Spring is finally here! The cherry blossoms are blooming at the University of Washington, the Mariners are playing (and losing), and right on schedule, rents are increasing once more.

This winter, the Seattle Times wrote about Seattle’s slowing rent growth. They suggested that the market is approaching a tipping point with so much construction on the horizon. Renters could be able to find more affordable housing in the future as vacancy rises. They asked:

Could 2017 be the Year of the Renter?

Alas, just weeks ago Dupre + Scott released its latest rent & vacancy data revealing exceedingly strong rent growth across the Seattle apartment market. The Seattle Times quickly downgraded the much-lauded rental tipping point from the winter to a momentary blip.

If you’ve been reading my newsletter long enough, you know that the story in our market is never that simple. Rent and vacancy trends can’t be boiled down to single numbers, and if one hazards to do so, valuable insights are lost.

We are here to advise clients on how to achieve the highest level of returns, not sell papers!

2017 may be the year for certain renters, yet it absolutely will be the year of the investor! Below are 3 key trends from the spring’s new rent and vacancy data that will help you stay on top of the market as it undoubtedly heats up this spring and summer:

1. Rent growth still increasing in smaller, older buildings

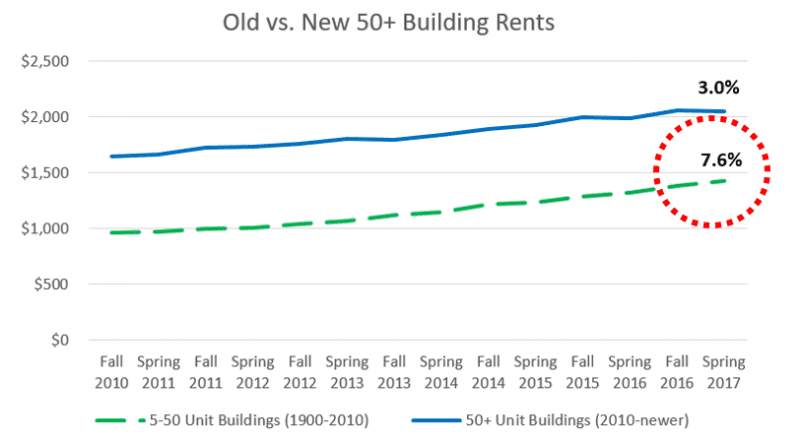

I’ve written before about the rental rate gap between newer, larger buildings and smaller, older ones. I predicted that older, lower-unit apartments will continue to experience rent growth as long as the newer product is significantly more expensive. Dupre + Scott’s spring release of data backs me up so far:

Rents increased 7.6% y-o-y for older 5-50 unit buildings while during this same period rental rates only increased by 3.0% in newer, 50+ unit buildings. The gap between average rents is slowly closing, yet there’s still a noticeable difference between paying $1,400/mo. for rent and paying $2,000/mo.!

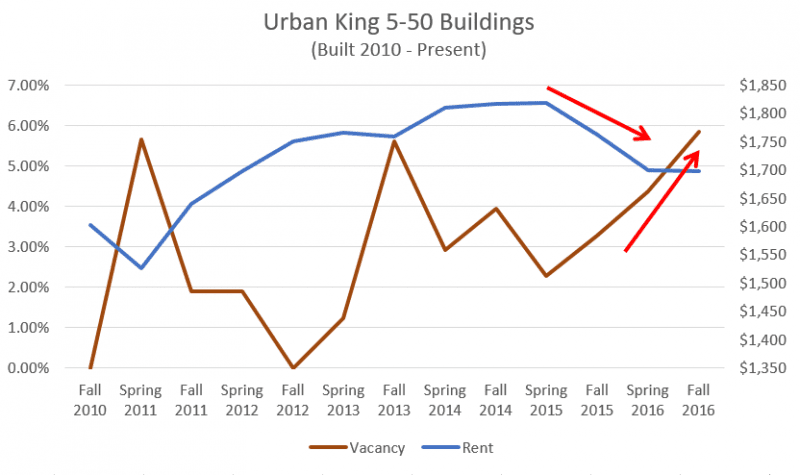

2. New 5-50 unit buildings see rising vacancy

While the large, institutional buildings in Seattle are filling up fast, vacancy in new 5-50 unit buildings continues its upward trend, now in excess of 5%. Upward trending vacancy continues a trend since Fall of 2015 when it hit a low of 2.28%. Rent also decreased by 3.8% since last spring, showing that the market is having a bit of trouble absorbing new units while maintaining low vacancy and ever-increasing rental rates.

Over 95 buildings under 50 units were added to the Seattle market since 2014, totaling more than 2,700 new units to the market. Overall rental rates are much higher than the beginning of this market cycle, yet the growth is beginning to taper – which is expected at some point.

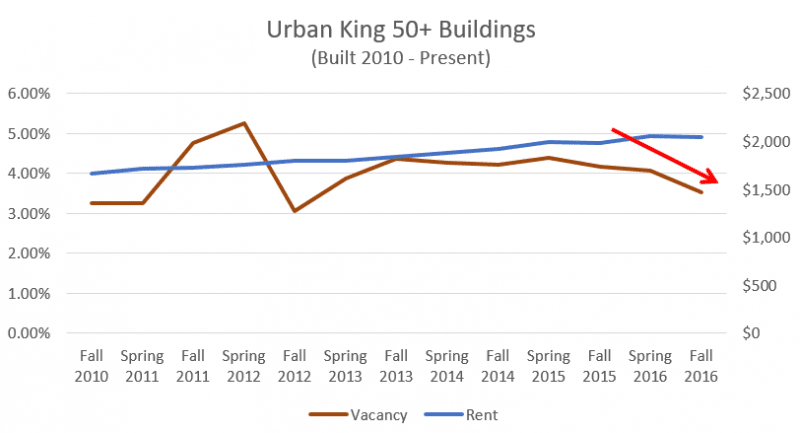

Yet 198 50+ unit buildings were developed in the same time frame, and vacancy rates for these buildings (impressively) continue to decline:

There are several possible theories for this discrepancy. To start, it may be that the companies managing the larger, institutional buildings are offering more aggressive concessions in order to quickly fill units, while owners of smaller buildings are taking a slower, quality-over-quantity approach toward leasing.

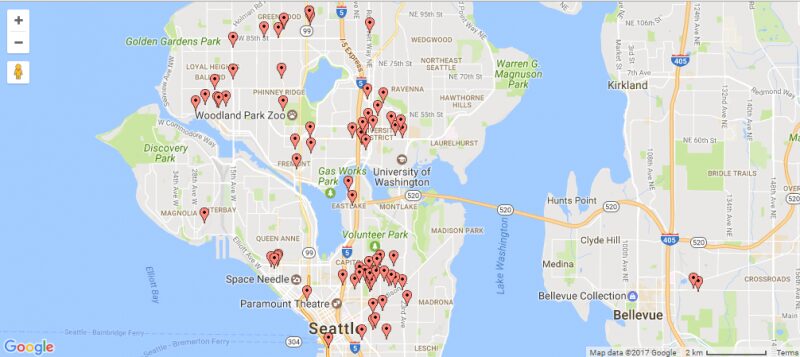

Geography could also play a part in the higher vacancy for new 5-50 unit buildings. Most of these building types developed in the last three years are clustered in key areas of the city, such as Capitol Hill and the University District. Developers continue to cluster in the core, proximate to the city’s cultural hot spots.

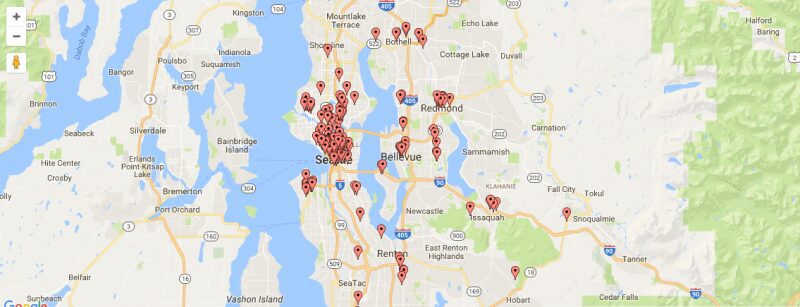

Snapshot of 5-50 Unit Buildings Developed Since 2014

The development of 50+ unit buildings has covered more of the map in Puget Sound. Bellevue, Redmond, Bothell, and Renton all had 50+ apartments delivered in the last three years.

Snapshot of 50+ Unit Buildings Developed Since 2014

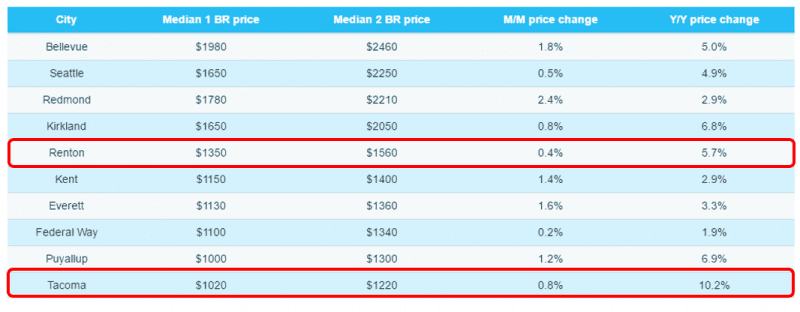

3. Suburbs continue to see stronger rent growth than urban core

Speaking of the suburbs, rent growth in the outer-ring continues to surpass Seattle’s growth – and by an impressive measure. Rental rates in Renton increased by 5.7% y-o-y, Mountlake Terrace (not depicted below) experienced 8.6% rental rate growth over the last year, and during this same time Tacoma outpaced everyone with 10.9% rental rate growth.

Keep in mind that none of these locations received newly developed apartment buildings. Such rental rate growth is even more impressive as it is purely organic, not driven any newer product that is intrinsically more expensive (which can lead to what Mike Scott calls “the skew of the new”).

I’ve written a lot about Seattle’s suburbs becoming the go-to destinations for renters seeking affordability, and so far the data is putting truth to my analysis. Demand has increased in these markets, and since enough supply hasn’t followed yet, owners can justify increasing rents without worrying about a spike in vacancy.

As development heats up in Seattle’s close-in suburbs like Renton and Lynnwood, keep an eye on cities like Tacoma and Everett to start reaping the rewards. The latest Census data reveals that Pierce and Snohomish counties rank in the nation’s top 5 counties with the largest net increases of people moving from another county in 2016. While the data doesn’t reveal how much of this migration comes from King County, the reality is that residents – local or new to the area – are seeking affordability beyond Seattle now.

Make 2017 Your “Year of the Investor”

Tracking Seattle’s apartment market is never boring, but it’s not simple either. Sites like Zillow, Zumper, the Apartment List, and Abodo all regularly publish updates about rental prices, but you must dig deeper to understand where the market is headed.

There is no one “right” answer to questions about where to develop and what type of apartment to buy. We are seeing newly developed urban-located apartment buildings in certain locations continue to outperform (e.g., Greenwood) and other emerging locations finally land on investors radars (e.g., Georgetown), and for good reason.

The key is knowing what to study and when and how to execute an investment strategy.

Our Seattle Multifamily Team has the experience and the resources to help you dig deeper. We make it our business to know the Seattle/Puget Sound apartment market at a granular level, and we’re ready to help you turn Our Expertise into Your Profit!