Last in, last out. Such was Seattle’s position in real estate cycles as they have occurred for decades. Both geographically distant from major economic centers and as at it touched the business world – timber, aircraft – the Seattle/Puget Sound region generally headed into recessions far behind other metropolitan cities, and emerged from them later as well.

Welcome to the new world order. Sorta. The Great Recession is recorded to have begun as early as 2007, according to the National Bureau of Economic Research. Yet, Seattle didn’t truly begin to feel the brunt of the downturn until well into 2009. Seattle certainly kept to its “last in” reputation. However, both regional economic fundamentals and changes in the macro business environment will likely change how the region participates in future economic cycles.

A NEW “First Out” City

Seattle was one of the first US cities to recover from the Great Recession. Placing itself in a well-heeled cohort of cities, Seattle recovered all jobs lost in the Great Recession as early as 2012. We are not halfway through 2015 and many cities remain with fewer jobs than they had in 2008. Our region is quite fortunate (and unique) for a “last in, first out” designation during the Great Recession. Why the change?

For reasons that now make headlines every week, Seattle emerged in 2012 as a leader in technology job growth. We are now getting used to such headlines, yet in 2012 economic pundits closely watched new orders at Boeing and requisition for new hires at Microsoft. Today, our focus is differentiated from A to Z – that is Amazon.com to Zillow/Zulily. Our tech sector pulled us out of the Great Recession early and it will do it again next time (see below how the same held true in San Francisco).

Yet, it goes beyond tech. In any recession, the go-to job sectors are education and healthcare. Although the Puget Sound region has always had phenomenal opportunities for post-secondary education, this segment has only grown. University of Washington recently announced that it is looking to double the size of its computer science graduating class – a boon to the local technology sector. UW Bothell is the fastest growing college in the state and the region’s communities college admissions are surging due to the influx of foreign students.

Additionally, healthcare in the region continues to grow, as well as dominate the stage in global health. Swedish Hospital and Virginia Mason continue to expand, yet these large recession-resilient sectors only tell half of the story. The Gates Foundation, Fred Hutchinson and Path are just a few tackling global health problems and growing as funding continues to support their global mandates.

The diversity of the region’s economic drivers pulled Seattle out of the recession early compared to previous cycles, yet exposure on such a global front is likely to make Seattle a “first in” city as well in the next cycle.

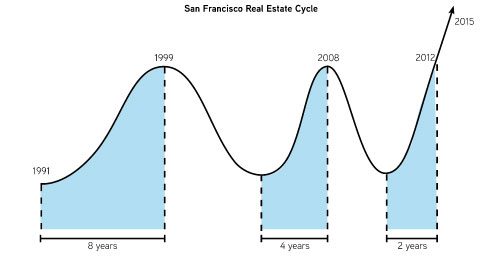

One may argue with exact dates, yet in basic terms the period it has taken to recover from each of the last three sequential downturns was reduced from 8 years to 4 years to 2 years. Why, you may ask. San Francisco is a region that “ships” a lot of software that the world uses. As of 2015, I don’t believe that Seattle is much different.

What to Expect Next Time

Where we are in the current real estate cycle is a question of great interest and debate. There is truly no way of knowing. However, as investors we can hedge risk by trying to understand how cycles affect the locations where we own and develop real assets. A greater understanding of these cycles, and more thoughtful hedging strategies, will protect gains made in up-cycles and better position ourselves on how to take advantage of opportunities in down-cycles.

With near certainty, Seattle’s position on the global economic stage has advanced. With such advancement, investors can expect old norms to succumb to new ones, and arguably ones we can analogize to other more evolved urban economic centers. Welcome to Seattle’s NEW real estate cycle.

To discuss how to best position your apartment assets for the greatest returns, please give me a call.