If you haven’t yet looked up today’s treasury rates, you should. Or better yet, if you would like to enjoy your weekend – maybe you shouldn’t. Although there is no direct correlation between the vibrancy of the apartment market – or outlook for continued performance – and Federal Reserve Rates, rate policy and rates themselves have served as a barometer of the health of our economy.

As the economy signals strength – even at rather anemic levels – the Federal Reserve believes timing is right for raising rates. However, the Federal Reserve’s first action to raise rates since the Great Recession (and concomitant Quantitative Easing) occurred in December 2015. And the market reacted unkindly since.

The following graph shows just how little the Federal Reserve’s Rate Policy has on the economy in the long term – nil!

Impacts on Commercial Real Estate

One might think that the government’s fear of a tepid economy – evidenced by low interest rates – would discourage investment, yet often times the opposite occurs. For leveraged investments, returns become less dependent on NOI growth when the cost to borrow decreases. Accordingly, in the Seattle market we have witnessed investors paying more for investment properties in low rate environments.

Over the last 24 months we have measured that price-points for assets increase as treasure rates have decreased. Keep in mind, economic fundamentals of the underlying investments (e.g., rent growth, other income growth and occupancy growth) have substantiated asset value. However, what about investor sentiment?

What the Pundits Say

Earlier this week, Grave Dancer himself – yes, Sam Zell – was quoted as remaining short on the real estate market. Siting an overheated residential real estate market, declining apartment rents in major metros and distorted capital markets. The latest summary of Mr. Zell’s concerns appears in this article in The Sovereign Investor – ominously titled “Time to Get Out of Real Estate”.

The prime cause of distortion in the capital markets – continued low interest rate policy. However, is interest rate policy, and low interest rates, enough to actually cause harm in commercial real estate? That is a far greater question than this post seeks to cover, yet cracks are showing.

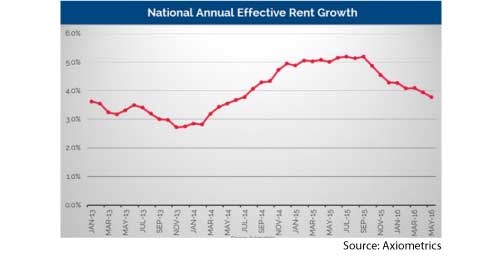

In its latest research, Axiometrics’ date illustrates declining growth in rental rates on a national basis.

As in the review of all data, granular analysis is necessary as micro trends are almost always lost when reviewing the macro picture. However, taking a step back and a holistic view of the market is always important.

Seattle Reigns Supreme – Or at Last Parts of It

Seattle remains a sweetheart market. Rising rents, low vacancy and high paying jobs. However, we are not immune to national trends that help shape the broader real estate market. And in some respects we must be caution of being victims of our own success.

With the rush of jobs entering Seattle and growth of our employment base, apartment development has followed suit. Availability of capital (low interest rates and lots of available cash) is fueling our development pipeline. The results are finally catching up with the market.

The broader Seattle apartment market continues to experience stellar rent growth – yet that rent growth is beginning to show signs of weakening in certain segments. Primarily, the same apartment types that gained the most rent growth years ago (modern-vintage, urban/downtown) is displaying less rent growth today.

Using data from Dupre + Scott I measured year-over-year rent growth for the newest apartment buildings (built 2012 – 2015) versus the overall stock of apartments in King County. Broadly, rents rose 8.9% year-over-year in King County, versus 4.4% for the “new stuff”.

The sky is certainly not falling, yet it is important to pay attention to the underlying fundamentals driving our market. In the case of interest rates (cheap, plentiful money) versus demand (resident willingness to pay more rent year-over-year), both can drive investment – yet only one remains profitable in the long run.