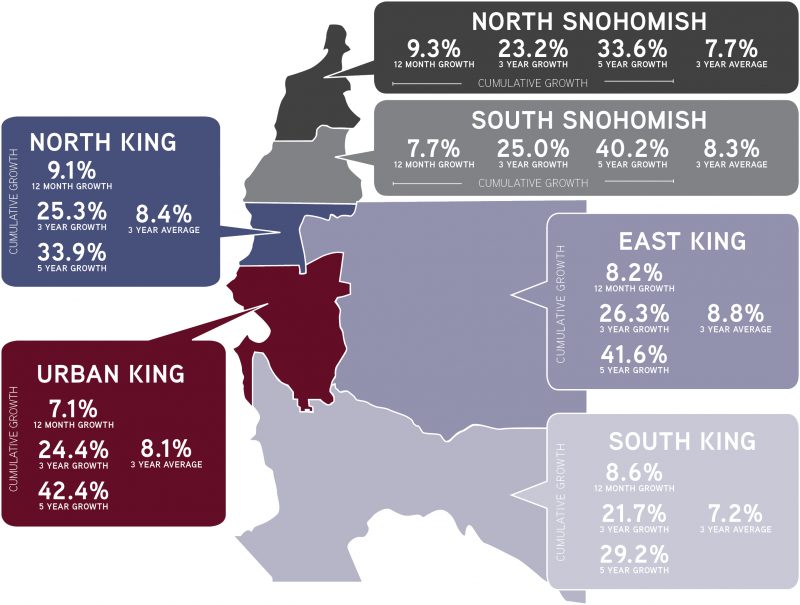

In a recent post, Where are Rents About to Rise the Most in the Seattle Region, I discussed economics dynamics impacting the region, and resultantly which counties and submarkets will see the highest rent growth in years to come. The following infographic is telling of the last several years of market performance.

Yet, what about the core of Seattle? Rental rate growth in the core stole headlines quarter-over-quarter from nascent signs of recovery in 2011, until recently. However, recent rental rate growth has displayed a slight taper in Seattle’s urban submarkets and neighborhoods.

Should we continue to expect tapering rental rate growth Seattle in the foreseeable future? No… and sorta yes.

Any analysis of rental rate growth requires granularity and specificity. To do so, it is best to analyze a myriad of factors, including building location, size and age. In the interest of time, we will distill and analyze building age in an effort to understand the influence of market dynamics on rental rate growth. For further and more in-depth discussion, please give us a call.

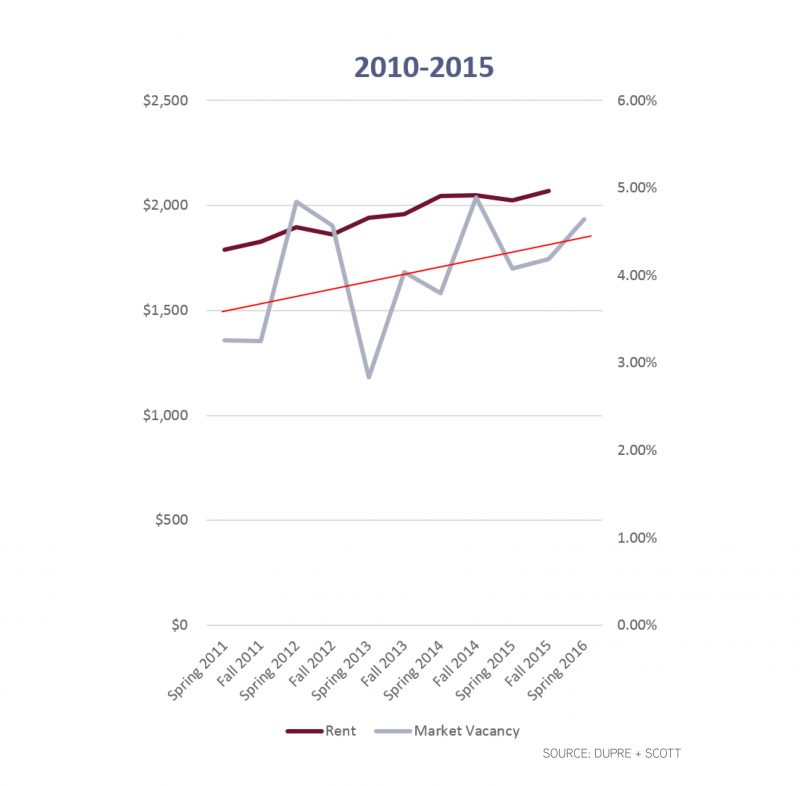

Apartment Buildings Built 2010 – 2015

Modern vintage, recently completed apartment buildings in Seattle are the toast of the town. High-end finishes, sexy marketing campaigns and amenities that would make any “last-cycle” condominium building blush. An analysis of rental rate growth versus vacancy is illustrative of how the market absorbed these units while attempting to sustain equilibrium.

The maroon line (rental rate) and the red line (trending vacancy) illustrate convergence – meaning vacancy is beginning to trend-up faster than rent growth. Both strong year-over-year rental rate growth (with moderate wage growth) and over 36,000 units added to the region since 2010 adequately explain tapering rental rate growth and increasing vacancy within this cohort of apartment buildings.

It is not surprising that rental rate increases and new supply is beginning to catch up with itself. We are certainly in the middle of the largest development boom the region has ever experienced. For a full analysis of the region’s development pipeline, download our 2016 Seattle Apartment Market Study.

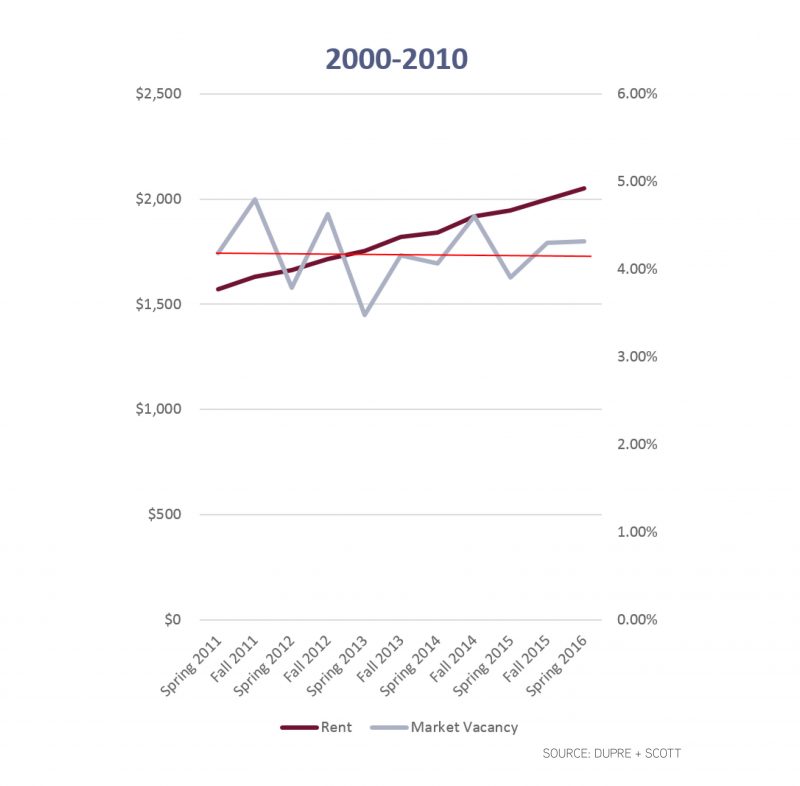

Apartment Buildings Built 2000 – 2010

From 2000 to 2010, developers did not deliver a large quantum of new apartment units to the market. Only 13,000 units were added to the region during this time period, whereas developers in our region on average deliver between 3,200 and 3,500 units each year.

Decidedly older, less sexy and less amenitized, it is easy to image that this cohort of apartment buildings would have a difficult time keeping up with more modern buildings when it comes to rental rate growth. Yet, this stock of apartments continues to perform well – remarkably well.

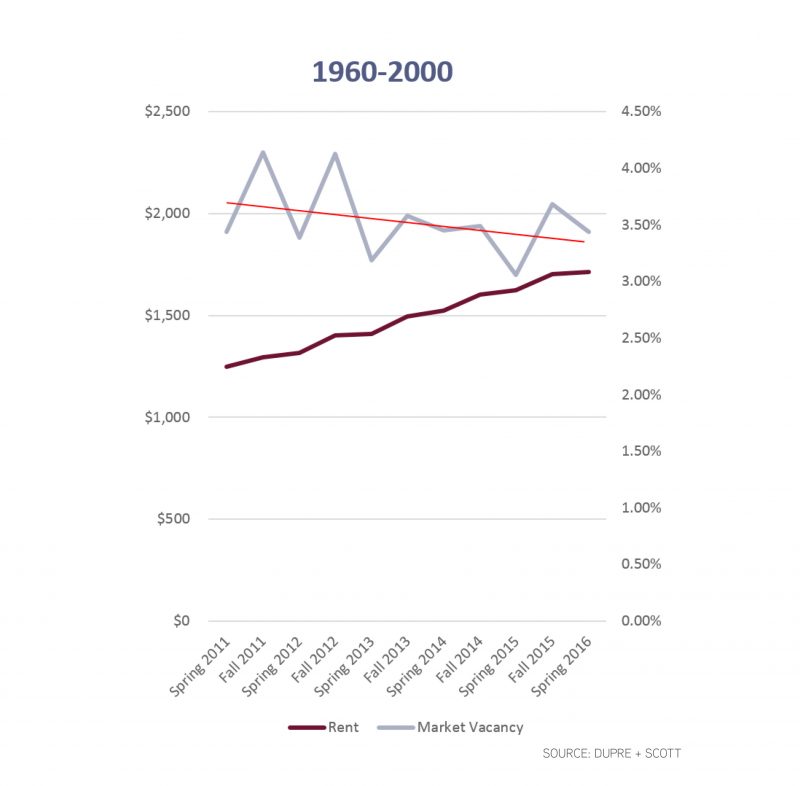

Apartment Buildings Built 1960 – 2000

Older stock of apartment buildings are not always the sexiest asset class. The buildings often have lower ceilings, narrower hallways and often don’t have modern amenities – like washers and dryers! The configuration of some buildings even require you to go outside for your dog to relieve itself, versus a sky-lounge with “pee patch” – shocking, I know.

Yet, as an investment class, the last several years are self-evidencing. The below graphic certainly proves the case for investing in an older apartment building.

Sharply declining vacancy rates (currently at less than 3.5%) and rising rental rates tell the story well. As far as convergence of trend lines, this is the type of convergence you want to see in a healthy investment market. As brand-new product pushes the boundaries of both affordability and absorption, the thesis for vintage apartment buildings remains strong.

Would you like to know more about us? CLICK HERE TO LEARN MORE ABOUT THE TEAM

Understanding both current and future market dynamics is critically important in positioning both your assets and your investment thesis for optimum returns. Our apartment investment sales team, comprised of four highly qualified professionals, and a back-office team of an additional four dedicated staff, specializes in assisting apartment owners in maximizing returns. We focus on representing buyers and sellers of apartment assets from 5 units to 500 units. Please give me a call to discuss how we can turn our expertise into your profit. – Dylan