Dot.bomb, Tech Wreck and Tech Bubble are well-known monikers for the great tech implosion at the beginning of this century. Although memories are short, near every current market participant enjoys a clear memory of the crazy market ascension and disastrous fall in 2000/01, all driven by technology companies (and the fervent investment in them).

The appeal that “This time is Different” is generally the first sign that it isn’t – and that a historical repetition of a previous event is imminent. That may not be so this go-round.

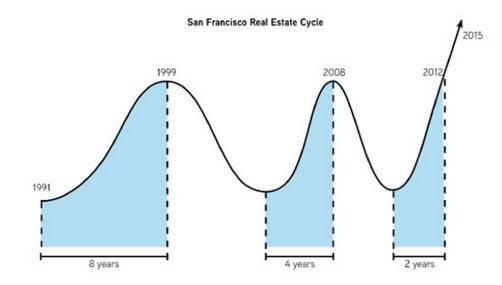

In a previous post, Seattle’s NEW Real Estate Cycle, I explored a phenomenon of shortening cycles in technology driven markets – namely the San Francisco Bay Area as displayed in the below graphic.

As an apartment investor one must study their sources of income, relying upon both stability of that income stream and predicting its likely growth. In tech-driven markets we have enjoyed phenomenal growth and stability – but the likelihood of future growth is often challenged by the idea of cycles, bubbles and the admonition that the good times can’t roll forever.

Technology markets have matured and as a result of that maturation process, the result of growth is likely not an imminent counterbalance of a fall. In the current cycle, key differences show signs of ongoing stability and predictable growth.

Efficiency, Not Just Invention

In the mid-1990s Silicon Valley was awash in invention. Inventions are great, yet not always profitable nor sustainable. Solutions are key. Entrepreneurial focus has shifted, and importantly so, to solutions to actual problems or inefficiencies. Solutions are wildly profitable. Applying efficiency to huge dislocations in markets even more so.

Uber is trendy to cite, yet for good reason. Is Uber a new concept? Paying a driver to drive you somewhere is hardly new – Uber did not truly invent anything. However, at a $50B valuation since its start in 2009 Uber is doing something very right. Uber is about making a marketplace more efficient – and that is a sustainable business.

Not far from Uber are a host of “efficiency” companies. Square didn’t invent point-of-sale for credit card transactions, yet it made is widely more efficient. Airbnb didn’t event hoteling. There was plenty of retail before Amazon.com, Zulily or BlueNile, yet getting products to you as efficiently as possible will never go out of vogue.

The actual companies are not as important as a conceptual shift to value creation. So long as technology is solving problems – big, expensive, ongoing problems – tech salaries, and your rent roll, are safe.

Investor Discipline is Healthy

Investors lost a lot of money in the Dot.com crash – arguably more than entrepreneurs. Today, investors are asking far different questions.

Eric Ries, a pioneer in the “Lean Startup” movement focuses on the customer and the solution, not the invention. Investors, and entrepreneurs have followed suit, shifting focus on revenue versus revelation. Startups today are focused on growing their customer base – and revenue – before raising venture capital.

As an apartment owner, it is challenging to follow the trends in technology. However, the stability of your revenue stream – at least in Seattle – is hugely dependent on decisions made by investors. Prudence in allocation of speculative venture dollars can reap sustainable rewards down the road.

Rising Tech-Tides Lifts all Boats (and salaries)

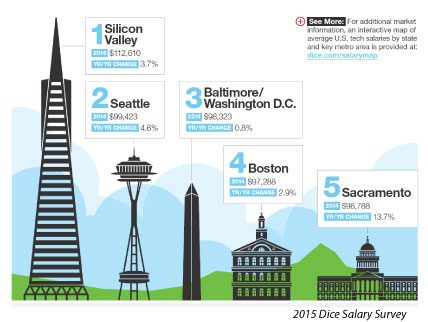

Much attention is paid to tech salaries and for good reason. Wage growth has been perniciously missing from a national recovery. Yet, tech-driven markets continue to enjoy healthy wage growth. Dice.com measures and reports technology wages and wage growth – showing health in both categories.

What about everyone else? From dog walkers to baristas, the often shamed theory of trickle-down economics is alive and well. In one of my most favorite economic books of 2013 – The New Geography of Jobs (order HERE on Amazon), Moretti argues that tech-focuses markets provide wage inflation to a broad category of the workforce much beyond tech workers.

A good friend of mine founded Who Let the Dogs Out SF, a dog walking service in San Francisco. When tech workers do well, his dog walkers, dog sitter and dog groomers do well – more services ordered, more frequent use of services and bigger tips.

The barista and the barber can charge more in tech markets. With competition for services, supply and demand takes hold and the market as a whole experiences inflation – an economic shift that has eluded policy makers at the FOMC and Federal Reserve for years!

Tech is Not a Panacea

Technology and wage growth spurred by technology is not a panacea for all economic ills. However, in an industry focused on the sustainability and growth of cash flows directly related to salaries and wage growth, we must pay close attention to where we place bets.

Apartment investors have placed big bets in Seattle, especially in hyper-growth markets such as South Lake Union Capitol Hill and Ballard. However, understanding the economics of the region at a deeper level can provide insight to the greatest level of returns – as well as more understanding of the stability and predicted growth of an investment.

Our apartment investment sales team, comprised of four highly qualified professionals, and a back-office team of an additional four dedicated staff, specializes in assisting apartment owners in maximizing returns. Please give me a call to discuss how we can turn our expertise into your profit.