Welcome to the other side – the other side of Deep-Seattle-Seasonality that is! Last September I penned a blog post titled Seattle Apartment Rental Seasonality & the Sales Season discussing the impacts of fall/winter on rental rates in Seattle. Although tulip bulbs may have not yet caught on, spring is upon us – and rental rate trends are encouraging.

Rental Rates on the Rise

Like it or not, leasing drops-off in fall and winter months. Although vacancy rates may not experience large swings during these times, rental rates certainly reflect tempered demand. The Puget Sound Region is not alone in this phenomenon. Lagging demand is as much a function of back-to-school business, hiring slow-downs and holiday-focus as it is the result of Daylight savings and what we refer to as the “Dark Months” in the PNW.

Trends in national average rental rates are telling. Although beginning/end periods for fall/winter rental rate compression periods vary – trends are obvious and pronounced.

Turning to a Seattle-focused analysis, Seattle is disproportionately impacted by seasonality. For the trailing three months, rental rates in the Seattle market rose 1.1%, versus a national average of 0.3% — showcasing 4x growth over the average.

Excellent and consistent job growth certainly explains rental rate growth in Seattle, yet the delivery of new units provides a counterbalance to the supply-demand equation. Simply put, Seattle always struggles in the fall/winter months. The following graph illustrates a fantastic leading indicator of the Seattle market Springing into Spring!

Based on preliminary data, the Seattle market is set for a strong leasing season this spring. Later this month Dupre + Scott Apartment Advisors will release their Spring Apartment Vacancy Report, compiling rent and vacancy data for the preceding 6 months. Dupre + Scott data is the best in the market and will assuredly provide fodder from which to draw even more conclusions about the health of the Seattle/Puget Sound apartment market.

Seasonality & the Apartment Sales Season

Seasonal impacts on rental rates is a foregone conclusion in the Seattle market. Yet, what impacts does seasonality have on preparing for a sale? This correlation is as much tied to investor behavior as that of renters.

The apartment sales season generally starts slow in January and February. Often times it is not until March that investors start to pound the pavement looking for good properties to buy. This timing works well with Seattle’s inherent seasonality as rents are now beginning to tick-up as life springs back into the leasing market.

Yet, the question remains as to whether 2016 is the right time to sell?

Timing to sell an apartment asset is both complicated and simple. The old adage “Buy Low, Sell High” is a fairly safe rule of thumb.

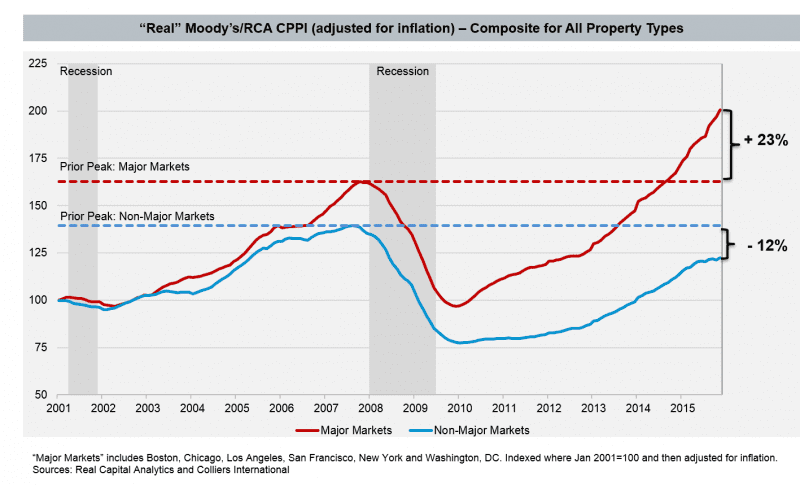

The following graph, although complicated in composition, if fairly simple in messaging – if not upon us already, the peak (e.g., market high-point) is imminent.

Although accordingly to the above graph Seattle is not defined as a “major market”, average pricing in Seattle is well beyond any previous peak. For example, the following are average sales prices in King County in 2008 versus 2015:

Of course myriad factors exist that distort data when distilled down to summary conclusions, yet there is little question that pricing is quite high at present.

So, you are thinking about selling?

The importance of running a highly optimized property from an operational standpoint is always in vogue, yet if you are planning a sale a few processes are best started early as they take time to implement and produce results.

To punctuate the importance of operational optimization, at a 32% expense load, every additional $150.00 in monthly rental rate at a 4.5% capitalization rate equates to over $27,000 of value in a sale.

The following are a few tips that may not immediately come to mind:

- Fine-tune Leasing – make sure you have a fresh-face on your leasing team

- Optimized your Online Presence – over 80% of apartment searches begin online

- Get Great Online Reviews – a recent survey showed 76% of renters surveyed rely on online reviews

- Update Photos – most renters make choices online, and based on photos

Spring is a wonderful time of renewal. As the market provides the opportunity for rental rate growth and the possibility of a well-timed sale, make sure you seize it. We are here to help!

Understanding both current and future market dynamics is critically important in positioning both your assets and your investment thesis for optimum returns. Our apartment investment sales team, comprised of four highly qualified professionals, and a back-office team of an additional four dedicated staff, specializes in assisting apartment owners in maximizing returns. We focus on representing buyers and sellers of apartment assets from 5 units to 500 units. Please give me a call to discuss how we can turn our expertise into your profit. – Dylan