As of October 2014, the Federal Reserve officially ended its support of U.S. bond markets, a 5-year monetary policy endeavor commonly known as quantitative easing. (For a great review of the impact of Q.E. take a look at this fantastic article in the New York Times). Accordingly, investors are gearing up for possible impacts on investment markets.

Significant changes in monetary policy directly impact interest rates, which in turn have correlative effect on bond and equity markets – and significant to this audience – hard asset markets, namely commercial real estate. To best position you investments and investment strategies while we prepare for 2015, is it useful to take a look at the economic health of the nation, as well as the key indices watched by the Federal Reserve in shaping monetary policy decisions.

Key Conclusions:

- Interest Rates Remain Low – The 10-Year is at ~2.3%, a significant decline from the beginning of 2014 when the same market interest rate was 3.0%.

- US Economic Health Remains in Question – The US Labor Participation Rate continues to decline and wage growth has stagnated in the last 5 years.

- Accommodative Policy Likely to Remain – Janet Yellen historically has shown behaviors and voting patterns that favor an accommodative Fed, typically resulting in a lower interest rate policy.

- Seattle’s Economic Health Continues to Outpace the Nation – Seattle’s unemployment rates remains 90 BP lower than the US and still 70 BP lower than Washington State.

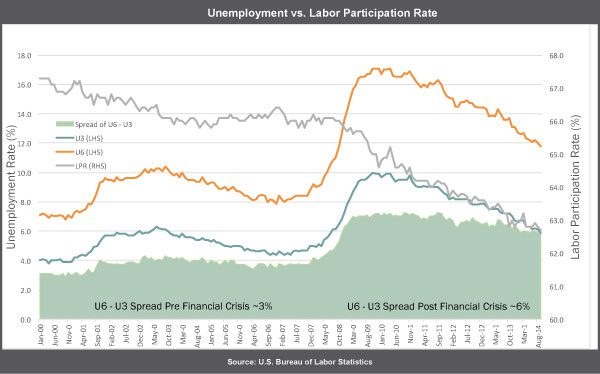

National unemployment figures have trended in the right direction; however, the indicator the Fed is currently watching is the Labor Participation Rate (LPR) – a measure of the active portion of the US labor force. The LPR is crucial as it is a much better indicator of how many people are actively employed. (For a better understanding of the LPR, see this article on U3 versus U6). The conclusion of this analysis is that US employment is not as strong as reported by the U3 and the Fed is watching this closely before raising rates.

Inflation & Wage Growth

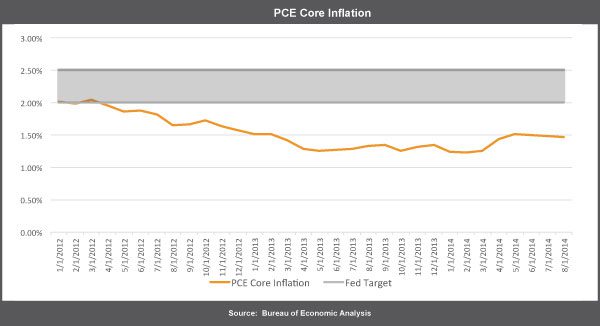

Wage growth is critical to creating inflation, a key benchmark the Fed is watching before increasing interest rates. The Fed has targeted an inflationary rate between 2.0% – 2.5% before increasing interest rates.

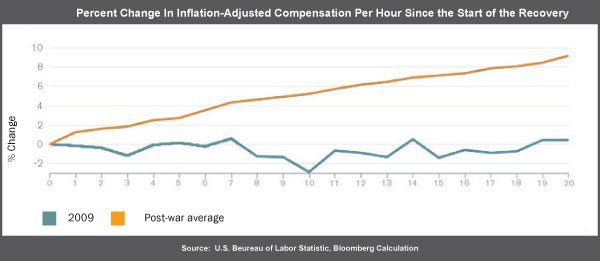

In the last 5-years, inflation has remained subdued, well below target rates for the Fed. When viewing wage stagnation, this phenomenon is not a surprise. Wages has stagnated since the Great Recession of 2008 and accordingly, Personal Consumption Expenditures (PCE) have not grown.

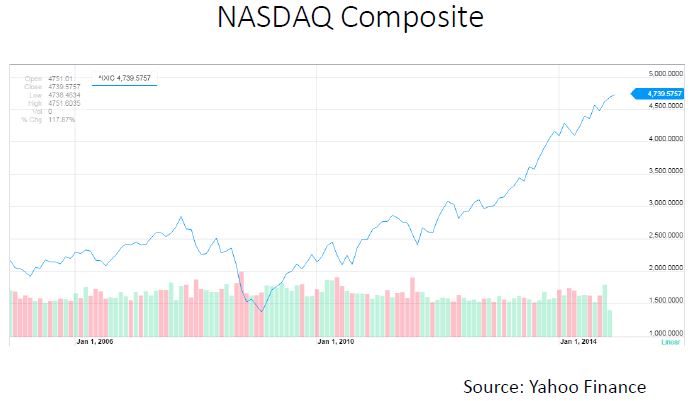

Wealth Effect of Q.E.

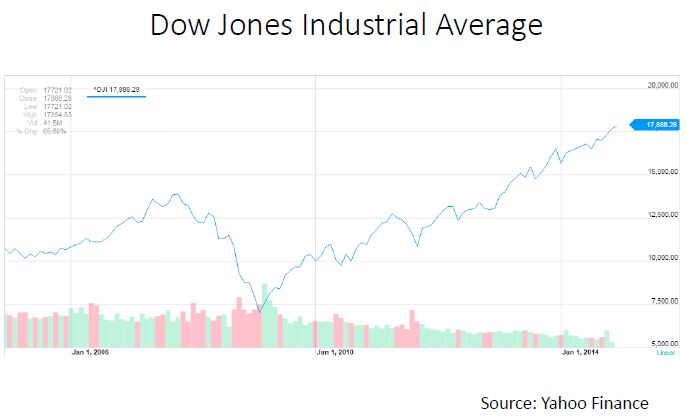

If the Fed has “pumped” nearly $4.5T (yes, that is trillion) dollars into the economy via Q.E., what is the resultant impact? During the last 5 years of Q.E., stock and bond markets have soared, as have values of hard assets such as commercial real estate.

Despite phenomenal growth in our securities markets – and significant asset appreciation for individuals who have invested in hard assets, Yellen is unlikely to use monetary policy to prevent asset bubbles. Her focus is more on income inequality, believing that income equality is “one of the most disturbing trends facing the nation”. Accordingly, it is unlikely that interest rate hikes will be tied to economic strength show in our securities markets.

Conclusions

The US economy continues to face headwinds, despite the Fed pulling back from Q.E. and charting a course towards a rate hike cycle. Interest rates will assuredly rise in the near term, possibly as soon as mid-2015. Yet the Fed is likely to continue an accommodative interest rate environment as it measures how best to raise interest rates while trying to spur employment and wage growth.

Even if interest rates rise, opportunities for the focused investor are plentiful. History proves that in rising rate environments, companies with stronger balance sheets perform best. Accordingly, I have formed several strategies for apartment investors to outperform the market as we venture into 2015 and the possibility of a rising interest rate environment.

As always, apartment investors are encouraged to call or email me with questions or to discuss their investments and investment strategies.