Last month began the second half of 2015 and year-to-date sales volume is proving that the Seattle region is off to a record-setting year. The region’s stellar economics, outperformance of other markets and substantial development pipeline of sexy new product places a spotlight on the Seattle region shining brighter than nearly any other market in the United States.

Concomitantly, sales volume is rocketing past previous peaks. Investors are clamoring to get a piece of the action and developers are eager to cash out of newly completed projects to fund the next venture. We are in the midst of a record-setting year and some of the fundamentals are both interesting and insightful. In the following post we will cover:

- 2015 Sales Volume will Break All Previous Records

- Where have the REITs gone?

- When will the foreign apartment investors arrive?

2015 Sales Volume will Break All Previous Records

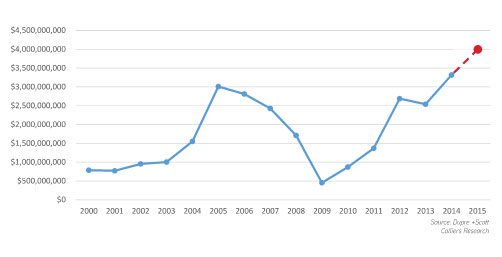

As of this writing two-thirds of the year has passed and the volume of apartment transactions in the Seattle/Puget Sound region has mounted. To date, $2.6B in apartment transactions have closed. Last year set a new record of $3.3B in transaction volume. During the previous peak in 2005, $3B in apartment deals were closed in the region. The region is on pace to close nearly $4B in apartment sales in 2015.

Where have the REITs gone?

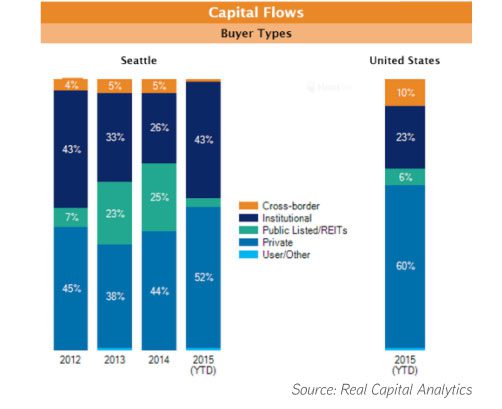

In 2014, residential REITs made up 25% of the buyer pool, in 2013 this percentage was 23%. So far in 2015, REIT purchases represent less than 5% of total regional sales volume. The national trend is similar.

As far as profitability, the residential REIT sector performed phenomenally in 2014. In a year when many expected REITs to double-down and grow their portfolios via acquisition, it simply hasn’t happened. The predominance of buyers in 2015 are funded by private and institutional capital.

When will the foreign apartment investors arrive?

Year to date, direct foreign investment into apartments into the Seattle region is $9.6M. Yes, that is one deal – 54 units. This dearth of foreign apartment deal volume certainly doesn’t compare to the $1.5B in YTD direct investment in other asset classes, primarily office and industrial. Remarkably, foreign investment metrics in SF track similarly so far in 2015– two foreign apartment deals (worth $157M) and $1.3B in transaction volume in other assets classes.

Direct foreign investment in apartments in coming. We have seen remarkable direct foreign investment in residential land, yet not in existing, cash-flowing residential assets. When we do, expect transaction volume (and pricing) to increase markedly.

What’s Driving Volume?

Sales trends are but one element highlighting the strength, investor demand and trajectory of the Seattle/Puget Sound market. Beyond – and quite frankly “fueling” – sales trends, our market lays claim to a remarkable development pipeline and dizzying rent growth statistics.

Nary has a week endured without a headline boasting of the specter of overbuilding. Each time Seattle is mentioned – yet mentioned as a key market for absorption and stability, despite record deliveries and a continually mounting pipeline of residential projects.

Rent growth is a similarly positive story. Over the last four years rent growth in the Seattle metro averaged between 6% – 8%, with MPF recently reporting 7.8% annualized growth in Q2 2015. Despite strong year-over-year rent growth, Seattle rental rates still rank higher on an affordability scale than most all major coastal metros – proving strong legs for the future.

The Seattle apartment investment market is set to record a remarkable 2015. The foregoing is simply a snapshot of overall market dynamics. Give me a call to discuss your particular apartment assets and investment goals for 2015 and planning as we quickly approach 2016.