As of Fall 2015, average rents in Seattle’s Capitol Hill neighborhood for new apartment communities (those delivered from 2010 – 2015) are $2.91 SF. What happened to $3.00 SF rents, you may decry. Well, once you remove larger 2 bedroom units from the equation, average rents are between $3.02 and $3.10 SF. That is a huge price tag considering trends over the last decade!

Such hyperbole is not lost in the current apartment rental environment in Seattle. Seattle first ascended to the heralded $3.00 SF mark as recently as December 2012 when Goodman Real Estate opened The Post Apartments along Seattle’s waterfront in the Commerce District. Since that time rents have continued their ascension.

However, it wasn’t long ago that $2.00 SF was rarified air. Taking a look back at Capitol Hill, which we can use as a ‘control market’ for this analysis, if we measure rental levels in 2010 for new apartment communities (those delivered from 2005 – 2010), average rents were nearly exactly $2.00 SF. One further measure back (apartments delivered 2000 – 2005), Capitol Hill rents in 2000 were yet another rung lower at $1.50 SF. Considering that some properties are aspiring to hit $3.50 SF, the market is looking at near 170% cumulative growth over the past 15 years.

While other consideration must be measured (e.g., inflation, rapidly rising non-controllable expenses, higher development costs), rent growth in Seattle’s urban core remains truly impressive. Yet arguably equally impressive is rent growth outside of Seattle’s most “core” neighborhoods.

NOTE: All rent data in these sections are provided by Dupre + Scott Apartment Advisors www.duprescott.com.

North of Downtown –Ballard & Roosevelt

Heading north of downtown takes renters to piping-hot Ballard and soon-to-be TOD Roosevelt. In both neighborhoods you can find new developments hitting rent levels in excess of $2.80 SF. This is extremely impressive rent growth and quickly closing-in on $3.00 SF. Historically these markets had an older stock of apartments and developers were excited to see rent levels of newly developed projects hitting $2.50 SF. The market has quickly sailed past that mark and is racing toward what appears to be a new normal.

West & South of Downtown – West Seattle & Columbia City

Heading an opposite direction, a bridge or water taxi ride away lands you in once sleepy West Seattle. Rent levels seems pegged at $2.15 SF for the better part of 2013 and 2014 in West Seattle, at least until the market caught a huge tailwind. Currently, newly developed projects are experiencing rent levels in the $2.60 – $2.75 SF range, with $3.00 SF right around the corner.

As Seattle emerged from the Great Recession in 2010 Columbia City has nearly no newly developed apartment communities. Bold developers embarked upon projects with ambitious proformas hitting $2.25 SF. With several hundred new units now open in the marketplace, rents are safely above $2.60 SF and headed towards $2.75 SF. Is $3.00 SF around the corner for Columbia City?

The possible ubiquity of $3.00 SF rents throughout the urban core of Seattle is upon us. Can it last? One big question is affordability. This is a topic discussed at length locally in Seattle, yet with national attention on our job market it is helpful to measure our affordability against our competitive cohort of cities versus historical norms. What do the “Z” companies say?

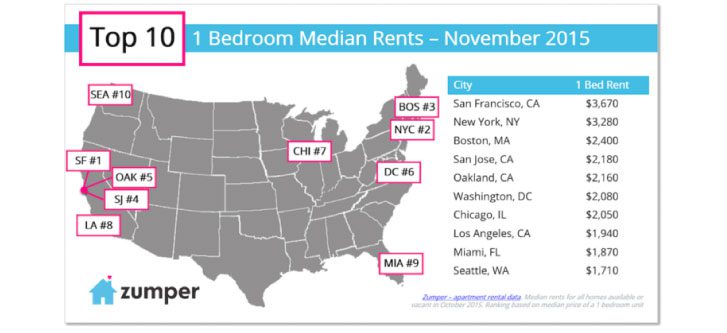

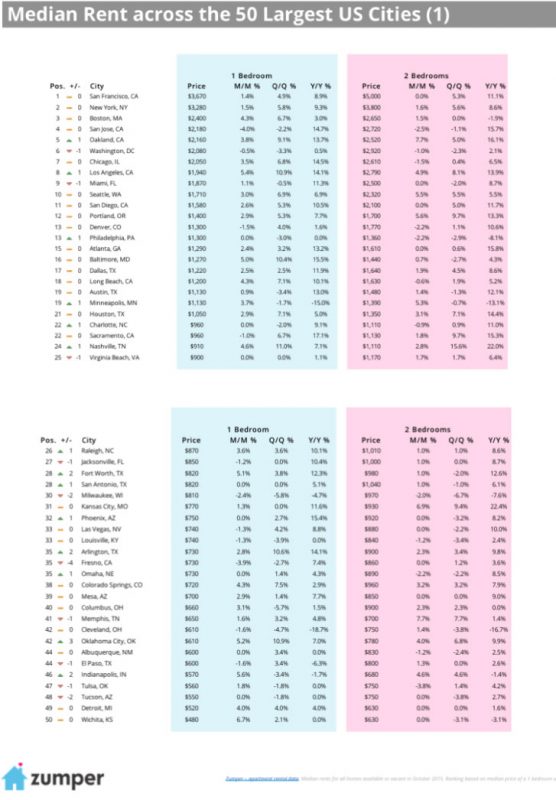

Seattle versus the Nation – What Zumper Says

Compared to key employment centers across the United States, Seattle remains quite affordable. The following summarizes the Largest 50 US Cities and provides data on both absolute rents and rent growth trends over the last year. Seattle is still looking pretty affordable.

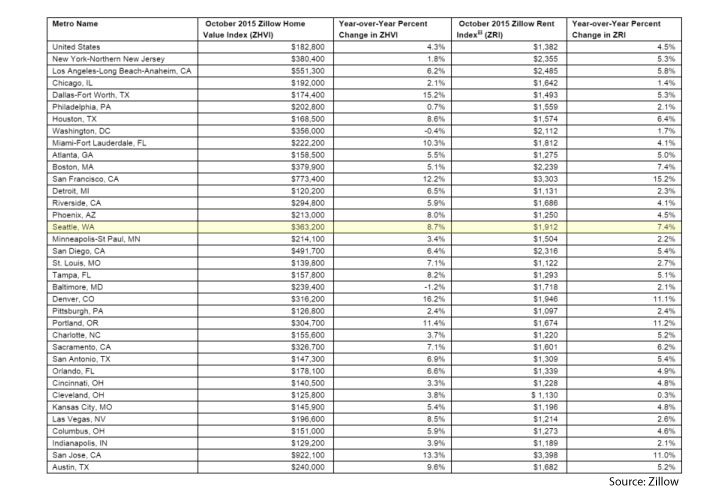

Seattle versus the Nation – What Zillow Says

According to Zillow’s data, Seattle’s rent levels are the 8th highest in the nation, yet y-o-y growth as of October 2015 is the 5th highest in the nation – posting gains of 7.4% and an average rent of $1,912/month.

Despite strong rent growth on the national front, Zillow reports that rent growth is slowing. “Rental appreciation has started to slow down in part due to more rental supply. Many of the bigger multifamily rental projects that were begun a couple years ago in cities nationwide are finally starting to open for occupancy, easing pressure on rents somewhat,” said Zillow Chief Economist Dr. Svenja Gudell.

Zillow’s data covers 35 of the largest markets in the United States. Although overall growth trends have slowed, Seattle continues to experience rent appreciation, yet also has significant room for growth before rental rates close-in on the most expensive markets in the nation.

A broad look at historical rent growth provides good context, yet is not necessarily the best predictor of future growth. An understanding of how Seattle measures to comparable markets in which companies and renters have options to locate is a far better indicator of our region’s future performance. For the near term, we will continue to buzz by $3.00 SF rents until they too are in our rearview mirror.

Understanding both current and future market dynamics is critically important in positioning both your assets and your investment thesis for optimum returns. Our apartment investment sales team, comprised of four highly qualified professionals, and a back-office team of an additional four dedicated staff, specializes in assisting apartment owners in maximizing returns. We focus on representing buyers and sellers of apartment assets from 5 units to 500 units. Please give me a call to discuss how we can turn our expertise into your profit. – Dylan