The national apartment market continues to exhibit fundamentals that would make any asset class blush. By nearly every measure the market exhibits vibrancy.

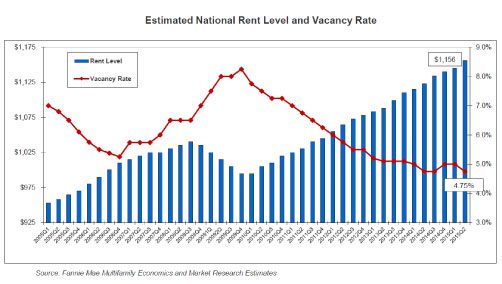

Rent growth – its up!

Vacancy rates – they continue to plummet!

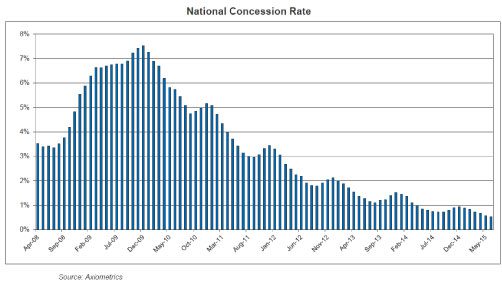

Concessions – well, those are just for buildings under lease-up!

Seattle Remains the Apple of Owner/Investor’s Eye

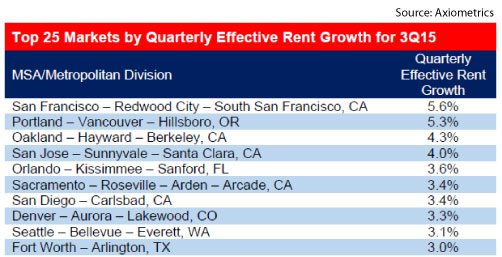

How does Seattle compare? In July our rent growth measured 7th in the Nation and as of August, we still ranked 8th in the Nation. Preliminary Q3 numbers recently released by Axiometrics demonstrate that the Seattle-Bellevue-Everett MSA retains a spot in the Top 10 nationally.

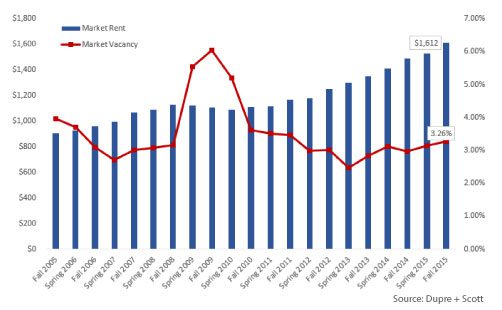

Taking a look at Seattle specifically, it doesn’t look much different than national averages – yet with two stark differences. Our average rents are much higher than the national average and our average vacancy is much lower!

Dupre + Scott Apartment Advisors just released their Fall Rent and Vacancy survey, providing the most up-to-date data and measurement on our market’s performance. In their report you will find similarly healthy fundamentals around the region.

How Rosy is 2016 and Beyond?

Q4 is upon us and we officially enter the season of predictions and prognostications. In the business of apartments, or commercial real estate for that matter, we talk in terms of jobs. Job growth equals absorption of new units and jobs + absorption often equate to rent growth.

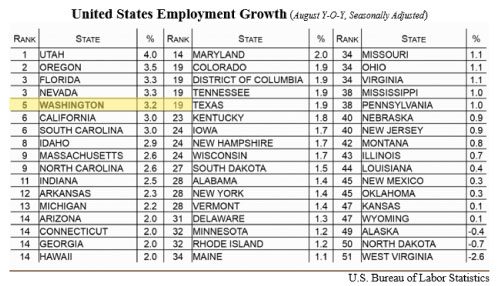

Washington State continues to generate new jobs at a faster clip than the rest of the nation, by about 50% (3.2% employment growth versus a national average of 2.1%).

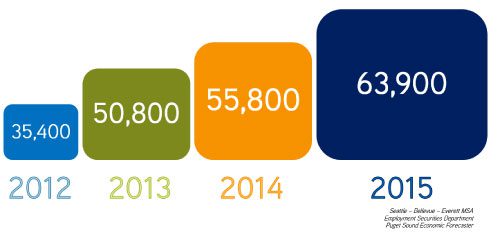

Over the last four years the Seattle-Bellevue-Everett MSA beat all expectations and delivered nation-leading job growth – the numbers are impressive and mounting. With the MSA on track to grow more than 65,000 jobs in 2015, we have bested all predictions.

With numbers like this we must be entering 2016 with high-hopes and an expectation of significant absorption of the +10,000/units expected for delivery y-o-y from 2016 – 2018. Not so much!

Based on numbers released by Puget Sound Economic Forecasters, the future does not look so bright.

Before you put the “for sale” sign on your development site and enroll in that truck-driving academy, realize that back in 2012 the prediction for job growth in 2015 wasn’t nearly 65,000 jobs (nor even close to it). Predicting job growth isn’t for the faint of heart and predictions beyond a year or two is a tricky endeavor. Trust I am digging into these number to better understand what the future holds.

I have every expectation that the Seattle market, including the Tri-County region, will continue to experience rent growth in 2016 and beyond. Be prepared to expect the effects of seasonality as we enter the ‘dark’ months in this region – as discussed in Seattle Apartment Rental Seasonality & the Sales Season.

Understanding both future and current market dynamics is critically important in positioning both your assets and your investment thesis for optimum results into the future. Our apartment investment sales team, comprised of four highly qualified professionals, and a back-office team of an additional four dedicated staff, specializes in assisting apartment owners in maximizing returns. Please give me a call to discuss how we can turn our expertise into your profit. – Dylan