Local papers and real estate nerds whipped themselves into a frenzy earlier this year when overall rental rates began to taper. The Seattle Times asked if the market was at a turning point. KING5 called it a cooldown, and the Puget Sound Business Journal warned of a deteriorating market.

If you own an older, 5-50 unit building, don’t necessarily believe what you read. All this negative news pertains to the glut of new supply coming into the market.

Let me clarify – any panic from small building owners is understandable! We were all hit hard in the Recession – not because of oversupply, but because of the financial crisis. For owners of smaller buildings, the biggest challenge was rising vacancy as residents lost jobs and moved away or back home with family.

Vacancy is something all private owners need to be aware of, but if you have owned during the recent boom, you have likely seen prospective renters applying by the dozens when you have an availability. But if you are trying to increase your income to keep up with taxes, the real question is:

By how much will you be able to raise rents in your older, smaller apartment?

Rents Are Already Rising in Older, Smaller Buildings

Almost exactly a year ago, our team wrote about the different rental rates in different apartment age groups. We wrote that older buildings – specifically those built between 1960 and 2000 – were experiencing steeper rental rate growth than newer apartments. My colleague Dylan Simon wrote,

“As brand-new product pushes the boundaries of both affordability and absorption, the thesis for vintage apartment buildings remains strong.”

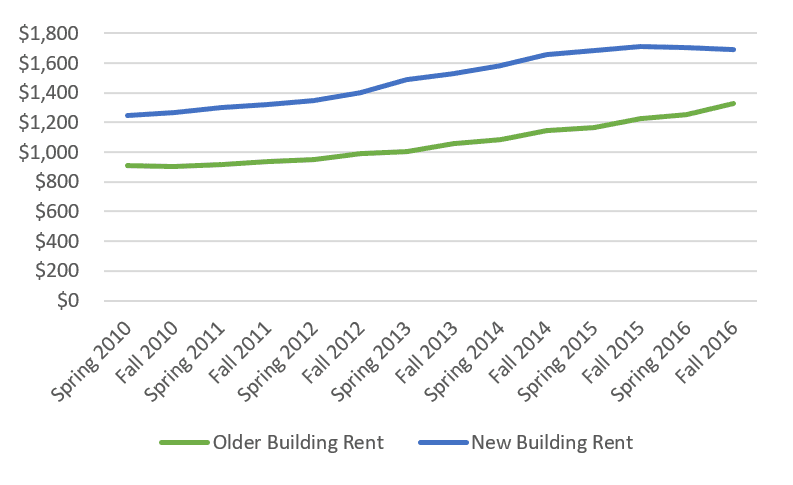

The theory has borne out in a big way since spring of 2016: average rent has been rising for older buildings over the past two to three years while rents have begun to plateau for newer product.

I don’t anticipate that similar rent plateaus will hit home and affect smaller owners, especially owners who aren’t pushing the market. As long as the gap between average rents in the older product and new supply remains – and I think it will – owners of older buildings can raise rents by around 6 percent every year and still retain renters.

Not only is the affordability gap big enough that most renters won’t be willing to move, but also boutique buildings attract a different kind of renter than the fancy new high-rises do. While the city may feel flooded with high-wage Amazon techies looking for dog walks and apartment gyms, they aren’t the only people renting in the city!

Raising Rents & Property Taxes

Owners’ ability to raise rents matters a lot in light of the increasing property taxes for older buildings. The property taxes have risen significantly over the last year due to voter-approved levies, but they put owners like you in a tricky position: pass the costs along, or try to absorb them and ride out the spike?

Right now, there’s room to raise rents in many neighborhoods. Even when rents start rising again for the newer product, old buildings will still be able to draft off the delta in asking rents.

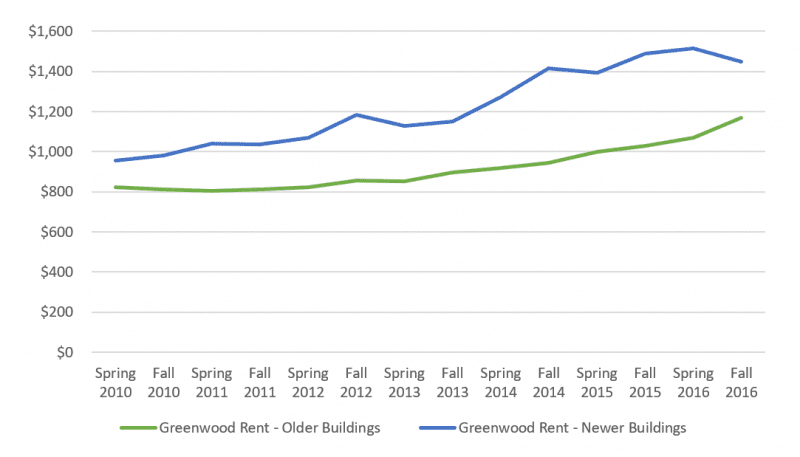

The Greenwood neighborhood is a great case study for comparing old and new rents: while the new supply’s rent has been going up and up over the past five years, it began to level off at the same time rents in older buildings have started to climb.

How to Keep Up

Our team at Colliers has a lot of resources, and we are always happy to provide assistance to clients like you. Whether you have a vacant unit turning over next month and would like advice on selecting your asking rent, don’t hesitate to call or email us. If you’d like us to assist in a broad analysis of your apartment investment portfolio, we’re also happy to help. We are here for you and ready to get to work when you are!