In 2012, a young Stanford computer science student had a great idea for a mobile wallet of sorts. By 2013, the high-flying 22-year old CEO of Clinkle had raised $30M. By 2015, Clinkle had died.

Although equally a story about poor execution, Clinkle is also a story about companies the world simply may not need. We don’t always know which companies we’ll need, but what we do know is that good economy or bad, established efficiency companies are far more likely to survive than innovation companies.

The future of Seattle’s economy and apartment market heavily depends on what type of companies our region is growing and sustaining – efficiency companies or innovation companies.

The distinction matters because when companies survive, they retain employees – and those employees require office space, apartments, baristas pouring expensive mochaccinos, dog walkers, drycleaners and barbers. And all of those people need apartments, too.

Efficiency Companies versus Innovation Companies

Currently, our region’s growth and sustainability depends heavily on the success of many technology-based companies. In that respect, we are not too different from San Francisco, Austin, Raleigh-Durham, and Boston. Yet a more granular distinction about the core functionality of each technology-based company is critically important.

Efficiency companies create efficiencies in industries that have already proven durable. The companies’ industries aren’t innovative – Airbnb is still in hospitality, Zillow is still in real estate – but their technology has created more efficient processes. The company saves money, and its efficiency also crucially ensures durability and survival.

Amazon, for example, qualifies as efficiency tech because it is essentially a logistics company. The company sells and distributes products, and for centuries retail has remained a proven business model. Yet Amazon’s existence centers around creating efficiencies.

Uber’s stock and trade is also the creation of efficiency in a preexisting industry. Hired “drivers” date back to ferrying passages along rivers in Mesopotamia. If economies shift, Uber can change its rates at any given second, so it’s more agile and sustainable in varying economic times. Such efficient pricing ensures its survival – and the jobs of many, many of Uber’s engineers who are renting expensive apartment units.

By contrast, innovation tech brings something entirely new into the marketplace. I’ll pick on Twitter as an example – do we need what Twitter is producing? We don’t yet know. I handicap those companies a bit more because when a downtown occurs (and it surely will), it’s easier to let go of innovation first. The Pinterests and the Yelps of the world aren’t as integral to our lives because we’re not certain we need that innovation, especially in more penny-pinching economic times.

I have nothing against innovation, per se. Yet if the world goes awry, I don’t want to place my economic bets on someone paying to use a new and possibly unnecessary service. These doubts lead to a second key distinction: recurring corporate revenue versus discretionary subscription revenue.

Recurring Corporate Revenue vs. Discretionary Subscription Revenue

When underwriting a company’s value (especially in the Internet Age), the sine qua non of success is revenue. Yet if we want to stress test tech resiliency, merely making money is not enough. We must ask: how is that money made?

Companies that able to capture recurring corporate revenue based on platform products stand the greatest chance to maintain those revenue streams during difficult economic times.

For example, Amazon’s AWS (Amazon Web Services) business unit and Microsoft’s Cloud. Both cloud computing platforms replace costlier stand-alone content delivery and data storage solutions for corporate clients. Equally resilient – yet not sexy – is Microsoft’s Exchange Server business, powering hundreds of millions of corporate email users. Good times or bad, companies will not downsize the use of email en masse.

Subscription-based businesses – especially for non-essential items and based on the outlay of discretionary income – raise a flag of concern. Although now thriving businesses, with business owners signing leases for office space and employees signing leases for apartments, these business models will prove the least successful during difficult economic times.

Age & Balance Sheets

The final factors I always consider are the age of a technology company and its balance sheet. In Seattle, most of our major technology companies are very mature. Microsoft is about to celebrate its 42nd birthday, and Amazon is now 24 years old. Zillow is growing very fast, and they’re 11 years old!

Some companies in the Bay Area are one and two years old, and I don’t know if they’ll survive. There’s no guarantee that the mature tech companies here will always be successful – look at AOL or Yahoo – yet the relative maturity of Seattle technology companies absorbing office space is reassuring.

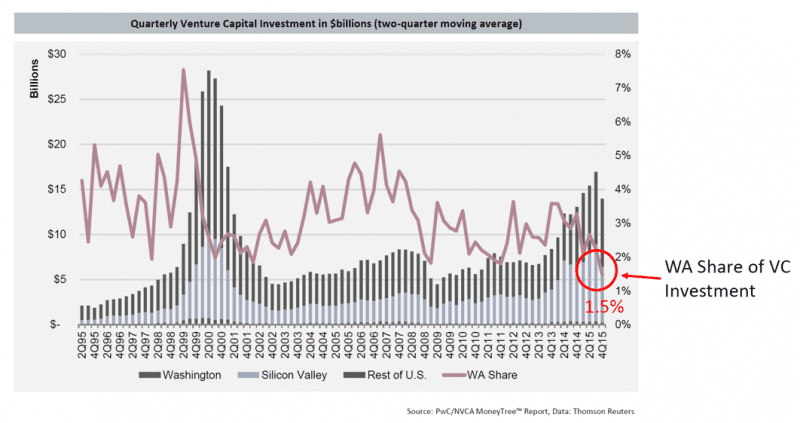

Finally, dependence on venture capital to bolster a balance sheet remains a fickle lot in life – especially as VCs are growing increasingly cautious with valuations. A lot of early stage companies in San Francisco and New York rely on getting funded, and that funding impacts the city’s office leasing, especially office subleasing. These impacts directly trickle down to demand for apartments.

As Goes Seattle Tech, So Goes Seattle Apartments

It would be heresy to suggest that the vibrancy of Seattle’s apartment market isn’t intrinsically tied to the health and sustainability of the region’s technology sector. The maturation of our economy fortunately finds roots in global health, aerospace, biomedical engineering and the life sciences, yet technology is very important for this city’s future.

The growth and sustainability of all companies in Seattle and the Puget Sound region is immensely important to the health of the commercial real estate market. The rise and growth of technology companies located in urban neighborhoods of Seattle, Bellevue, and Redmond mirrors that of the current swath of apartment development – or should I say vice versa.

Understanding the business models, revenue streams, age, and balance sheets of these companies lends support to the health of our region’s apartment market and its economic vibrancy into the future. Bets on the vibrancy of tech in the Northwest are well-placed.