We are off to a banner year in 2015. Apartment investors came in droves in 2014 and such momentum continues in 2015. Given most all Q1 2015 sales originated in Q3/Q4 of 2014, the prominent start to 2015 is more of a continuation of 2014 than any new phenomenon.

Investors from across the nation (and globe) have their eyes on Seattle and the Puget Sound. Given the economic strength of our region, 2015 will continue as a strong year for investment in apartment assets. Buoyed by unprecedented job growth, demographic tailwinds and overall desirability of our region, expect Seattle to top previous sales peaks and metrics in 2015.

The following summary includes year-to-date sales of apartment buildings +50 units in King and Snohomish Counties. Please see my 2015 Seattle Apartment Market Studyfor a full analysis of 2014 sales and a look at historical sales trends for each of the following regions.

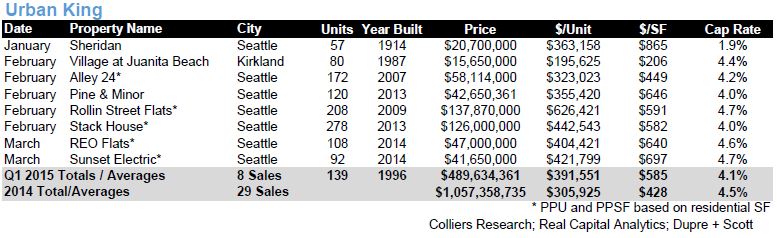

Urban King County

The greatest sales strength in the region is undoubtably in Urban King County. With 8 sales totaling nearly $500M, this quarter is undoubtedly the strongest in history, more than doubling any previous Q1 sales volume. Explanation for such sales is found mostly in the sale of pieces of the Vulcan Portfolio, with 3 sales in Q1 totaling $322M.

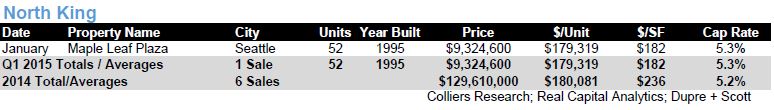

North King County

Only one sale occurred in North King County in Q1, equaling the same number of sales in Q1 2014. Overall North King County had rather tepid sales volume in 2014, yet there is still time for momentum to build in 2015.

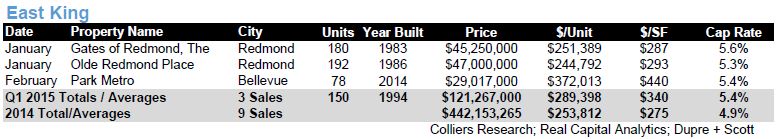

East King County

In Q1, there were three sales in East King County, following a strong close to 2014 with two sales in December 2014 alone, totaling over $150M. East King County is poised to top 2014 sales volume with the momentum we are currently seeing in the marketplace.

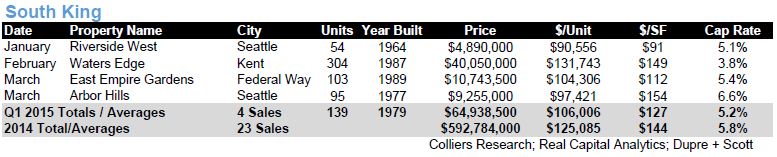

South King County

Second only to Urban King County, South King County showed impressive sales volume in Q1. The region had four sales in Q1, edging out the three sales that occurred in Q1 2014.

North Snohomish County

North Snohomish County is our only region that experienced no sales in Q1 2015. In Q1 2014, North Snohomish County only had one sale and overall it tied with North King County for the least number of sales in 2014, each with 6 sales (compared to Urban King County with 29 sales and South King County with 23 sales).

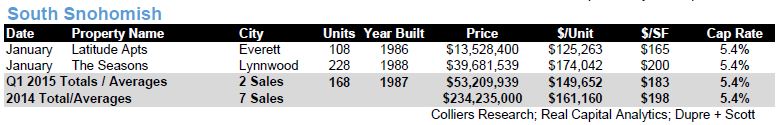

South Snohomish County

South Snohomish County has booked two sales year-to-date, matching Q1 2014 total sales. This region barely edged out North Snohomish County in 2014, counting 7 total sales compared to North Snohomish County’s 6 total sales. Given strong rent growth momentum in submarkets like Lynnwood, expect to see strong investor demand in South Snohomish County.

Overall, our region’s investment sales market is off to a very strong start in 2015. Listed properties are few and far between, yet those on the market are experiencing extremely strong investor interest and correlated upward pressure on pricing. For the time being, we will continue to see record pricing on a price/unit and price/NRSF basis.

Expect Seattle / Puget Sound to post impressive sales figures throughout 2015, or at least until we see upward pressure on interest rates. Please call me to discuss the Seattle apartment investment market and gain a finer understanding of opportunities in the marketplace.