What a summer it’s been in Seattle! Combined with record heat (that means hitting 85 degrees in Seattle!), the apartment market continues to experience strong absorption and continually escalating rents.

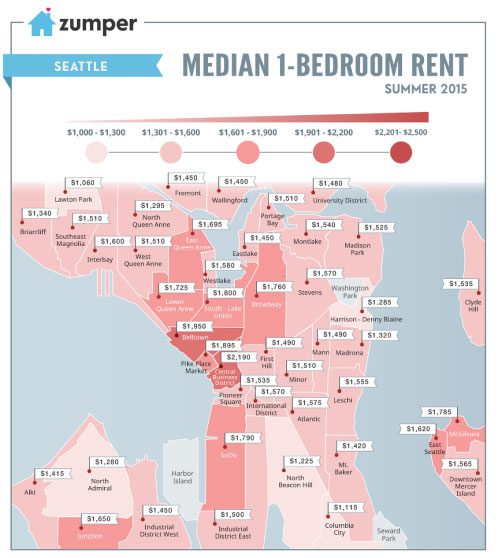

With a baseline of $1,500/month for a one-bedroom in urban Seattle (see Zumper infographic below), this summer is certainly one of the hottest [READ: most expensive] leasing seasons ever. We are not yet through Q3 and the market has absorbed the delivery of nearly 3,000 new apartment units in Seattle alone, amounting to 2/3 of deliveries in King County.

Summers are fantastic in Seattle, they are one of the best reasons to live in Seattle. As a landlord summers are especially sweet, yet leases expire year-round and preparing a property for sale takes forethought and timing around certain PNW nuances.

Rental Seasonality is both Friend & Foe

A discussion of apartment rental seasonality mid-September is apropos – we are just entering a generally quiet period of the year. Our memories are often short and despite many months of minimal concessions (if any) and rapidly increasing rental rates, last November the market experienced concessions as deep as 6-8 weeks free rent – and these weren’t just for newly delivered buildings.

The “dark months” in Seattle – generally November through February – can be very dark for apartment owners. Managing lease expirations and delivery of new apartment units is serious business. Experienced operators in the Seattle/Puget Sound market grow adept at ensuring they have full buildings upon entering seasonal disruptions in rental demand. Keeping close tabs on winter months in Seattle vis-à-vis your rent roll is of critical importance.

Conversely, when the calendar strikes March (and often despite winter cloud not yet lifting over the PNW), concessions are put away like galoshes and “for rent” signs are dusted off and placed prominently street side. It’s time to clean up that rent roll and make your investors proud.

For owners and managers, pronounced seasonality in Seattle is very impactful to operations. Strategic leasing decisions are important and in the current environment of 10,000 units delivered year-over-year through 2018 (yes, maybe 40,000 units), programmatically designing a leasing plan around the calendar and the competition of newly delivered buildings (and their concomitant concessions) is paramount.

What if you are considering selling your building? Therein lies a host of considerations for maximizing value.

Selling into the Most Profitable Environment

As was discussed in Record Breaking Apartment Sales Volume for Seattle in 2015, Seattle’s current apartment investment sales market deserves a platinum star. If you are in the market to sell an apartment asset, your timing is impeccable – yet how do you maximize profit?

Marketing and selling an apartment asset is mired in its own complexity and nuance. Seasonality of a sales environment, differentiated from strong rental seasons, means paying close attention to several important factors, namely:

- When investors are most actively looking to buy

- Having strong occupancy history, yet enough vacancy to maximize rental rates

- Momentum in rental rate growth and other income as demonstrated with recent leasing activity

- Timing of other competing assets hitting the sales market

- Navigating new construction: pre-sales, concessions and the sale of newly stabilized apartments

Despite “Platinum Star” status as an apartment sales market, maximizing value requires forethought and careful attention to timing. If you are thinking about selling next year, now is the time to formalize and implement a leasing strategy that allows you to utilize leasing seasonality to your advantage and maximize pricing and returns when it comes time to sell.

Our apartment investment sales team, comprised of four highly qualified professionals, and a back-office team of an additional four dedicated staff, specializes in assisting apartment owners in maximizing returns. Please give me a call to discuss how we can turn our expertise into your profit.