Want to know where the highest apartment rental rates are destined outside the core of downtown Seattle? Where can you expect the most vibrant commercial real estate development in our region’s future? You better familiarize yourself with TOD!

If you have your pulse on commercial real estate development, then you’re familiar with TOD – Transit Oriented Development. The concept, is simple – orient real estate development near transit lines allowing residents to access local and regional job centers, amenities and major transit hubs. The concept is so ubiquitous – it has its own .ORG – www.tod.org.

What does it mean for Seattle? Quite a lot. Both Sound Transit 2 (ST2) and Sound Transit 3 (ST3) focus on urban redevelopment around newly developed transit stations throughout the region. For our region’s foreseeable future, an incredible amount of capital – both public and private – is dedicated to TOD.

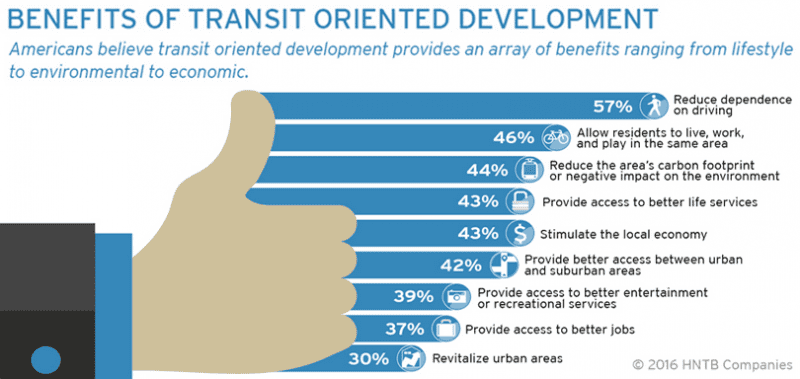

Although ST2 and ST3 were polarizing ballot initiatives, they’re here to stay and they will vastly impact the trajectory of the region’s real estate market. Is this good for Seattle/Puget Sound? Well, the pundits of TOD seem to think so!

If executed poorly, TOD looks like a train station in a vast wasteland of parking stalls. When thoughtfully designed with a vision toward urbanscapes, TOD can transform a region. Whether you study Santana Row in Silicon Valley, Mockingbird Station in Dallas or Tysons Corner in DC, TOD has the ability to truly transform an otherwise inactivated, suburban location.

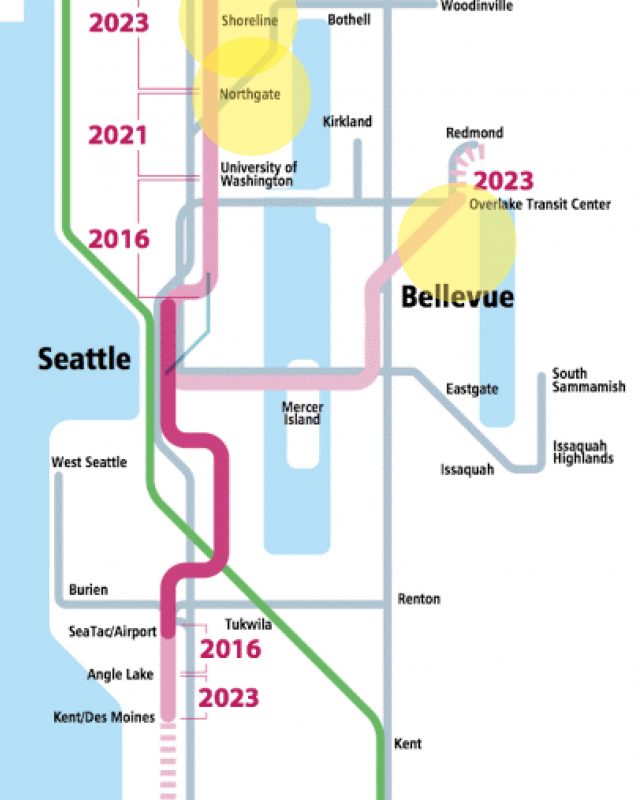

Its 2017 and many of our region’s future light-rail stations won’t open until 2021 or 2023. Why should we care today? Two reasons. First, at the pace of purchase, entitlement, development and stabilization – the horizon for new development is 5 to 7 years. Timing is perfect to focus on TOD.

Second, as we’ve discussed before on this blog, understanding the dynamics of future value today yields the highest returns. Waiting until an “undiscovered” location is discovered provides inferior investment returns. The winners in real estate are those who first pick tomorrow’s best locations.

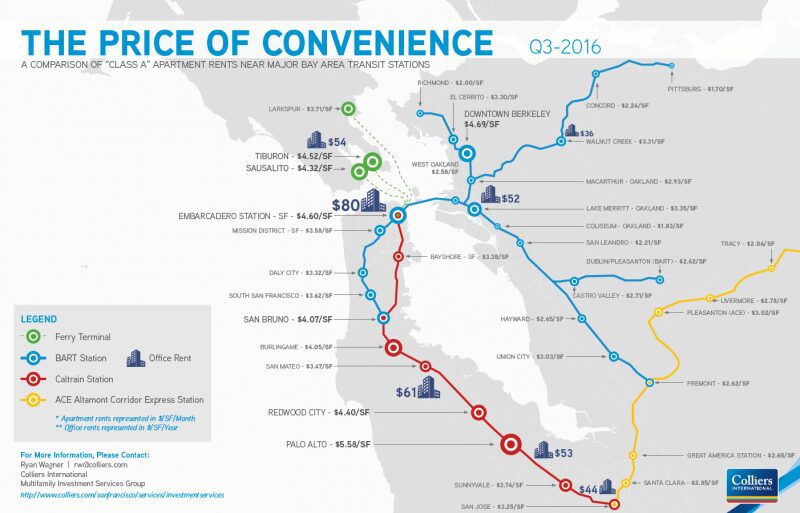

Case Study – San Francisco Bay Area

I think we can all agree that San Francisco / Silicon Valley is a poster child for vibrant, urban and suburban communities. What if we understood where rental rates are the highest across its markets?

Thanks to Collier’s San Francisco office (and the genius work of Ryan Wagner, SVP Colliers), we have a lens into which markets are performing the best throughout the Bay Area – and they are not all traditional urban downtowns!

There is no question that downtown San Francisco has some of the highest apartment rental rates in the nation. One would hazard to guess that once you leave the City those rental rates trail-off quite a bit. Yet, such a guess is quite wrong. Proven by data pulled over 12 months ago, Berkeley’s apartment rental rates were higher and downtown SF. Walnut Creek (25 miles away from SF) has rental rates rivaling Seattle’s Capitol Hill.

The BART System (Bay Area Rapid Transit) was formed in 1957 – 60 years ago. We’re lucky to have the time to study its formation and current impact on the region’s real estate market. I can assure you, we don’t need 60 years of study to find out what will happen in our region.

Where to Invest Near Seattle

In my March 2015 post, 90 Degrees of Similarity I compared the geographical layout of the SF/Bay Area market to our own. Those similarities persist. Both regions have thriving downtown cores, yet urban-suburban markets (think Redmond and Palo Alto) have transformative employers that punch above their economic weight class – spreading the reach of economic vibrancy beyond dense, urbanized downtowns.

As ST2 takes shape, TOD will provide immeasurable opportunity to those presciently focused on how these urban-suburban markets will emerge, stabilize and outperform their non-transit oriented brethren.

The greatest opportunities exist in the proven path-of-progress locations where light-rail stations are destined, zoning provides for development and communities provide for great lifestyle. We see opportunities in:

- Northgate

- Shoreline

- Bellevue / Bel-Red Corridor

The vibrancy that is occurring in the Bay Area, and across the nation, around suburban located TOD locations provides a perfect roadmap to the future of our region. One of the most important concepts of investment is how accurately one can predict future dynamics.

Give us a call so we can Turn Our Expertise into Your Profit!