The story of Seattle’s economic strength is borne of an early recovery from the Great Recession and rapid job growth in high-wage employment sectors. This story began early for Seattle, as early as Spring 2013, when the region recovered all of its +113,000 jobs lost in the Great Recession.

In the following two years, job growth – and wage growth – in Seattle surged!

The rest of the state, and the nation at large, traveled a much slower path and overall never reached employment fundamentals approaching the strength exhibited in Seattle. Yet in the last year, notable changes are taking shape.

The impacts of these changes are of course felt in the apartment industry, yet just how is important to understand.

Employment Growth by Region

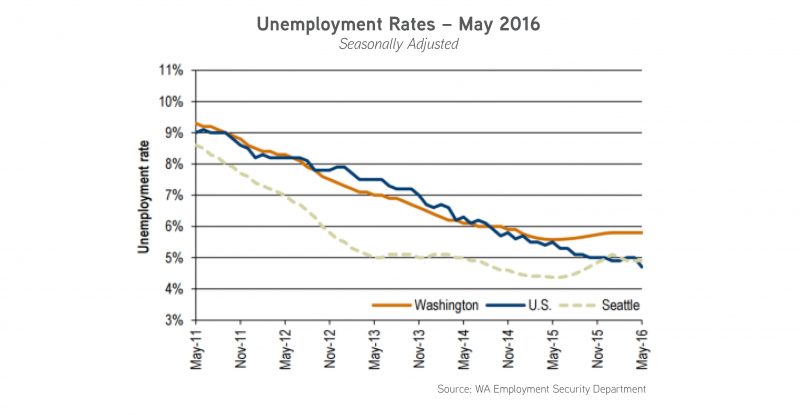

Employment and wage growth in Seattle is storied. Such growth is fueling rental rate increases topping 6% year-over-year for several years running. The below graph depicts rapid job growth periods, which of course manifest in great fundamentals for the apartment industry.

As of the last year, however, unemployment has tapered up, both in Seattle and Washington State. Interestingly, the rest of the nation now leads both Seattle and Washington State in per capita employment.

You can find original graph HERE

Should Apartment Investors Worry

No, absolutely not. Our region is healthy – very healthy – and the tea leaves suggest more good times ahead. However, the intrepid investor must always find guidance in what most likely lies ahead versus predicting that past is prologue.

Accordingly, how can we know where to invest dollars to achieve the highest investment return? Foremost, we must understand current dynamics.

At present, a few factors are likely impacting the Seattle apartment market.

Namely:

- We have recovered all jobs lost in the Great Recession, the nation has not

- Future job growth must be purely organic

- New development is impacting the supply versus demand balance

The impact of the above factors is certainly proving itself in analysis of rent growth in our market. Taking a look at two segments of the market provides proof.

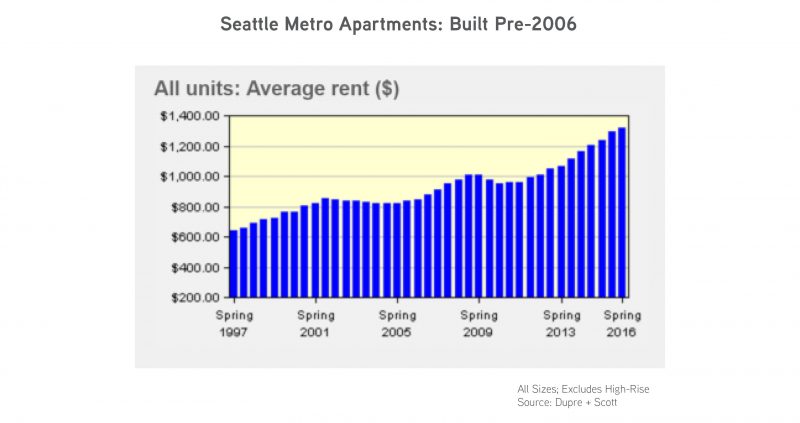

Seattle’s Older Apartment Stock

Using Dupre + Scott data, we analyzed rent growth for apartments in Seattle’s metro markets that were built pre-2006. For this stock of apartments, average year-over-year rent growth tops 6.7%. This same cohort has an average vacancy rate of 3.1%.

This level of rent growth with sustained sub-4% vacancy for several years exhibits an extremely healthy market. This growth is likely the result of strong job growth, but also is based in lower wage renters moving to older apartment buildings to seek refuge from rent hikes.

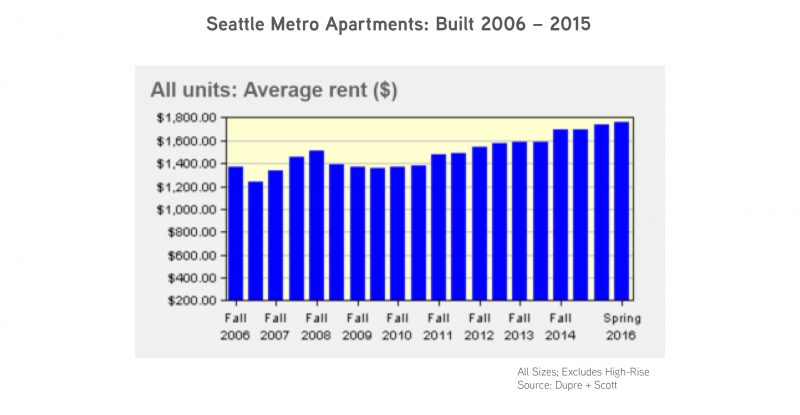

Seattle’s Newer Apartment Stock

Turning to Seattle’s more modern apartment stock, rent growth has tapered much below recent headlines. On average, rents ticked-up by 3.6% year-over-year – exhibiting only 54% of the growth experienced by the region’s older stock of apartments (nearly half!).

Two points are interesting to consider. First, newer product usually rents at a higher rate – exhibiting what I call non-organic rent growth. We are at an inflection point in that non-organic rent growth is not supremely pushing rates and organic growth in new apartments is not surpassing older apartments.

It is also important to consider that Seattle’s urban neighborhoods absorbed nearly 6,000 new units in the last 12 months and over 20,000 units over the last 4 years – all while holding a sub-4% vacancy rate.

These are envious fundamentals. Yet, based on the data we must consider if we are nearing a supply versus demand equilibrium while at the same time facing the possibility of steady versus exponential job growth.

What to Expect Moving Forward

In the case of any analysis, the results are only specific to the sample set and any conclusion extrapolated over an entire market is simply a generalization. Accordingly (and in general), over the next couple of years I expect the performance of older apartment to continue its outperformance of new apartment buildings.

Specifically, there are a few market segments where special attention should be paid due to the eventual and impending impacts of supply versus demand imbalances.

These segments are generally:

- High rise construction

- High density construction neighborhood, e.g., South Lake Union / Capitol Hill

However, beyond certain market segments that require more rigorous analysis to reach specific conclusions, I expect the overall apartment market to continue its strong performance. Job growth and concomitant wage growth continue, regional economic fundamentals continue to outperform the nation (as well as the globe – thanks Brexit!) and Seattle continues its rise as a destination city.

Would you like to know more about us? CLICK HERE TO LEARN MORE ABOUT THE TEAM

Understanding both current and future market dynamics is critically important in positioning both your assets and your capital for optimum returns. Our apartment investment sales team, comprised of five highly qualified professionals specializes in assisting apartment investors in maximizing returns.

We focus on representing apartment developers and buyers and sellers of apartment buildings from 5 units to 500 units. Please give me a call to discuss how we can turn our expertise into your profit. – Dylan