Our slant towards a renter nation has only grown, and lately accelerated, from historic norms. The benchmark is commonly rates of homeownership, yet that is a lagging indicator. Leading-edge data suggests that our predilection (or necessity?) towards renting continues to accelerate.

Although this is welcome news for the apartment industry, supply-demand imbalances must not only receive acknowledgement, study and respect is warranted should the pendulum swing too far and upset the balance of rental and vacancy rates.

Beyond the data of home ownership versus renting are myriad factors that affect the apartment industry and the broader economy, not the least of which include:

- Competition for labor and materials

- Construction employment leading to job growth and consumer spending

- New household formation, leading to consumer spending

The following is an overview of national trends, then a look at the Seattle/Puget Sound market.

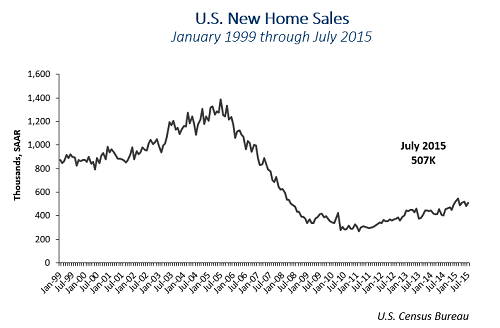

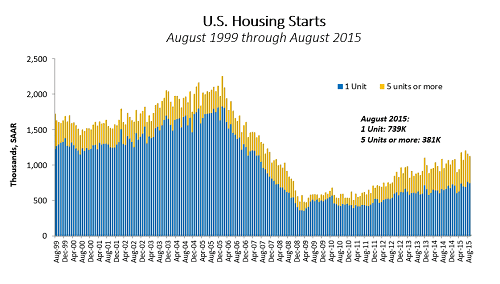

Single Family Home Starts

Single family home starts are dismal – and that is putting it lightly. As of July 2015 new starts are almost half of historic norms and a third of the peak in 2005. Recent data suggests growth, yet fundamentals such as wage growth and credit acceptance continue to provide barriers to new buyers.

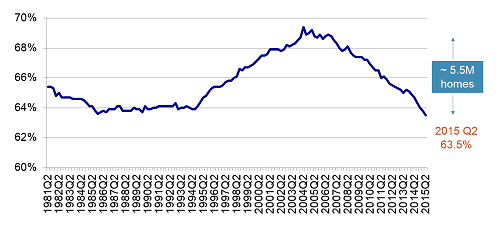

The lagging indicator is actual ownership rates. The US market has shed roughly 5.5M homes from the ranks of home ownership. The current level of 63.5% is well below the 35 year rolling average of 65.0% — and dropping. Looks like a good time to build apartments!

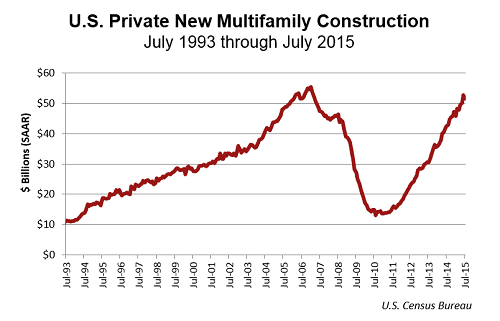

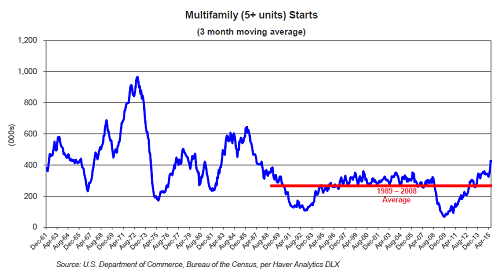

Multifamily Starts

The shimmering economic light you see is the sun hitting hammers constructing apartment buildings. A sharp rise from the ashes of the Great Recession continues to point north with apartment starts about to best the previous peak.

A juxtaposition of apartment starts over single family starts best tells the story of doldrums of the single family industry. When one of the nation’s largest homebuilders, Lennar, invests in a $1.1B JV to build apartments – that is a pretty good indicator as well.

Historical Trends

Over the last 20 years the multifamily industry has built about 250,000 apartment units a year. As a point of reference, that is the approximate size of the inventory of apartment units in Puget Sound. Although apartment starts have been robust since 2010, the industry didn’t break past the average until 2013.

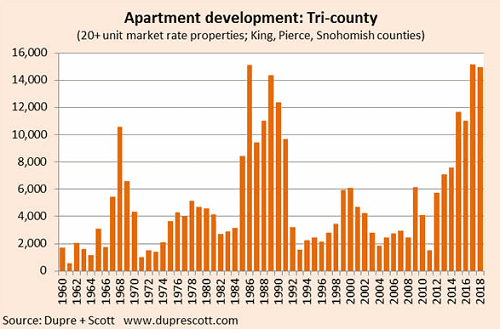

What About Seattle

Seattle is on a development tear in the construction of new apartments– that is not news. On a percentage basis, the Seattle-Tacoma-Bellevue MSA has issued 44.6% more apartment permits y-o-y, yet is down 4.2% in single family permit issuance. Apartments remain hot and development is accelerating to what seems stratospheric levels.

What some might not consider is that between 1985 and 1992 over 80,000 units were delivered in the region. If you take new supply delivered since the end of the Great Recession (2010) and add projected units through 2019, the region’s deliveries equal roughly 80,000. Relatively clever math and coincidence, I would say.

Although the numbers are staggering, adjusting for population increase, the current bull-run is less than the supply delivered in our last at bat. The cycles are strikingly similar.

What is different this time? A lot. Development during the last cycle found its beginning in huge shifts in monetary policy (21% interest rates anyone?) and found its demise in tax reform, S&L collapse and RTC shake-out. This time around the cycle’s beginnings were founded in grass shoots from a recession, $3.5T in Quantitative Easing and massive demographic and preferential shifts.

What is most different? We are not slowing, at least not in Seattle. Nary has a week passed when a new market entrant calls me to discuss finding new sites. Fundamentals still prove-out, yet when will the music stop? We don’t yet know; however, as students of the market we have a strong sense of where to find value (and safety).

Our apartment investment sales team, comprised of four highly qualified professionals, and a back-office team of an additional four dedicated staff, specializes in assisting apartment owners in maximizing returns. Give me a call to discuss the current market dynamics in Seattle and how to position both your developments and your assets for the highest level of returns. Allow us to turn our expertise into your profit.

Note: A special thanks to Anirban Basu of Sale Policy Group, Inc. for a recent presentation and use of materials. www.sagepolicy.com