The first half of 2017 was both everything and nothing we expected. Entering the year, the multifamily market braced itself for uncertainty, volatility and hyperactivity. Uncertainty permeated the first six months of the year, yet the promise of volatility and hyperactivity remained anticipated, but unrealized.

We’re released our new 2017 Mid-Year Review today, and you’re receiving a first glimpse at our latest findings at what is driving our market, namely employment growth, and its impact on multifamily rent and vacancy trends, and sales metrics. We also delve into Seattle’s office market dynamics.

There are plenty of questions in the market as we come into the home stretch of 2017. Are we set for another boom year? We don’t yet know; however, you can count on the Seattle Multifamily Team to keep you as up-to-date as possible!

Here are 5 key trends we found from our research:

- Employment sluggish, yet employers are hungry

- Tech companies snapping up office space

- Urban King rent growth strong, but tapering

- South King leads the region in Y-O-Y rent growth

- Sales pricing up despite uneven sales volume

1. Employment sluggish, yet employers are hungry

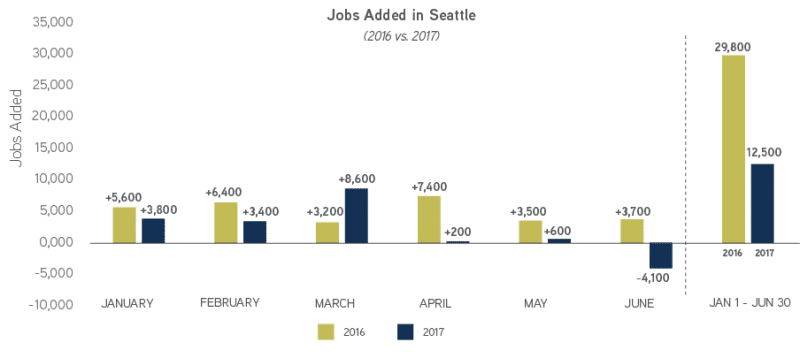

The first six months of 2017 show a pronounced lag in new employment compared to the first six months of 2016: from January 1st to June 30th we added only 42% of the jobs the region added in the first six months of last year.

Despite slower employment growth, the region’s unemployment rate rests at 4.5% (slightly higher than the nation – 4.3%), and Seattle continues to lead the state and the nation with 3.5% unemployment. We are still well positioned to match the past three years of stellar employment growth. Our region will need to add a considerable number of jobs during the second half of the year to remain on track, however.

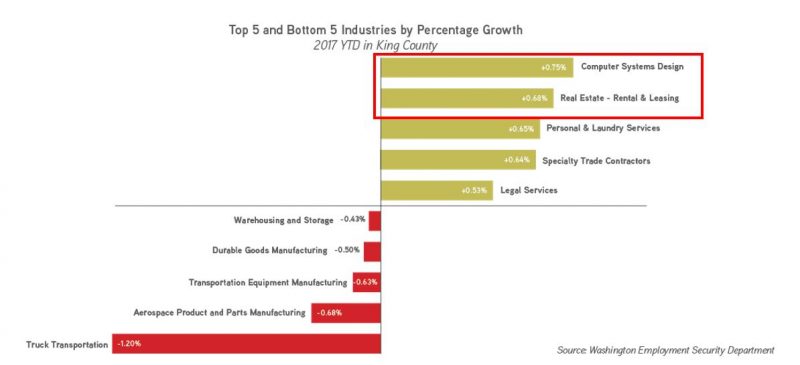

A deeper analysis of regional industry growth offers comfort – and no real surprises. Technology sectors lead job growth, followed by rental real estate. The connection between the two is simple: supply and demand.

Our region’s high-growth computer/technology space drives employment, which in turn drives demand for office leasing and residential housing (mostly rentals). As long as Seattle’s tech sector remains strong, our real estate market stands to thrive.

2. Tech companies snapping up office space

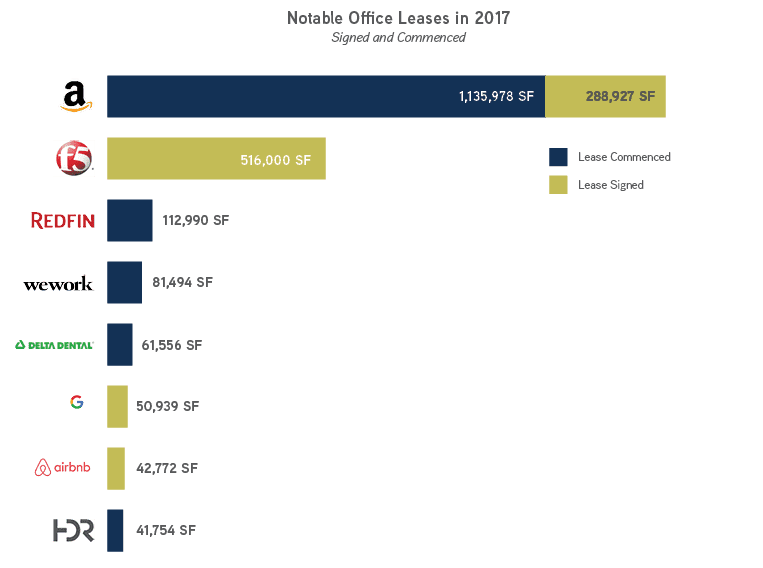

Employment gains trickle through the commercial real estate market by creating demand for office space, the need for rental housing, and retail dollars expended – all of which contributes to industrial demand. Our team has long believed that increased employment is a panacea for all that ills a commercial real estate market.

If this is truly the case, then Seattle is set for a healthy run into the future. As quickly as office developers build, local employers sign new leases. The office development market lagged the multifamily development market by nearly four years, yet now it’s at full stride.

The mix of home-grown users alongside world famous tech companies seen in the chart above proves the strength and agility of our office market.

The diversity of companies signing leases for new office space also reveals a more significant trend: Amazon may be a lead horse, but the talent it’s attracting to our region is only making the composition of Seattle’s ecosystem of tech employers stronger and more dynamic.

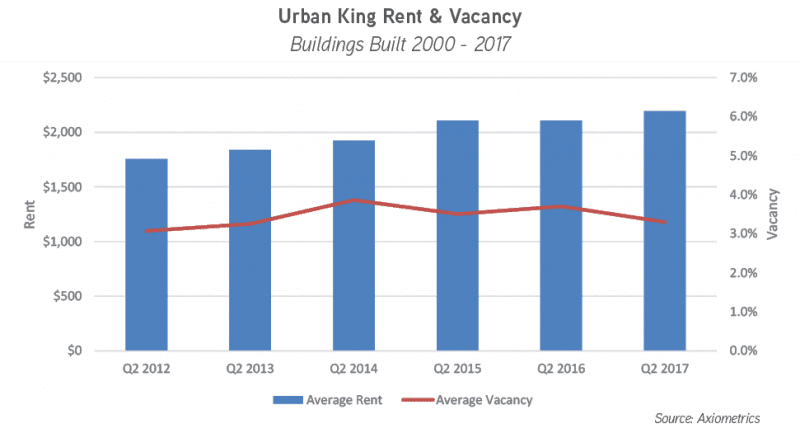

3. Urban King rent growth strong, but tapering

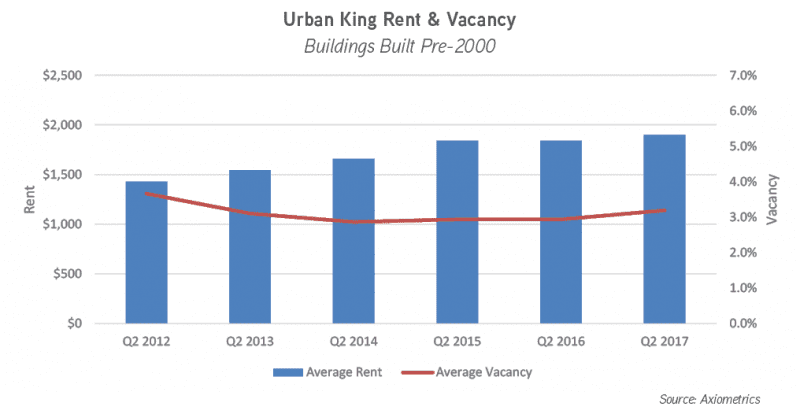

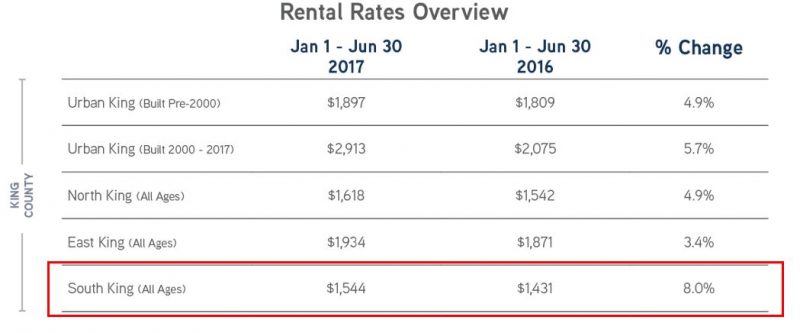

Apartment rent growth in Seattle’s urban core remained steady in the first six months of the year, continuing a 5-year trend of significant growth. Yet rental rates have tapered slightly for all building ages as the market absorbs new supply. There’s still room for owners of older buildings (built pre-2000) to push rents, since the delta between older buildings and newer product is still nearly $300.

Apartment growth remains strong for newer apartment buildings, yet it is becoming more challenging to increase rental rates at +6% year-over-year given the nearly 40% cumulative rental rate growth since 2012. Most of the apartment stock in Seattle’s urban markets was delivered after 2007, as there were few deliveries from 2000 through 2006.

Seattle’s urban core is still a powerful investment market, and with sub-4% vacancy across the board, it’s clear we haven’t reached the rental rate ceiling quite yet.

4. South King leads the region in Y-O-Y rent growth

While +6% rental rate growth is tapering slightly in urban Seattle, rental rates continue to skyrocket in the South King submarket. Rental rates in the first half of the year increased 8.0% compared to 2016, with average rental rate growth between 7% and 9% during each of the two previous years.

Rental rates are rising on all sides of Seattle and Bellevue, and South King is still the market of last resort for renters seeking affordability. Owners in these markets continue to raise rental rates, but markets like Burien, Renton, and Kent are still more reasonable options than most Seattle neighborhoods.

Little development is planned in South King, with most developers focusing their efforts to the north along the planned light rail route. The dearth of development means owners have more room for rental rate growth before they need to worry about increased vacancy.

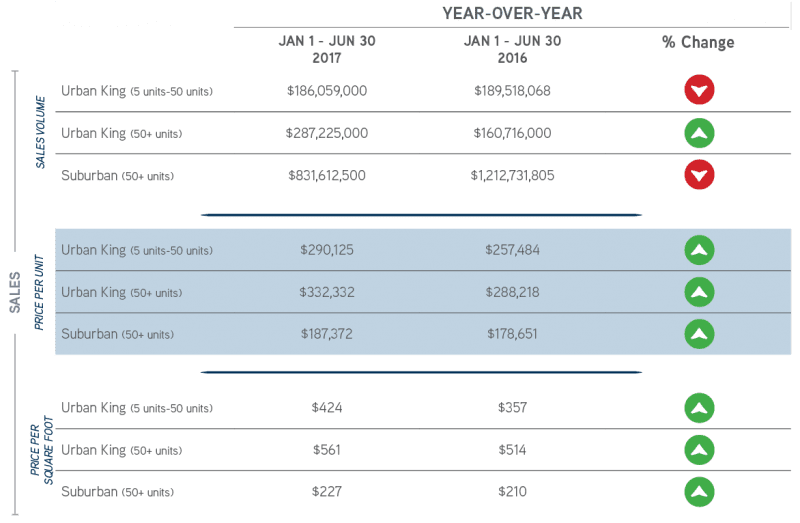

5. Sales pricing up despite uneven sales volume

Sales in the first half of the year varied widely by region and product type. Sales volume decreased for smaller buildings in Urban King as well as in the suburban markets, yet larger, marquee sales doubled.

Despite choppiness in sales volume, pricing is clearly up year-over-year, across all locations and category of building. A combination of rising rental rates across the region and sustained low capitalization rates continue to push sales pricing for all assets.

The first half of 2017 was sluggish for sales as investors (and everyone) acclimated to new leadership, but when investors did buy, they were clearly willing to pay top dollar for a piece of the Seattle pie.

In the first half of 2017, average price per net rentable square foot increased by 13.8% and average price per unit bumped up by 14.0% in Urban King across all building categories. Sales metrics were weaker in suburban King and in Snohomish county, but overall sales were still hitting new watermarks in these submarkets.

To discover more trends and analysis from the first half of 2017, you can access the full 2017 Mid-Year Review here. We are the experts in apartment brokerage in the Seattle & Puget Sound markets – call us with questions about the study, or to discuss the potential value of your property.

Allow us to Turn Our Expertise into Your Profit!