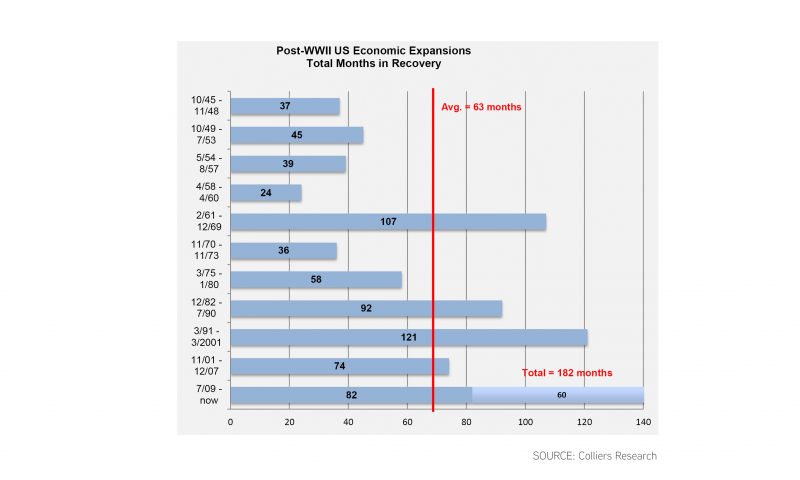

The continued vitality of the apartment market remains a topic of both focus and debate. The Great Recession ended in mid-2009, placing us well into 7 years of expansion. The adroit real estate investor knows that cycles are not a relic of past economic behavior – and the learned one recollects that full cycles usually are about 7 to 10 years in duration.

Regardless of past economic behaviors, the sun continues to shine brightly on the apartment market, enough so that looking at a few fundamental factors is useful in analyzing the current state of affairs.

Rental Rate Growth

Apartment investors love rental rate growth. Rising rents can cure a lot of ills. Rent appreciation belies concerns of overdevelopment, negates rate loss with respect to concessions and helps to overcome gradual yet continue expense creep – especially as the tax-man continues to visit Seattle apartment owners with a pretty powerful hand.

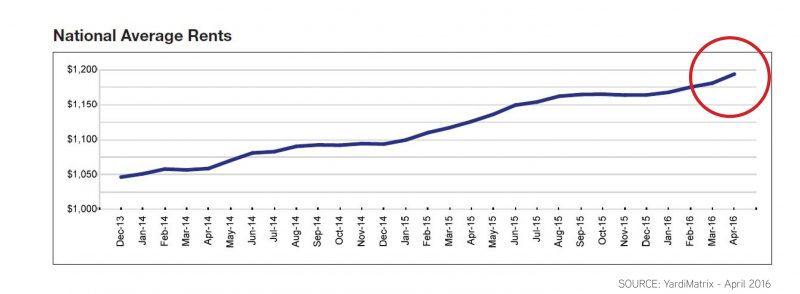

On a national basis, rental rate growth continues to impress, picking up from a lull in growth during the winter months and continuing a pronounced upward trajectory.

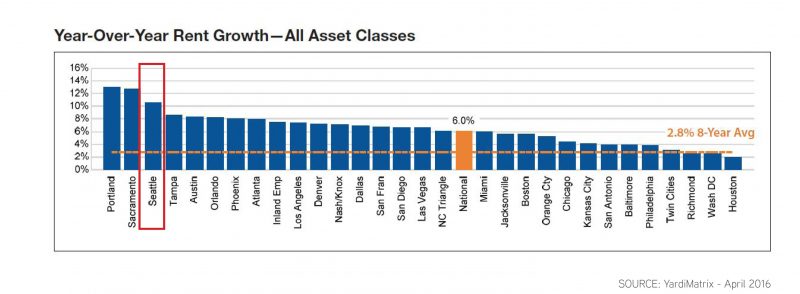

Analyzing rent growth year-over-year, Seattle’s rent growth tops 10% when summarizing rental rate growth across all locations and asset classes (A,B & C quality buildings). Interestingly, Seattle continues to outpace large-metro cohort job centers, such as San Francisco, New York and Chicago.

Finally, 3-month trends better illustrate the velocity of rental rate growth. Given Seattle remains a Top 5 market in rental appreciation with annualized rental rate growth predicted to crest 6.5% again in 2016, it is no wonder investors and developers continue to prize Seattle as a “must” city to place capital.

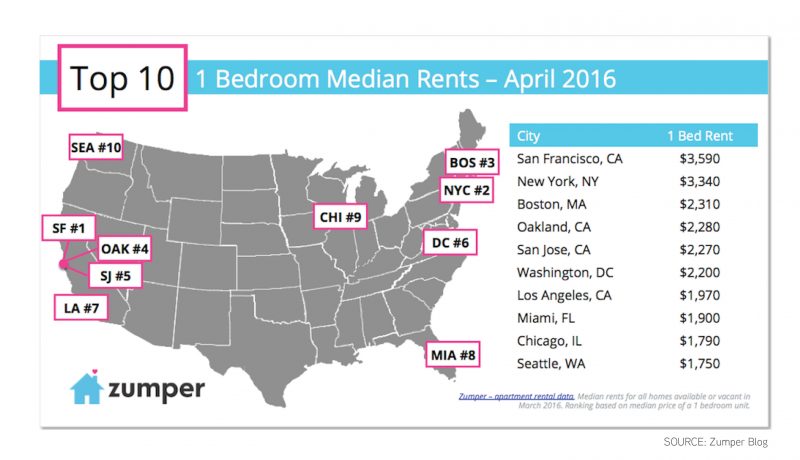

Although Seattle rental rate appreciation continues to impress, absolute rental rates trail markets where Seattle competes for employee talent. This phenomenon provides a feather in our cap on the affordability front and as a thesis on room for continued rental rate growth.

Zumper keeps us honest in where Seattle resides on a national front vis-à-vis absolute rental rates.

Visit the Zumper National Rent Report: April 2016 to review the entire report – chocked full of interesting rental rate facts.

Vacancy Rates Falling… Still

The counterbalance to rental rate appreciation generally falls on the vacancy side of the ledger. Inflection points in demand rears its ugly head in the form of increased vacancy. In a perfectly balanced market – a rarity and often a snap-shot in time – results in equal but opposite changes in rent versus vacancy.

In Seattle, however, such an inflection point is yet to arrive. Since entering a market-recovery phase – call it Spring 2010 – vacancy rates in the Puget Sound region plummeted. The downward trend continues, despite record regional delivery of new apartment units (greater than 36,000 units since 2010) and massive rental rate growth (cumulatively 42% — which equates to 6.0% y-o-y growth every year continuously for 7 years).

What is on the Horizon?

Calling the Seattle apartment market stable is a vast understatement. Under current market conditions job growth (and wage appreciation) continue to keep pace with apartment production and asking rental rates.

The numbers prove it!

Yes, smooth seas never last. On a daily basis I field calls from cautious (yet soberly-optimistic) investors and developers inquiring as to future market dynamics. After pointing out the aforementioned general health of the apartment market, I often point out the bogies in our market, which are as follows.

- Massive Amount of Development: Developers and speculators continue to plan, permit and develop – to the tune of +80,000 new apartment units.

- Mounting Concessions: Generally we see most all winter-month concessions burn-off by March, possibly April. In the current market we are seeing concessions (and not simply on new developments) continue well into May.

- Market Cycles: Market cycles exists and are very real. Each market cycle is different – and caused by different fundamentals – yet they are intrinsic to our business. We are deep into the current market cycle and in real estate, late-cycle investments are always exposed to more risk.

Given the strength of our region, opportunities for investment and development continue to exist – in spite of and often because of the aforementioned challenges. Understanding our apartment investment market at a macro, as well as highly granular level, provides the background to uncover and opportunistically pursue these opportunities.

Would you like to know more about us? CLICK HERE TO LEARN MORE ABOUT THE TEAM

Understanding both current and future market dynamics is critically important in positioning both your assets and your investment thesis for optimum returns. Our apartment investment sales team, comprised of four highly qualified professionals, and a back-office team of an additional four dedicated staff, specializes in assisting apartment owners in maximizing returns. We focus on representing buyers and sellers of apartment assets from 5 units to 500 units. Please give me a call to discuss how we can turn our expertise into your profit. – Dylan