All eyes are on the US Federal Reserve and the Federal Open Markets Committee (FOMC) meeting scheduled for mid-September. Interest rates are set to rise next month and guidance over the past several months points to the first upward rate movement since Quantitative Easing began 72 months and $4.5 trillion ago. Yet, guidance of increasing interest rates was announced in late 2014 and again through the first half of 2105.

Three macro-economic factors could potentially stand in the way of increased interest rates, or at least appreciable movement in interest rates over the course of the next 12 to 24 months. The following factors are worthy of both discussion and future attention as real estate investors execute on real estate investment strategies:

- Greek National Debt

- Supply/Demand Metrics for Crude Oil

- Chinese Monetary Policy

Greek National Debt

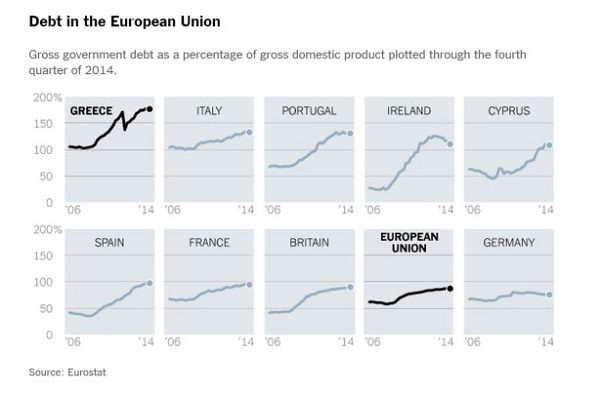

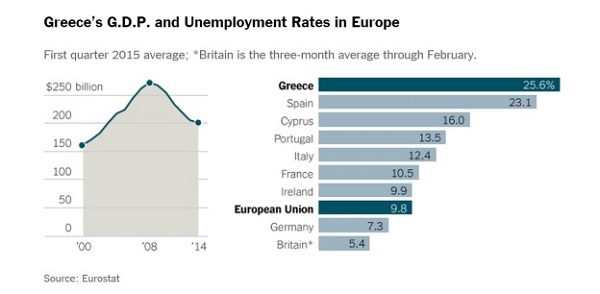

Instability in Greece, and throughout EU member nations, holds global destabilizing power. Over the course of the last week, Greece struck a deal with its international creditors to restructure nearly $100B in outstanding debt, yet that amount accounts for only ½ of its overall debt obligations.

Many other EU member nations have begun to stabilize their own economies, yet Greece’s economy remains unstable and threatens a cautious balance in Europe. United States commercial real estate is both partially driven by and maintained by global capital flows. So long as Greece remains part of the EU, as Greece goes … so does the EU.

It is clear by both Greek debt equaling nearly 200% of annual GDP and an unprecedented unemployment rate (see below), problems in Greece will remain for years to come. Yet, dealing in current terms, the United States is unlikely to take any great measures with its own monetary policy while Europe remains in such disarray.

It is important to keep an eye on Greece’s debt issues as they are inextricably tied to the EU, European Central Bank and International Monetary fund. Also keep in mind, many EU member nations sold off bond holdings to global investors outside of Europe – including those in the United States. In our global economy, the US Federal Reserve must – and will – remain mindful of global fiscal issues and is therefore unlikely to act briskly, or at all, in September based on issues at play in the EU.

Supply/Demand Metrics for Crude Oil

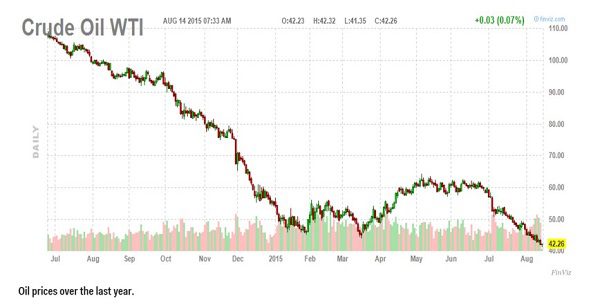

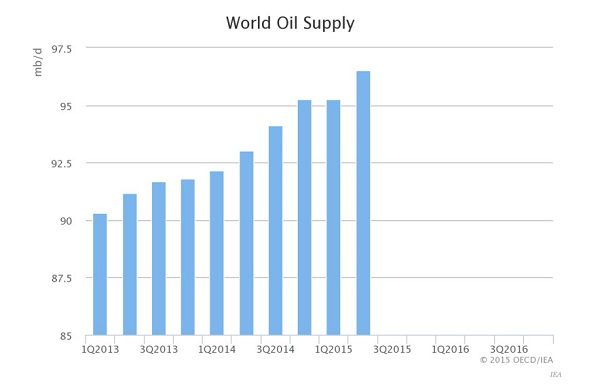

Remember when crude oil hit $110 a year ago? Maybe not, yet I am sure you recollect well gas prices last summer. As of this morning, crude oil futures hit a low of sub-$43. Low oil prices were supposed to spur the economy, promote consumer spending and drive inflation. That didn’t happen. Although Janet Yellen claims that the nation is reasonably on track vis-à-vis inflation, low oil pricing essentially producing a “zero-effect” on consumer spending or inflation will weigh heavy in the mind of the Fed.

The prospect of oil prices resuming a stabilized rate in the near-term in unlikely. OPEC has essentially lost control of monopolistic pricing power and its strong-hold on scarcity inducing supply constraints. Mindful consumers, drilling in Alaska and a focus on renewal energy further remove us from a historical supply/demand balance promulgated by OPEC.

Current oil prices, as well as global supply/demand balance, are neither a symptom or byproduct of economic policy in the United States, yet rest assure the last of influence of low oil pricings on consumer spending will impact our monetary policy on a moving forward basis.

Chinese Monetary Policy

In a historic move this past week, the Chinese government moved away from a frowned-upon practice of inflationary currency manipulation and actually devalued the Yuan. Pundits have opined in every direction as to the impact on the United States, yet one impact is clear – confusion on a path moving forward and further concern of a slowing economy in China.

Devaluation of the Yuan has both global and domestic US ramification – yet is particularly important to the economics of Washington State. China is Washington’s largest foreign trade partner – making the trade partnership between Washington and China the strongest of all US states.

It is too soon to tell what will come of recent manipulation of the Yuan by the Chinese government. Some believe it will be a boon to US commercial real estate as Chinese nationals attempt to move more capital out of a depreciating Chinese economy to a stable US economy – more EB-5 activity!

A possible negative impact is the artificial increase in the cost of US goods in China – an impact that is especially bad for Washington, including large global suppliers such as Microsoft and Boeing.

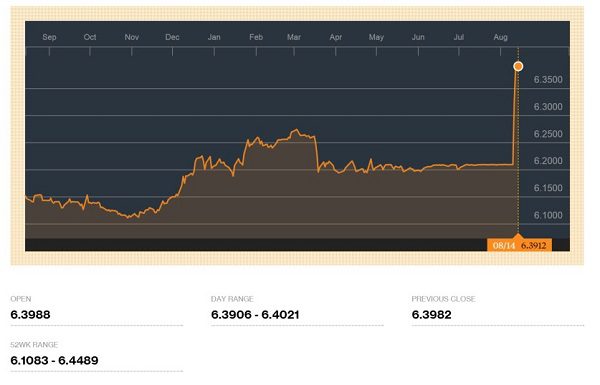

Truly, we are in early innings. If you look at the overall impact on Yuan-US Dollar conversion ratio, it is rather slight, especially looking at the following graph of an exchange spike of only 3.1% over the last 12 months moving average.

Overall, manipulation of the Yuan and the impact of a further trade deficit with China will likely cause the Fed to move cautiously with increasing interest rates. Increasing US interest rates will make our products even more expensive in China, a very harmful impact. The Yuan in “one” to watch.

Although the foregoing factors are global and macro in nature, they are considerably important to watch when considering placing debt on apartment assets and restructuring debt. Please give me a call to discuss your apartment investment strategies and how to position your investments for the greatest possible returns.