In 2008, the Puget Sound Regional Council (PSRC) convened to create Vision 2040, a comprehensive growth strategy for the Puget Sound region. This extensive project forecasted population, employment, and housing growth in the area through 2040, and it attempted to create a plan for this growth.

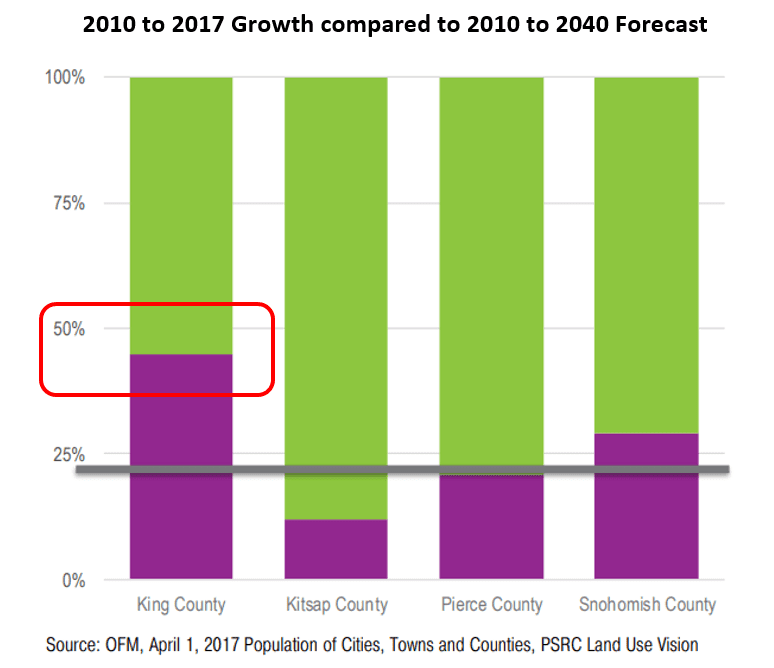

Economists love to plan, but you know what they say about the best-laid plans! Less than a decade has passed, yet the PSRC recently reported that King County has already achieved nearly half of the planned growth for 2040!

Many important investors already have their eyes (and dollars) trained on Seattle. Yet investors must also look for predictable growth in emerging markets beyond the core of Seattle.

As the region welcomes (many, many) more residents and continues to absorb new supply, investors should watch out for these crucial factors that could shape the apartment market:

- Supply Trying to Match Demand

- More Upzones on the Horizon

- Transit Driving Development

Supply Trying to Match Demand

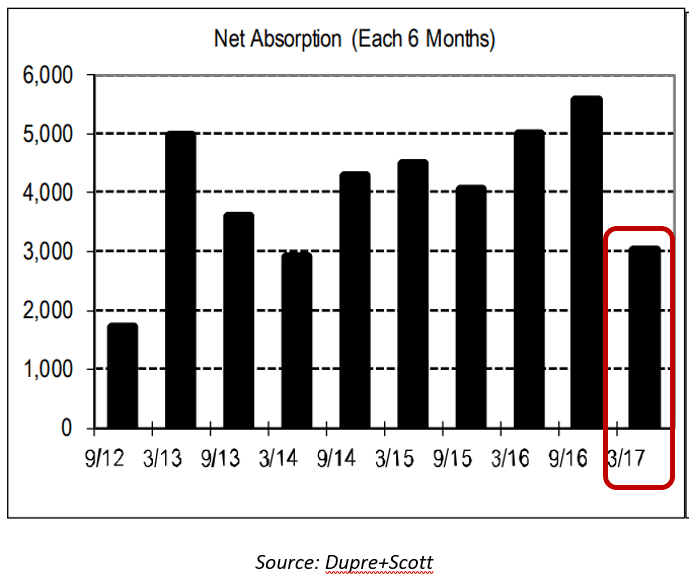

The concept of “over supply” is every developer’s worst nightmare, and for good reason – too many units available in the market means higher vacancy and an overall softer rental market. Nearly 9,500 units opened in the tri-county area last year, and Dupre+Scott predicts that about 12,700 more units will open by the time 2017 is done. And indeed, net absorption was lower this Spring after steadily rising in 2016:

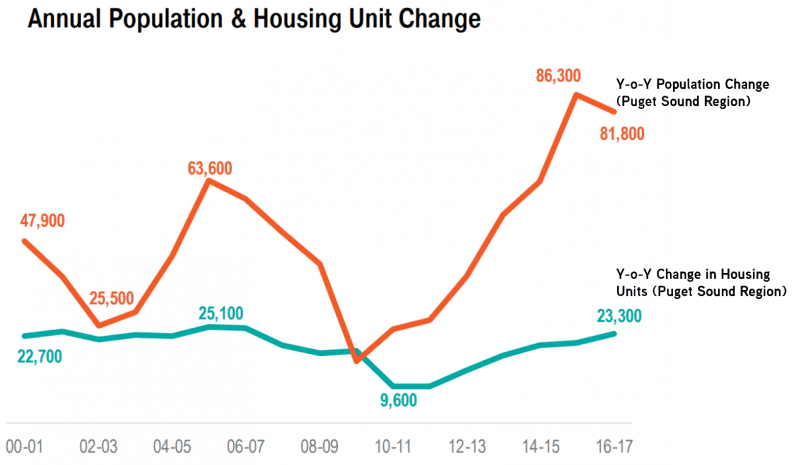

A small dip, however, shouldn’t prompt developers and investors to lift shovels out of the dirt just yet. Seattle’s unprecedented growth – more than 1,000 new people per week! – will keep the demand side of the pipeline strong, and the short supply of SFR housing will keep newcomers in the rental market for much longer than historical trends would otherwise conclude. However, at some point the scales always tip.

The Puget Sound region is set to gain nearly 72,000 more units between 2017 and 2022. That number sounds astronomical today – but if Seattle’s tech companies continue hiring and housing prices stay high, demand for new apartment supply across the region will remain high as well.

More Upzones on the Horizon

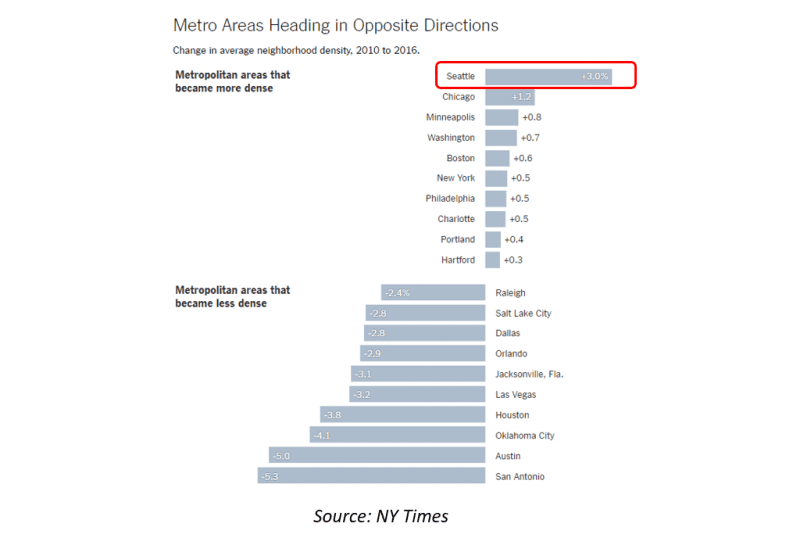

Longtime Seattleites sometimes gripe about the recent boom in population as they see the city rapidly changing: multifamily development is everywhere! Neighborhoods that historically were sleepy and spread out are seeing new apartments, restaurants, and shops spring up on a weekly basis.

Seattle is becoming denser quickly, but we’re far from being a dense city. Nearly two-thirds of the city is zoned for SFR housing, which means only a few neighborhoods are absorbing the impact of our population growth.

This trend is starting to change. Seattle’s City Council has approved upzones already for Downtown, South Lake Union, the University District, and for several intersections in the Central District. They’re deciding on an upzone for the Chinatown International District as well, and the council has made clear that they’re just getting started.

While the full impact of upzoning for developers is still unclear, they are guaranteed to increase density in some of Seattle’s fastest-growing neighborhoods. And since the upzones are being approved primarily around current and future light rail stations, they will shape how people travel through the city as well.

Transit Driving Development

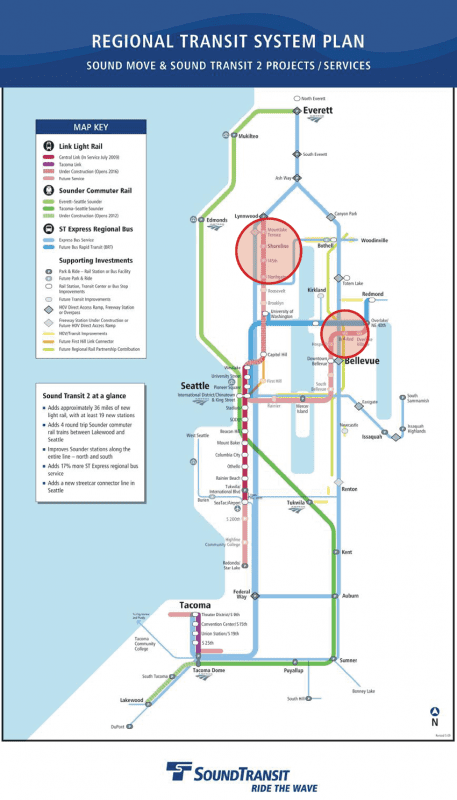

As light rail construction advances slowly northward, developers are snapping up as much available land as they can around the future stations. Transit-oriented development is an important enough phenomenon in Seattle that it warrants its own post altogether (keep your eyes peeled!), but it bears mentioning in relation to Seattle’s population boom as well.

Seattle residents twenty years ago didn’t factor bus stops or Monorail stops into their apartment decisions because they were able to drive easily to and from work every day. But today Seattle is adding as many cars to the population as we’re adding humans, which means traffic isn’t likely to improve. Transit matters, particularly to the younger and renting demographic.

We’re seeing a lot of action around anticipated light rail stations north of the city and to the east – Shoreline has been upzoned and is poised for considerable growth in the next few years, while the new Bel-Red district near Bellevue is quickly urbanizing alongside the Spring District. Both areas are projected to see massive population and employment gains as the light rail stations are built, and developers are ready!

In addition to the light rail stations, RapidRide bus routes and new transit methods like the First Hill Streetcar have carved new corridors of development into the city. Areas like Greenwood and West Seattle are receiving new apartment units along their respective RapidRide lines, and First Hill will see more than 5,000 more units over the next five years along the streetcar route.

Our Seattle Multifamily Team spends a lot of time watching population and market trends like the ones described above so we’re prepared to help investors make smart decisions. Call us today to discuss our latest investment opportunities!