One of the foolhardiest games to play is the prediction game – from the weather forecaster predicting sun before a storm, to economists predicting good times before the bubble burst – these predictions often end up the punchline to jokes years later.

But looking backwards can only take you so far in this market, so this week I’m forging ahead into the forecasting business! Based on our extensive research for the 2017 Seattle Apartment Market Study, here are five predictions of what I think will happen in the Seattle apartment market:

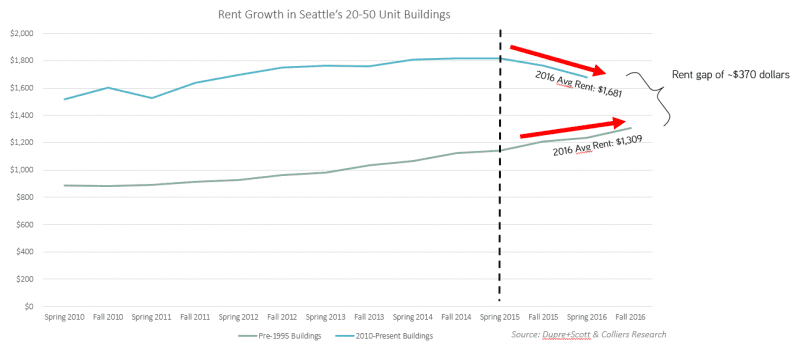

1. Urban Core Rent & Vacancy: Older, smaller buildings will experience +6% rent growth until they close $350-$400 gap with new buildings

In Seattle’s urban core, rent growth for newer buildings reached a plateau over the past two years as the supply of new, high-end buildings inundated the market. Meanwhile, older buildings have still had room to increase rents. Because their average rent is so much lower than their newer counterparts (approx. $1,300 versus $1,680), landlords can afford to raise rent without residents jumping ship.

In some neighborhoods, owners can justify rent increases by performing minor apartment upgrades. But in competitive neighborhoods like Capitol Hill that are set to see a lot of new 20-50 unit supply, owners could likely raise rents by $200 and still remain affordable in comparison.

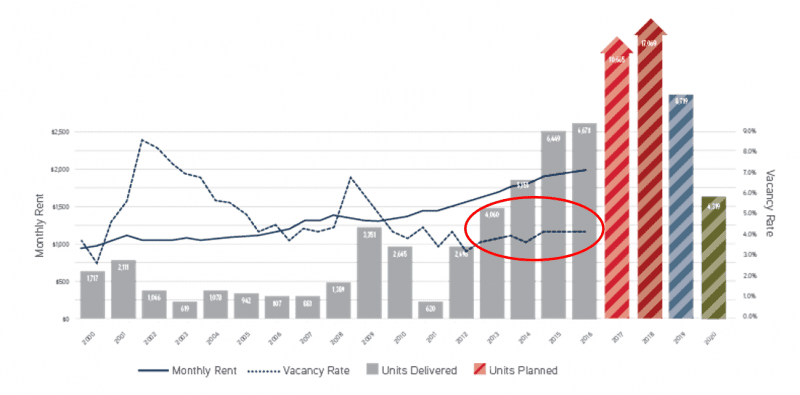

In Seattle’s urban core there are fewer older, large (+50 unit) apartment buildings, so comparisons to the stock of modern apartment buildings are hard to make. Yet, these urban locations are set to receive +28,000 units in the next two years (see graph in Prediction #3), so guess for yourself the level of competition the market is about to experience in 2017 and 2018!

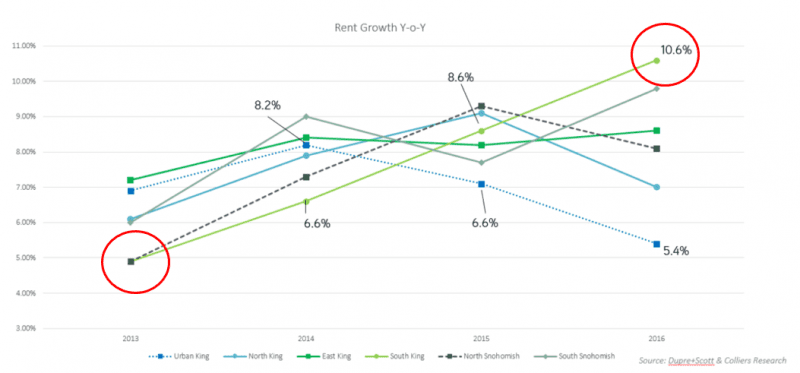

2. Sales: Suburban markets will continue to outperform urban markets for the next 24 months

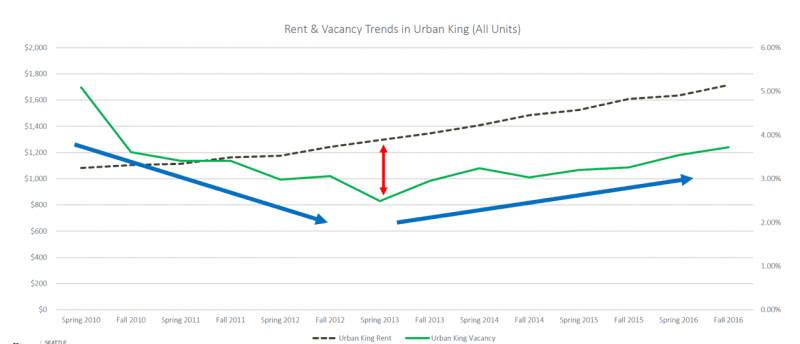

You’ve heard me say it before (Where to Invest Outside the Core and Where are Rents About the Rise the Most): Seattle’s suburban markets are poised to see a lot of growth in the next few years. All the indicators are present – rental rates are increasing in regions like South King and South Snohomish, while vacancy rates remain low.

Sales pricing and volume are increasing outside Seattle’s core, and this trend will continue as renters seek affordability while developers deliver competing new apartments in the core.

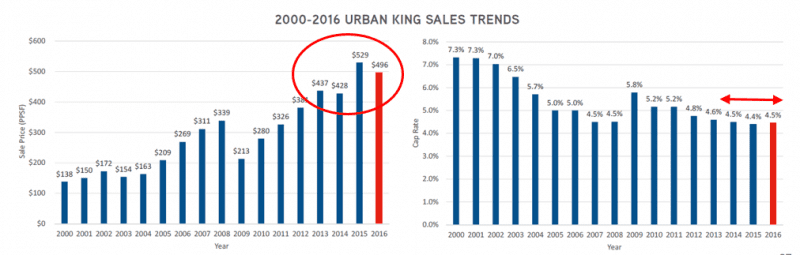

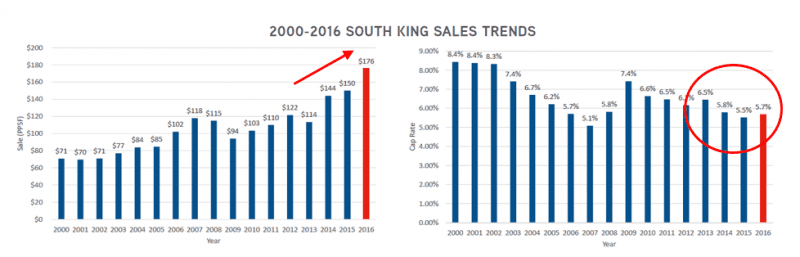

These trends are already manifesting. When one reviews the sales trends in the urban core versus close-in suburbs, it’s clear the market truly hit an inflection point in 2016. Sales metrics in the urban core (mostly newly delivered buildings) did not accelerate in 2016 as they had in the previous 4 years.

Yet in suburban markets, sales trends metrics are showing strength in the investment market, marked by high investor demand and concomitant price increases.

3. Development: New development will correlate more directly to higher vacancy than it has for the last 4 years

In the last few years, Seattle experienced a boom in new development. King County alone has received nearly 39,000 units since 2010, and more is on the way. Yet increasing demand suppressed vacancy rates that would otherwise bump up in the face of new product.

The vacancy rate remained stable in 2016, ending the year with a tremendously impressive 3.7% vacancy rate across King County. In urban markets, developers delivered nearly 7,000 units, yet vacancy only increased 10 BP year-over-year.

Urban King Market Fundamentals (50+ Units)

As sunny a picture as this is, I expect the trends to change as we look ahead. For the last several years, rental rates increased significantly with vacancy rates only rising marginally. Yet the last time rents trended up and vacancy trended down significantly was 2013.

Ever since 2013, vacancy rates have crept up slowly. As the market is set to receive a huge number of new units in 2017 and 2018, I predict that increasing vacancy will be more directly (READ: strongly!) correlated to new supply.

4. We will see A LOT of new buildings opening, but less new construction sites, because of:

Construction costs.

In our 2017 Seattle Apartment Market Study, we discuss that over 77,000 apartment units are in some form of construction, entitlement, or proposal. This pipeline is in addition to the more than 46,000 units delivered so far this cycle. With this much development planned, a tremendous number of new apartment units will be delivered – but not as many as we think.

Three factors will slow the market:

- Construction Costs: The cost to build new buildings is increasing quickly. In fact, it’s increasing faster than rent growth can provide returns, which makes it tough for multifamily developers to justify higher build costs to investors. And apartment developers are not only competing with themselves for labor, but with hotel developers, office developers and industrial developers as well.

- Construction Lending: Construction lenders are growing wary of both the development pipeline and the duration of this market cycle. As a result, less construction debt is available, and what is available in the market is priced to its scarcity. Upticks in interest rates add another layer of cost.

- HALA / MIZ / Land Costs: Regulation in the form of Seattle’s Housing Affordability and Livability Agenda and Mandatory Inclusionary Zoning is impacting developers’ proformas, and not always positively. When regulation and zoning changes are depreciating land values, land owners are not always willing to take the haircut, and can stall land transactions.

5. Employment: Job growth will beat all expectations

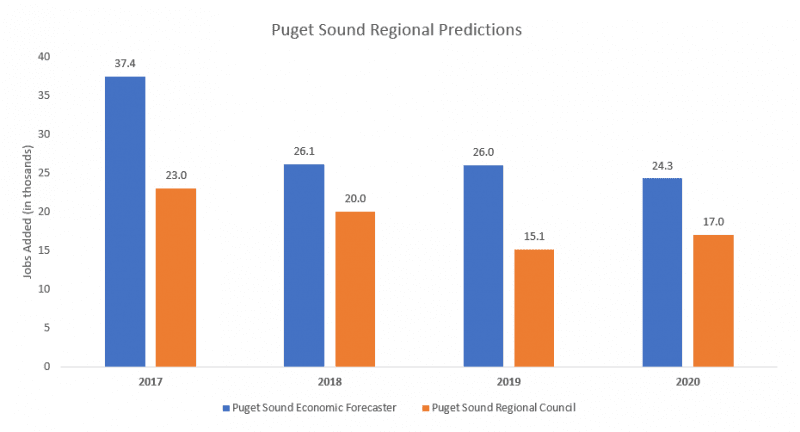

Job growth in the Seattle region is truly a Cinderella story. Our region restored all jobs lost in the Great Recession well before most other markets in the nation, and the employment sector has been on a tear ever since.

Our region’s economists are simply having trouble keeping up with a “new Seattle” job growth environment. Although econometric models kept pace with actual new jobs early in the market cycle, the models failed ever since – which is great news for Seattle!

Economists are predicting less than 40,000 new jobs each year for the next 4 years in the region. The Seattle/Bellevue/Everett region added 5,400 new jobs in January 2017 alone, while unemployment held steady at 3.7%. At this rate, we could add only 2,000 jobs each month for the rest of the year and still exceed predictions!

I predict the market will far outpace that growth. The region’s technology engine is alive and well, and the technology sector is bolstered the most diverse job sector ever for our region. For the next several years, expect job growth to outperform every prediction.

What To Do with These Predictions

We are in a tricky part of the real estate cycle. Some of the above predictions may pose challenges, while others highlight significant opportunities. Looking back to 2012, it was almost hard to make a mistake in multifamily. Looking forward, choices are not that easy – yet they didn’t they seem easy back in 2012, either.

We have a lot more information about how this cycle is preforming based on the last 6 years. Now is certainly the time to separate from the pack. The pack followed itself into good times, yet packs can also follow themselves into trouble.

As we’ve always recommended, study the market and work with experts. Give us a call.