Without question, the Seattle apartment market is experiencing both record development AND sustained rent growth, while maintaining low vacancy. Sound like a market that is too good to be true? Yes, it does – yet current fundamentals support that the market is indeed healthy, or so it has been over the last 48 months.

We are going to take a look at three market segments and analyze performance since 2000, with a considerate focus on the last 48 months – dating back to 2010, when our apartment market began to find its legs again after The Great Recession (reported as ending June 2009).

In this post we will review rent growth, gross market vacancy (which includes vacancy of newly developed buildings) and apartment deliveries/pipeline for a selection of micro-markets/neighborhoods in the following market segments:

- Seattle Urban

- North End Seattle / Snohomish

- South End Seattle

Data provided is based on an analysis of Dupre + Scott data, as recent as EOM September 2014; however, the analysis is my own perspective on the data.

Seattle Urban Neighborhoods

Undoubtedly, these markets have drawn the most attention from investors (nearly 20 sales YTD – double the entire Snohomish County total) and have been the benefactor of the strongest rent growth, yet greatest amount of new apartment deliveries. I will let the slides speak for themselves, but also add a couple of insights.

Downtown/Belltown/South Lake Union—The data is grouped in this fashion, so I am unable (at this time) to trifurcate the data. Rents have steadily grown, 6.8% y-o-y since 2010, yet a monumental amount of supply is planned for these markets – predominantly in Belltown and SLU.

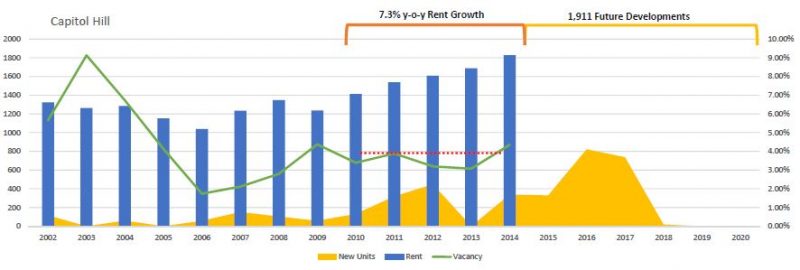

Capitol Hill—This market has experienced stellar rent growth in the last four years, yet as development has ticked up in 2013, so have vacancy rates. This will be a market to watch through 2017.

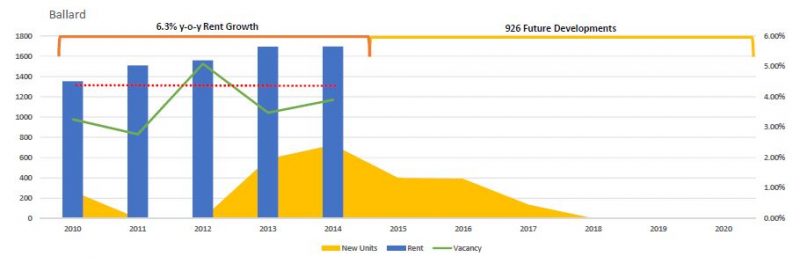

Ballard—Churning through new supply, Ballard has performed well. As you can see from the graph, this is a relatively “new” apartment market from a data-collection standpoint. Extrinsic fundamentals – traffic, proximity to job centers – will play a definite role in its future, yet you can’t do much better vis-à-vis metrics for a walkable, safe and Millennial-centric neighborhood!

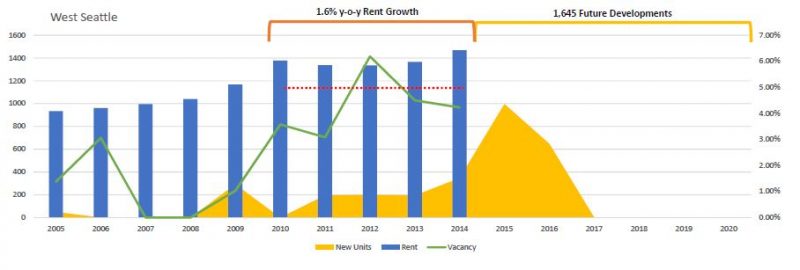

West Seattle—Another relative newcomer to becoming a modern apartment market, West Seattle has steadily built upon its rents since 2005, yet with new development rent growth has slowed in the past few years. As the graph shows, a veritable pile of new apartment development is slated for delivery in the next three years. For the near term, pay keen attention to rent growth and vacancy rates.

North End Seattle & Snohomish

As of late, pontificators and prognosticators have paid less attention outside of the core – yet these markets offer an opportunity for interesting analysis. I have selected a few markets to highlight market dynamics north of Seattle.

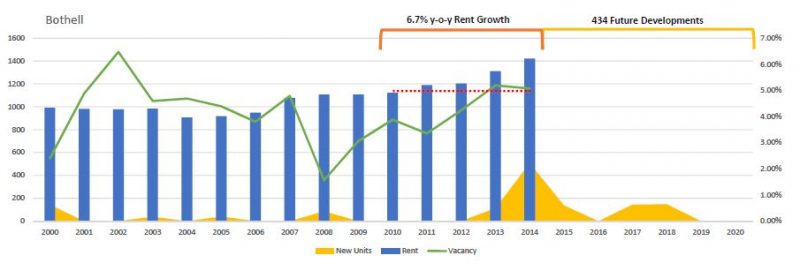

Bothell—Some may not have guessed, but Bothell’s rent growth nearly matches that of Seattle’s vibrant urban core. Development of new, modern product is transforming the market – and vacancy has stabilized despite the addition of new apartments.

Lynnwood—A mecca of new development outside of the core, nearly 900 deliveries occurred in the last 48 months and another 925 new units are planned in the next 48 months. Yet, despite new apartment stock added to the market, rents have continued to rise – but so have vacancy rates!

South End Seattle

A favorite market for me to watch, Seattle’s South End offers unique investment opportunities for an investor with a critical eye towards yield. New development is occurring with strong fundamentals providing wind to investors’ backs.

Renton—Rent growth is beginning to mount in Renton, yet the market has not quite caught up with North End Seattle. Renton’s own “north end” received a lot of new supply from 2006 – 2012, which is now absorbed. Vacancy remains low with moderate new supply coming. Look for rents to continue to rise in Renton.

Kent—In this market we see steady rent growth over time, yet with not nearly the velocity of growth that other markets have experienced. New supply is minimal, yet vacancy continues to fluctuate. This market is one to watch as more supply is on the horizon.

The inspiration for a more detailed historical and forward looking analysis, specifically including development delivery/pipeline data, is one of my most astute and detailed clients – a nod to him and his excellent request for a more refined analysis (you know who you are – thank you!). I offer such a note as an invitation for your ideas on analysis you would like to see in the future. Happy Halloween!