Welcome to 2018 – time to buckle up for a fast-paced year! Looking back, 2017 was a banner year for Seattle and the Puget Sound region. In Spring 2017, it was announced that Seattle was the fastest growing city in the country. Following was a string of equally impressive accolades: Seattle is the fastest growing market for software developers, Seattle in the top 10 cities for jobs, and—for the cool among us—Seattle is the number 2 “Coolest City.”

Not to be outdone by earlier awards, Seattle earned national, if not global, attention by earning the Urban Land Institute’s coveted Number 1 spot: Seattle Number 1 Real Estate Investment Market.

2017 will be a tough act to follow!

Yet, as we enter 2018, it feels as though now is the time for Seattle to prove its resilience, and establish its right for continued inclusion among the most venerable, exciting and flourishing cities in the nation, if not the world.

In the following post, we examine the state of our region’s most prominent commercial real estate sectors:

- Apartment Market

- Office Market

- Industrial Market

1. Apartment Market

Seattle’s apartment market continues to exhibit extremely strong and durable fundamentals. Year-over-year rental rate growth continues to push into the high single digits, while other “Top Tier” markets, such as San Francisco and New York City, show chinks in their armor.

Will the good times continue to roll in 2018?

Surveying landlords over the last several months exposes some vulnerability. The start of the Fall rental season in Seattle marks the beginning of tough months for leasing. It is not strange to see concessions from October through January in the Seattle region. Truth be told, 8 weeks of concessions on stabilized buildings is concerning.

Yet, despite the doldrums of “seasonality” each year, the grass shoots of Spring carried the Seattle apartment rental market through a vibrant season each of the last 6 years—and the data proves it. Across the region, year-over-year rental rate growth from 2012 to present remains phenomenal.

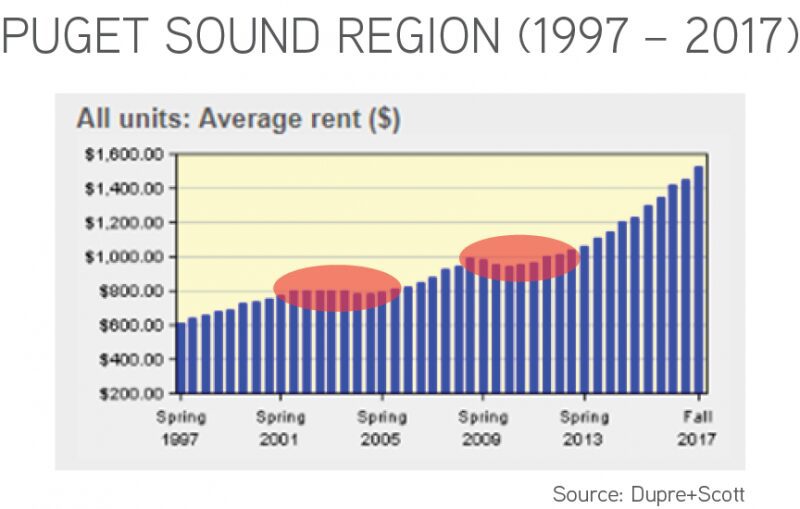

Looking back 20 years, there are marked periods of flattening rent—only to rise again. The Dot-Com/Dot-Bomb period of the early 2000s, then the Great Recession in the start of the 2010s, proved market vulnerability at the change of a decade.

Strong tailwinds in our region continue to drive our apartment market forward—especially in core, urban markets. While 20-year rental rate growth shows impressive cumulative gains, urban markets did not pick-up steam until the current decade, proving a case for continued growth in these markets.

Urbanization, demographic trends and preferential shifts all support the outsized growth in rental rates in Seattle’s urban markets. More positive rental rate growth is on the horizon for 2018.

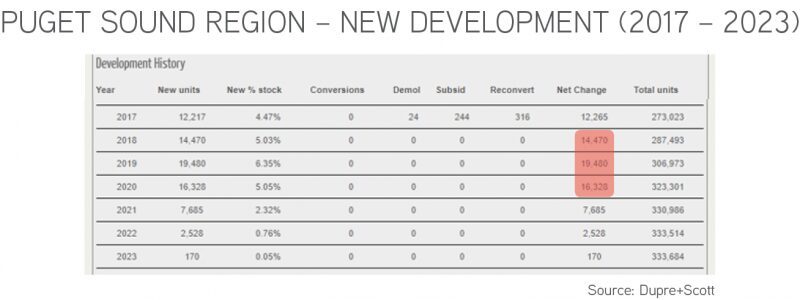

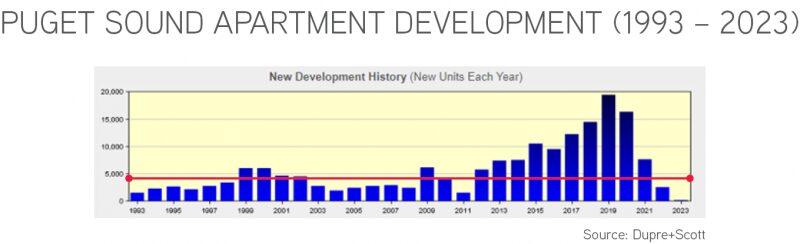

Yet, where apartment investors see rental rate growth demonstrates fertile grounds for apartment development. In the last 6 years, the Puget Sound region added roughly 52,000 new apartment units. The current development pipeline is forecast to nearly match that supply with 50,300 units slated for delivery from 2018 to 2020.

A development boom is not strange for our region, and we have discussed this before, recalling approximately 80,000 units delivered between 1985 and 1993. A 20-year history of development in the region demonstrates a positive number of apartment deliveries throughout the 1990s and late 2000s.

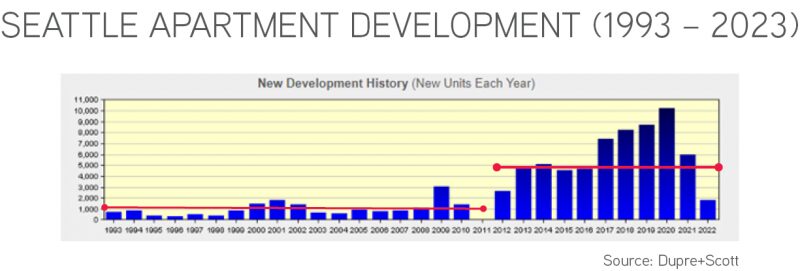

Yet, distilling the amount of development to suburban versus urban demonstrates the current trend even more saliently. The below graph shows apartment deliveries in the Seattle market, noting only one year that Seattle exceeded more than 2,000 units between 1993 and 2011.

Accordingly, through 2018 and beyond, expectations for rental rate growth must be tempered against a delicate supply-demand balance. For locations and building types where there is not demonstrable new supply, the future is remarkably bright. For all others, competition will remain fierce for the time being.

Alas, taking a quick look at vibrancy in other commercial real estate sectors will offer solace that new, high-paying jobs continue to land in our region.

2. Office Market

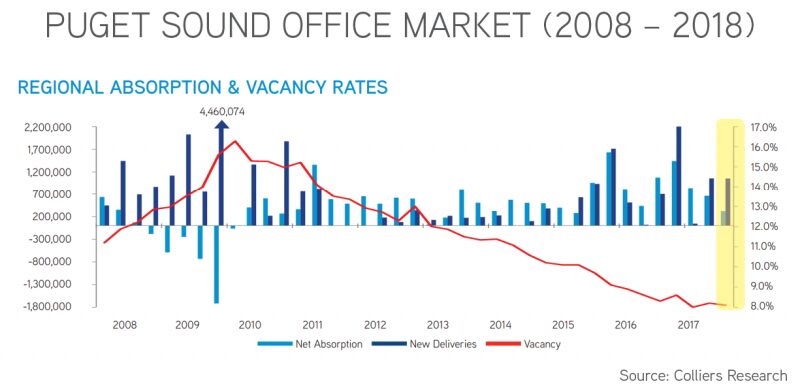

The Puget Sound office market demonstrates some of the healthiest fundamentals in the nation. The below graph shows a complete inversion of vacancy rates from a Great Recession peak vacancy of +16% to a current 8.0% vacancy rate.

Measuring vacancy against absorption of new development paints a very clear picture of a healthy market, insomuch as record deliveries are occurring amidst rapidly falling vacancy rates.

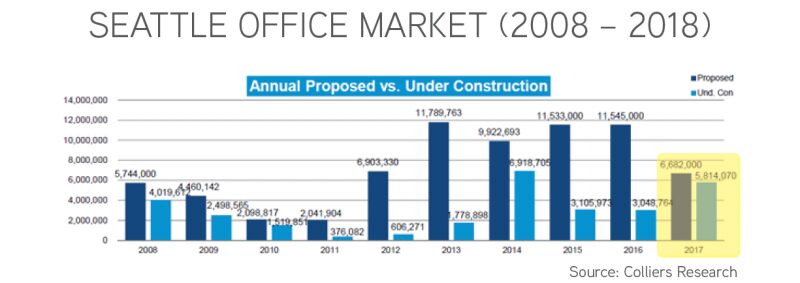

With rapidly falling vacancy and growing rental rates (see below), developers are quick to propose new office development. Unlike the development of apartments, getting from proposal to actual development is challenging—generally requiring a signed lease.

Accordingly, the ratio of “proposed” to “under construction” can serve as a proxy for the health of the leasing market. As of late 2017, of the nearly 7M square feet proposed, 5.8M is under construction.

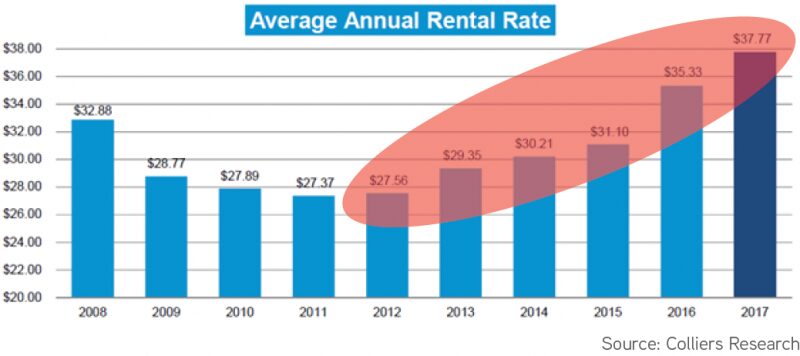

Along with falling vacancy rates are rapidly rising office rental rates. The office market was slower to get started post-Great Recession, yet is rapidly picking-up steam. One item to note is that although rates are now cresting $38 LSF, compared to San Francisco, these rates are very reasonable. San Francisco Class A office rates are nearing $70 LSF.

It is no wonder any exodus of San Francisco / Silicon Valley is landing in Seattle!

A healthy—and growing—office market is the best predictor of a healthy and growing apartment market. Space remains tight in Seattle. Predictors of decline, especially in tech-focused markets, are a slowdown in venture capital financing and a growing shadow market of available space for sublease.

Neither of these factors are prevalent in Seattle. The horizon for the office market in 2018 is bright (even if the weather this January disappoints!).

3. Industrial Market

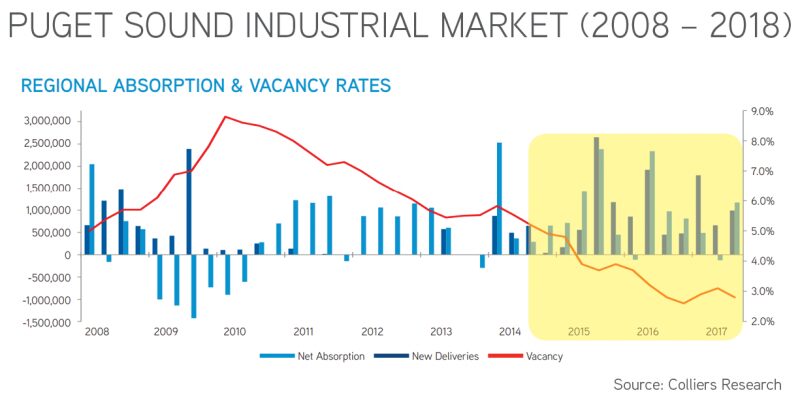

We don’t often discuss the Puget Sound industrial market. Yet, with vacancy rates falling sub-3.0% (2.8% as of Q3 2107) and capitalization rates not far behind, one cannot discuss the health of our region’s commercial real estate market without touching on the industrial markets.

Although manufacturing is one segment in mild decline, the overall market is extremely robust. Developers rushed to the market in 2014 to add space as vacancy dipped below 5.0%. Users met delivery with extremely strong absorption throughout the past 3 years.

In a region so focused on e-commerce (from Amazon to Zulily—literally A to Z!), industrial use is infinitely important to our region, whether as a function of business model or use of space. Vibrancy in the industrial sector supports apartment markets in the North End (Lynnwood to Everett), as well as the South End (Renton to Tacoma).

Seattle’s apartment market relies on the entire ecosystem of employment—whether blue collar, grey collar or white collar. The health of each sector is a predictor of continued vibrancy in our apartment market, and the future looks very bright in 2018!

Give us a call to discuss your plans in 2018. Whether you are considering selling your apartment building, buying more apartment buildings, or simply trying to optimize the portfolio of apartments you currently own, we can help.

Allow us to Turn Our Expertise into Your Profit!