To the outside observer, it may seem that landlords have never had it better in Seattle! High-paid, tech renters are moving to Seattle by the hundreds each week. Rents continue their upward ascendency, and vacancy is low across the city.

Yet every silver lining has a cloud. Seattle landlords are also dealing with a bevy of legislative changes that change how they can operate their properties, the taxes they pay, and how they collect income.

The type of rent control other cities like New York City and Los Angeles implement is illegal in Washington State, so Seattle’s City Council’s creativity in attempting to manage the exponential increase of rental rates in the city’s core knows no bounds.

These changes don’t impact landlords in a vacuum, however. The new legislation influences every aspect of investment property ownership, from management practices to value on sale. It’s important for investors to understand the new rules of “landlordship” so that they can make informed market decisions.

Pet Rent

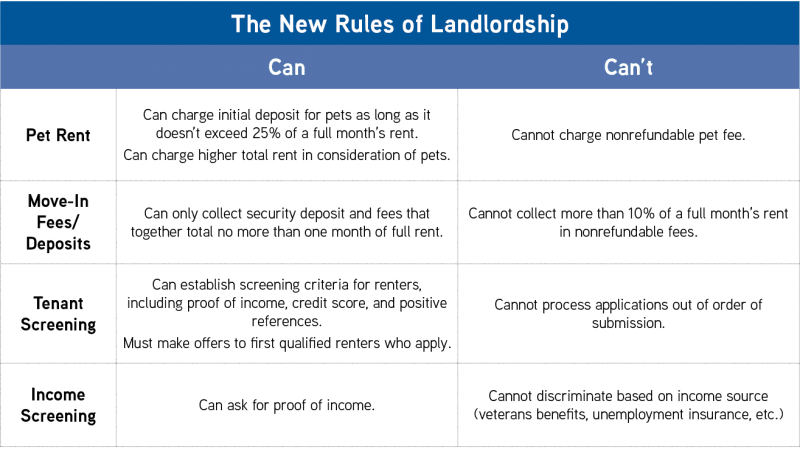

Effective January 15th of this year, landlords are no longer allowed to charge nonrefundable fees to tenants with pets. Landlords can charge an initial pet damage deposit, but the amount can’t exceed 25% of a full month’s rent, regardless of how many pets the tenant owns.

Before the legislation changed, landlords often used initial fees as a security measure against potential damage from rowdy or messy pets. While this legislative change might have pet owners popping champagne, it presents new challenges and risks for landlords, as well as larger implications for the market.

Landlords can charge higher overall rent to compensate for pet damages, and they can adjust their screening criteria to exclude pet owners. Yet, such operational changes have their impacts as well.

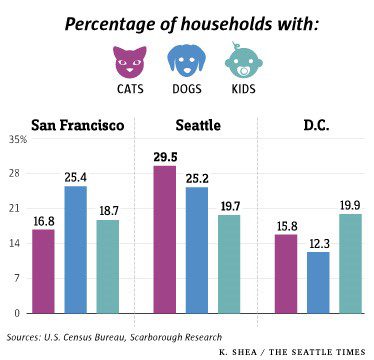

Some market watchers predict that these new rules will prompt a dip in pet-friendly apartment buildings, but I don’t think this will be the case in Seattle, a city where there are more dogs than humans at Green Lake and Gas Works on any given Saturday:

The Venn diagrams of high-wage workers and pet owners closely align in Seattle, and landlords won’t risk deterring this demographic. Instead, I predict that rents in will see a slight bump overall as landlords adjust to the uptick in property damage risk.

Move-In Fees & Deposits

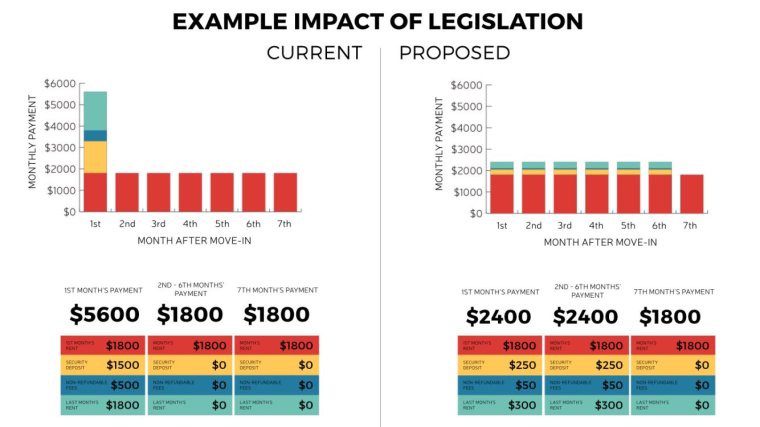

Pet rent and fees are just the tip of the iceberg; in December 2016, the Seattle City Council voted to limit the nonrefundable move-in fees that landlords can charge on rentals. The new legislation limits the deposits and nonrefundable fees that landlords can charge, capping the total at no more than one month’s rent. Tenants are also permitted to pay these costs over the course of six months if they need more time.

This change won’t impact all landlords equally: higher-end, institutional buildings managed by property management companies have more resources to absorb the risk of a bad tenant or extensive damages. Landlords of smaller buildings – who may own a rental property as supplemental income – face much more risk. The capped fees put them at greater risk because they’ll have less in the coffers to cover repairs or renovations. In either case, this is a substantial increase in operational risk for all landlords.

Tenants’ new ability to spread payments out over six months also increases risk for landlords and operations for property management companies. A tenant could destroy an apartment within the first two months and then leave, and the landlord would be left with a third of the deposit and a trashed unit.

The new rules might be an inconvenience for the property managers in bigger buildings, yet they’re a big deal for smaller building owners. It’s an understatement to say this ruling has seen blowback from the landlord community – there are several landlords who have already filed a suit against the city!

The bigger market impact will likely manifest in increased rent growth in the short-term for smaller, older buildings as landlords pass on such risk to new tenants. Long term, the new structure for move-in deposits may be onerous enough to push longtime owners into selling their properties if they can’t afford to negotiate the new, riskier rental landscape.

Tenant Screening: First Come, First Served

Nearly a year ago, the Seattle City Council carved out a small piece of history: they passed a rule that landlords must rent to qualified applicants on a first come, first served basis.

The legislation is intended to reduce housing discrimination, yet it’s been hotly contested by landlord advocacy groups and by many landlords. Controversy aside, this legislation significantly limits lower-unit landlords’ autonomy in the leasing process, and it could increase the day-to-day volatility of property management. Landlords could raise their criteria for tenants, or they could raise rents to ensure they’re attracting “quality candidates.” Seattle may be a great market for larger scale investors, but the new legislation is a wild card for mom and pop owners.

Income Screening

Just in case you needed more changes – landlords are also unable to discriminate based on a tenants’ income source. Larger properties have high enough rent and strict enough criteria that most unqualified applicants are naturally filtered out of the process, but this new restriction adds more uncertainty to landlords’ plates.

Rising Property Taxes & Utilities

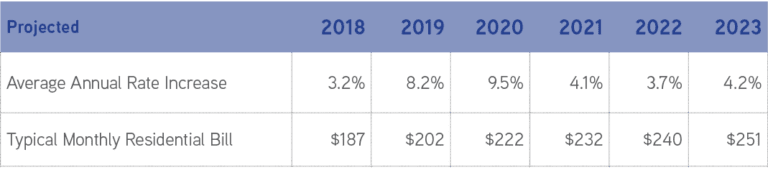

I discussed this phenomenon in depth a few weeks ago, but it’s important to address again the amount of pressure that landlords are facing from every direction. Property taxes have steadily increased in Seattle over the past five to six years, and the costs are putting pressure on landlords. They’re forced to pass along the additional costs to tenants in the form of rent increases. If the increases are high enough, these renters may choose to seek greener grass outside the Seattle core (where rents are also increasing in the suburbs!).

Utility costs have also been steadily increasing. Bigger properties with more resources can take steps to reduce their consumption, but the owners of smaller buildings don’t always have the capital or time to reduce their footprint. According to Dupre+Scott, utilities in buildings built before 2000 increased by 88% between 2000 and 2015 in King County.

I predict that the market will see a boost in sales in 2018 for 5-50 unit buildings built before 2000. The combination of rising taxes and utilities is a lethal one, and it’s pushing many owners to cut their losses and sell while the market is hot. If you’re considering selling your property, don’t hesitate to call us to discuss your property’s value!

The big picture amid all these legislative changes? Rising rents will help landlords stay above water and maintain some autonomy in light of their increased risk. However, larger challenges like rising taxes and increasing utilities won’t disappear soon, despite the filing of lawsuits.

As always, understanding these market characteristics at the macro and micro level will keep you ahead of the curve. Call us to discuss these trends further, and allow us to Turn Our Expertise into Your Profit!