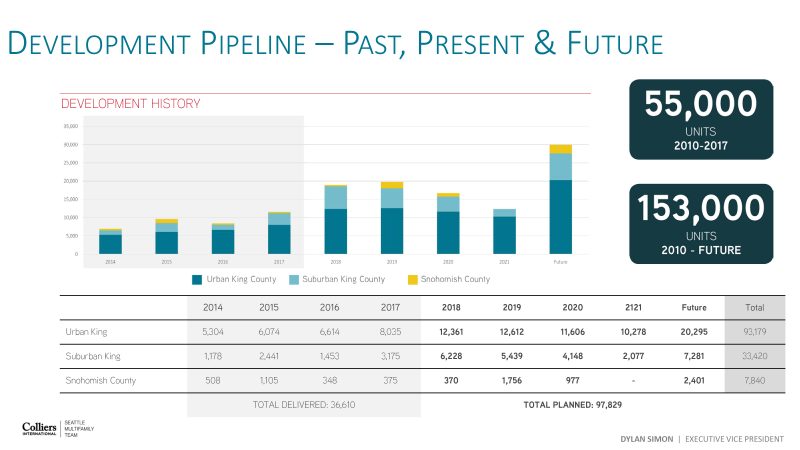

With a basis of understanding of the drivers of demand, Simon continued to break down the overarching topics from the 98-page Seattle Apartment Market Study, which is heralded as the most comprehensive market research in the industry, including the development pipeline, rent and vacancy, and sales.

“Granularity is the theme of our research—if there’s ever a year for granular understanding, it’s now as this market cycle continues to mature.”

This is especially the case as we look at a development pipeline potentially delivering 100,000 units. “Granular underwriting is really necessary because I believe there’s great opportunity for developing in the market,” Simon explained, “but it’s not just across the board where you’re going to hit every opportunity out of the ballpark.”

Simon also touched on emerging trends to watch, including transit-oriented development, efficiency-unit concentrations, and “urbanizing” markets in the suburbs.

“Now is a really good time in the cycle, as we expand outside of the core, to educate ourselves on what’s driving these new developments, what’s driving the price points—and how do they impact vacancy and rent in the core when renters have opportunities for new product outside of the core.”

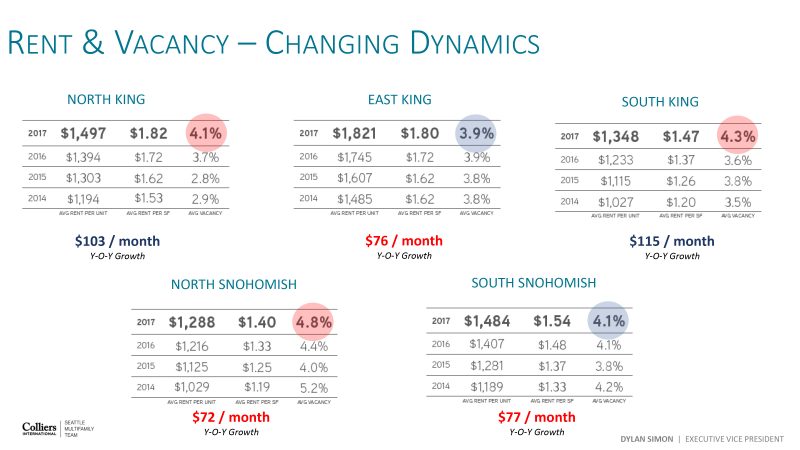

The key takeaways for those rent growth and vacancy numbers we’ve heard so much buzz about recently:

- Urban-located, sub-50 unit buildings still have runway

- Larger, urban-located buildings need big job growth

- Watch concentration of development in suburban markets

- Nearly all markets are trading rent growth for vacancy

- Watch “travel distance” as a measure of rent elasticity (if just going a few miles reduces rent, but only marginally increases commute)

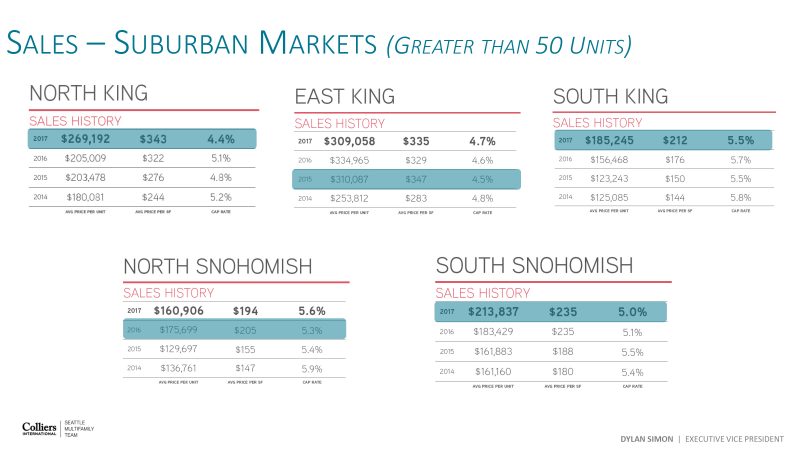

Fortunately, according to Simon, “On the sales side, everything is still pretty hot.”

Although 2015 remains the peak of the market, each year we’re not going to see a huge drop off in value. Price per unit and price per square foot have increased—although it’s a more marginal increase YOY—and last year matched volume with 2015.

Looking forward, the two main areas to watch are 5-50 unit buildings, where cap rates have plummeted and price per square foot has rocketed up, and neighborhoods outside of the urban core.

“People are starting to want to move out of the core of Seattle, but are willing to pay to stay close,” noted Simon. “Investors have been willing to pay higher prices for older, core-plus buildings because the rent growth is there YOY.”

Another driving factor will be regulations. “There are a lot of investors who want to get out of King County, and I think South Snohomish is the next best market to avoid what is going on in the City of Seattle.”

Now, with the granular data in hand, there’s no need to pull out our crystal balls or visit our fortune tellers as we move forward in this cycle.

“We have our eye on 2022—what does it look like and what are the dynamics? Between now and then, we’re going to have a little unpredictable turbulence,” Simon anticipates, “but the data we have right now points to the fact that we’re going to have steady job growth,” which is the best trend we could ask for moving forward.

If you are interested in viewing the full presentation, please email Dylan Simon at dylan.simon@colliers.com.

Ready to dive deeper into the data? The full 2018 Seattle Apartment Market Study is available for download here.

The Seattle Multifamily Team doesn’t just create industry-leading research! We are the leading Apartment Sales Brokers in Seattle and the Puget Sound region.

Please give us a call to discuss your plans and goals in 2018. Whether you are considering selling your apartment building, buying more apartment buildings, or simply trying to optimize the portfolio of apartments you currently own, we can help.

Call us for a valuation and to discuss how we can work together.

Allow us to Turn Our Expertise into Your Profit!