Seattle has earned itself several new rankings so far in 2017 – the city has been named the no. 6 top tech city in the country, it’s the fastest-growing big city, and it has the fastest growing housing market. This week, Seattle sticks out for a different reason: Seattle has the highest rent growth of all major cities in the U.S.

That rent is increasing here is no secret – but how did Seattle become the leading city for rent growth nationwide?

Seattle’s Phenomenal Rent Growth

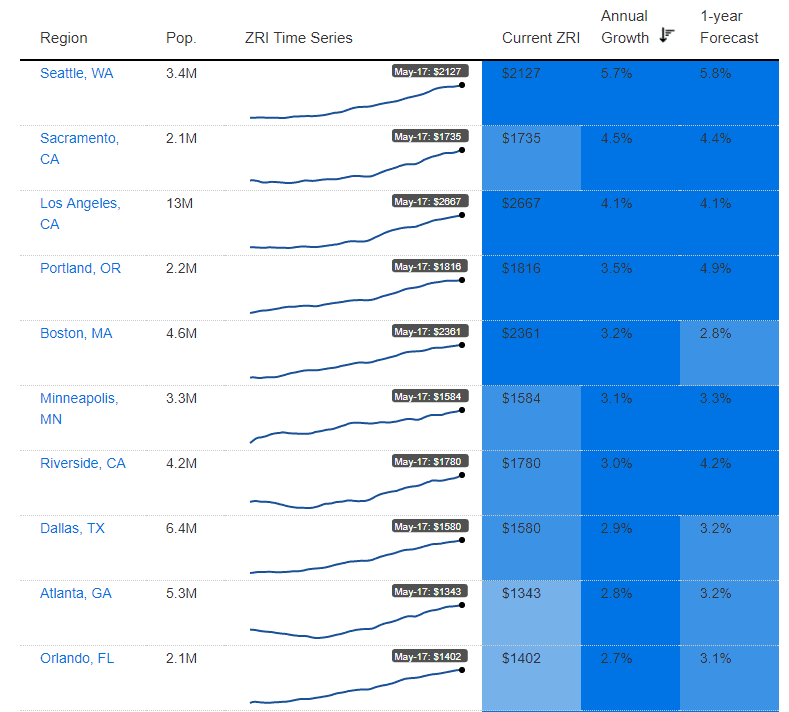

The Seattle Times reported this week that while rent in cities like New York and San Francisco are seeing rent decreases (-1.9% and -0.4% y-o-y respectively), Seattle is leading the pack with reported 5.7% growth compared to 2016. To add some context to these numbers, the next city with the highest annual growth was Sacramento, CA, at 4.5%.

Not only is Seattle leading in annual growth, but the city leads in forecasted rent growth, too (interestingly, the other cities with the highest forecasted rent growth are Portland, Denver, and San Diego – all cities with growing tech centers).

Based on what I’ve seen in the market, here’s my take on why Seattle’s rent keeps going up, up, and away:

- Seattle’s Never Been More Popular

- Nobody is Buying Houses

- Rising Taxes Filter Down

- Seattle’s Submarkets Booming

Seattle’s Never Been More Popular

A major cause of Seattle’s rent growth is simple economics: supply and demand. Seattle is the fastest-growing city in the nation due to the recent tech employment boom and the city’s attractive lifestyle (biking, hiking, and boating, all within the city limits? Yes, please).

Seattle’s population exploded from 600,000 in 2010 to more than 700,000 in 2016, and many of these new residents are moving for high-wage jobs at companies like Amazon, Google, and Microsoft.

Seattle is poised to deliver more than 54,000 units in the next four to five years, a number which seemed daunting when we released it in our 2017 Seattle Apartment Market Study earlier this year. Now, it sounds like it may not be enough to keep pace with the city’s growth!

Increased demand justifies higher costs in a limited supply – namely, apartment owners and landlords can boost prices without worrying about a rise in vacancy. There are new Seattleites who are willing and capable of paying top-dollar for housing for the ability to live near the city’s core.

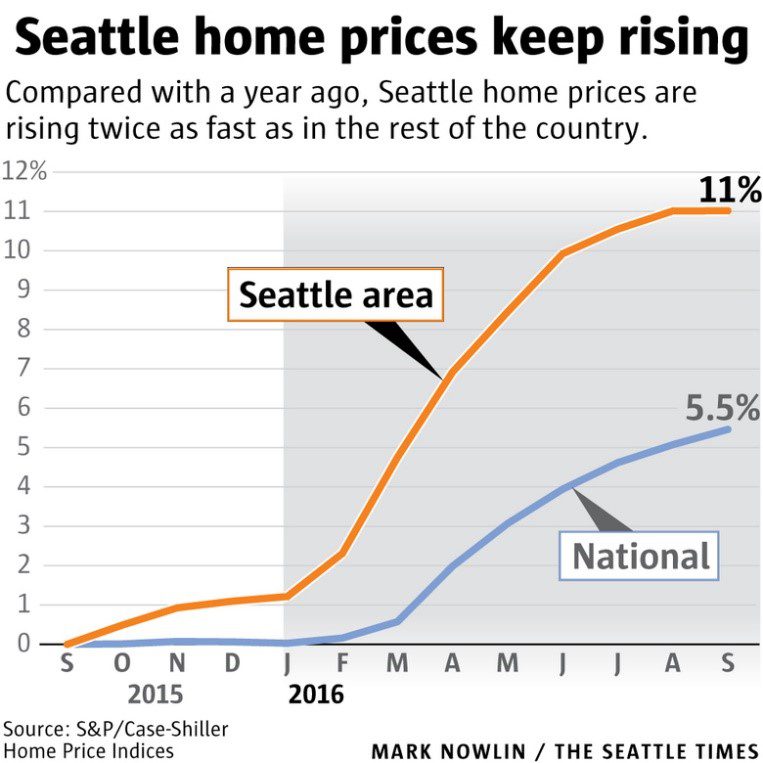

Nobody is Buying Houses

Everyone wants to buy a home in Seattle, but the market is making that dream increasingly tough for even wealthy Seattleites. Seattle has had the hottest housing market in the country for eight months in a row, while inventory has continued to dwindle.

Residents who grew up in Seattle dreaming of a Fremont craftsman of their own are forced to look to Shoreline, Kent, Issaquah and beyond to find affordable prices, or they choose to remain in the rental market (we are okay with that!). Many of Seattle’s new high-wage residents are opting to stay in the rental market, too, which adds even more upward pressure on rent growth.

The combination of frustrated, would-be homeowners and renting newcomers means our city is poised for many more years of rent growth. We’re not at San Francisco levels yet, but it’s on the horizon so long as Silicon Valley techies flee to Seattle.

Rising Taxes Filter Down

Pressure on rents isn’t only coming from the influx of new, wealthy renters; landlords must raise rents to keep up with their own increasing expenses.

Seattle’s ambitious voters have approved a lot of taxes over the past three to four years, and many of these taxes are appearing on apartment owners’ bills. While most of this tax money goes to local schools, construction, parks, and affordable housing – all noble causes – the recent increases put landlords in the difficult position of either absorbing the costs or passing them along to renters.

The increasing utilities (have you seen a postcard with the recent utility forecast increases of 8.2% in 2019 and 9.5% in 2020?) and taxes could prompt owners of smaller or older buildings in Seattle to sell instead of trying to keep their heads above water. The multifamily market is hot right now, and there’s never been a better time for small apartment owners to get top market prices!

Seattle’s Submarkets Booming

When most people think about rent growth in Seattle, they point first to the fancy high-rises going up in Downtown Seattle, or to the new luxury apartments surrounding South Lake Union as the driving cause.

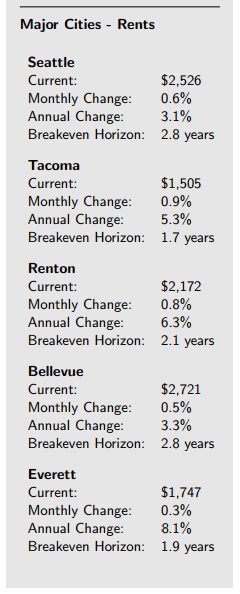

A deeper dive into Zillow’s data, however, tells another story. Zillow’s statistical boundaries for Seattle include most of Snohomish and Pierce counties, and growth in these submarkets is what’s truly driving Seattle to lead the nation. To the north, Everett’s rent increased by 8.1% annually, and to the south, Renton’s rent increased by 6.3%, while Seattle’s core only saw an increase of 3.1%.

As Seattle’s average rent continues to rise, residents are rushing into more affordable submarkets like Renton, Shoreline, and Everett. It’s important to note that most of these people aren’t changing jobs, however. They’re choosing different transit solutions – like light rail – or they’re becoming mega-commuters.

Fasten your seat belts; this rent growth ride is far from over. 2017 is already shaping up to be a record-breaking year for Seattle by all metrics, and staying up to date on the market will ensure investors can find the next great deal before the crowds. Pick up the phone and call us (or shoot us an email) with any questions about the market. Contact us to Turn Our Expertise into your Profit!