The multifamily market isn’t the only segment of the commercial real estate market performing well in Seattle: our office market – driven by the great engine of Amazon – is hitting new records as companies continue to hire and other companies (tech and otherwise) clamor to enter our market and compete for talent.

Companies are devouring available office space faster than the cranes can build it, and they’re willing to pay for a spot in the center of the action, namely Downtown, South Lake Union, or Pioneer Square.

Office demand drives the balance of real estate demand – and each one of those new employees needs a place to live and places to shop!

Growing companies need more employees, and these employees – whether they’re new residents or Seattle lifers – need places to live. While some will choose to buy (good luck in this market!), many will look to the rental market.

A thorough analysis of the state of the office market provides apartment investors with a more holistic perspective on where to invest in Seattle as well as just how long this golden period will last.

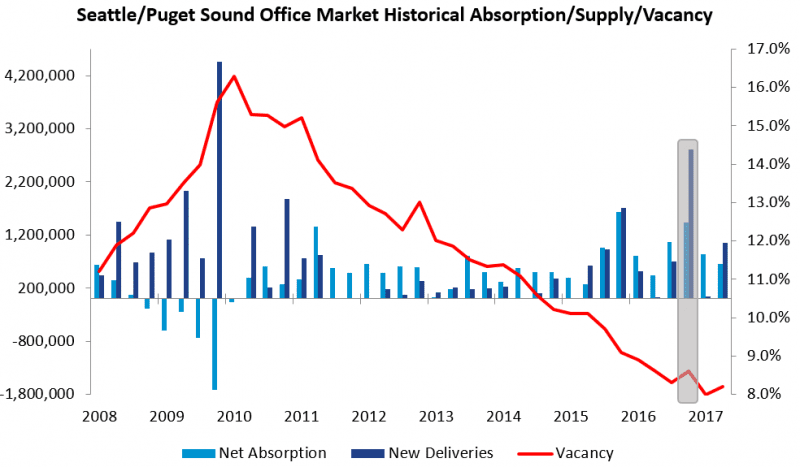

Absorption is Up, Vacancy is Down

It seems like no matter how much space developers build, it’s never enough for companies in Seattle. One million square feet of Class A office space was delivered in Q2 2017, yet Seattle’s vacancy rate didn’t budge from 7.7%! Major employers continue to demand more square footage in Seattle’s employment hubs, and the market proves remarkable capacity for absorbing new supply.

The Puget Sound region’s vacancy rate has steadily declined since the economic downtown. Development activity has increased since 2015, yet net absorption has kept pace as more companies move to Seattle and local companies expand their footprint.

It’s remarkable that a slug of new supply can hit the market in early 2017, yet vacancy only ticked up a slight blip, before resorting to its sub-8.5% vacancy rate.

As of Q2 2017, 7.44 million square feet of office space is under construction (you may have noticed a few cranes), with nearly 60% of it preleased. Seattle’s economic base is growing quickly, and it shows no sign of slowing!

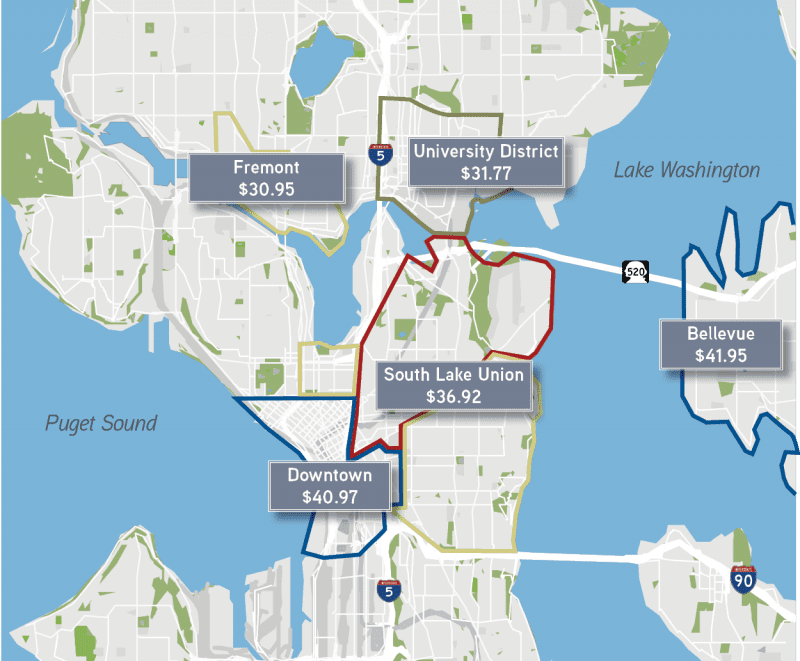

Competition for Space Pushes Prices, Creates New Hubs

As rents rise in Seattle’s more established employment hubs, I predict we’ll see employers moving into new submarkets and neighborhoods in Seattle. Expensive asking rents in Downtown Seattle ($40.97), South Lake Union ($36.92), and Bellevue ($41.95) will push smaller employers and startups to seek new (cooler?) areas to put down roots.

Neighborhoods like the University District ($31.77) and Fremont ($30.95) will benefit and continue on their trajectory as 18-hour neighborhoods with daytime and nighttime activation.

Seattle Office Asking Rents (Q2 2017)

Why does the competitive office market impact apartments? Because employees want to live close to where they work. Downtown Seattle, South Lake Union, and downtown Bellevue have all seen impressive multifamily rental growth over the last two to three years in step with their rapid office market growth.

Google and Tableau’s presence in Fremont helped transform the quirky neighborhood into an 18-hour destination, and the emergence of Pioneer Square as a tech hub has resulted in a boom of multifamily development and rent growth in the area.

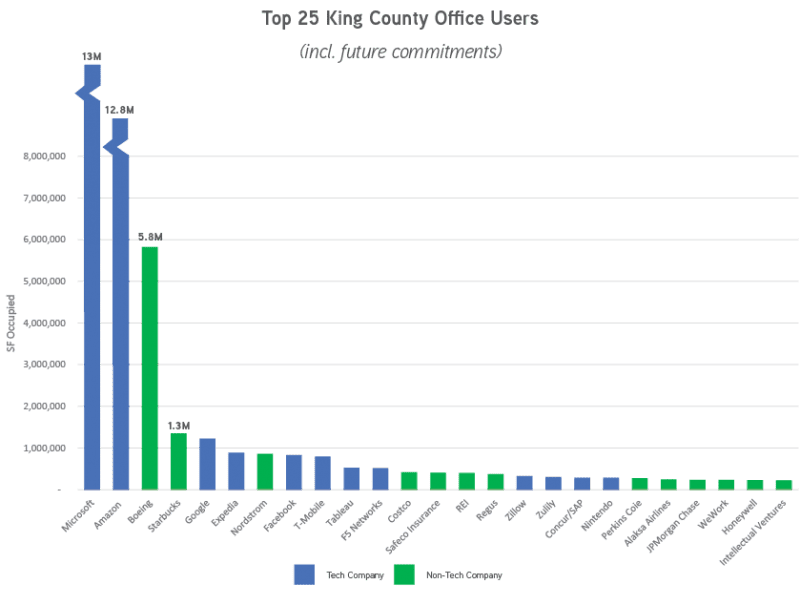

The Tech Flywheel Impacts Office Leasing, Too

Growth begets growth, and in Seattle, tech companies beget tech companies. Major players like Amazon and Google continue to absorb space as soon as its available, all while newer market entrants like Airbnb, Apple, and WeWork try to establish themselves in the Seattle market as well.

The tech renaissance in Seattle is apparent when one examines King County’s top office users:

While longtime Seattle companies like Boeing and Starbucks still have a strong presence in the region, tech giants like Google and Facebook that are new to the region are quickly gaining ground. Local tech companies like F5 Networks and Zillow are benefiting from the city’s tech rush, too.

These tech companies will keep growing, and they’ll keep attracting more high-wage employees to the area. It’s not news that Seattle’s tech boom is dramatically reshaping Seattle’s economy, but how this tech boom will reshape the city’s geography is a story still in the making.

Seattle continues to change rapidly year-over-year, both in the multifamily and office markets. The savvy investor won’t silo themselves, but will instead stay on top of all the factors impacting their current and potential investments. As always, our team is here to help. Pick up the phone and call us (or shoot us an email) with any questions about the market. Contact us to Turn Our Expertise into your Profit!