Earlier this month we hosted our 2024 Fall Multifamily Investor Forum and presented key insights on the Seattle/Bellevue/PNW apartment market.

Here are 10 Essential Takeaways from the event:

- Development Pipeline: A Pause Before Cranes Swing Again

- Construction Costs: Slight Decrease, Yet Don’t Expect More

- Rental Rates & Vacancy: Eastside Growth Outshines Seattle

- Capital Markets: Off the Bottom, Heading to a New Peak

- Buyer Interest & Underwriting: Optimism is Back

- Cap Rates Gapping Out: Compression in the Core

- Work-from-Home: Shaping Rental Growth?

- Investor Strategy: “Buy the Smile”

- Long-Term Outlook: The PNW is Soaring Again

- Seizing Opportunity: Start Now

1. Development Pipeline: A Pause Before Cranes Swing Again

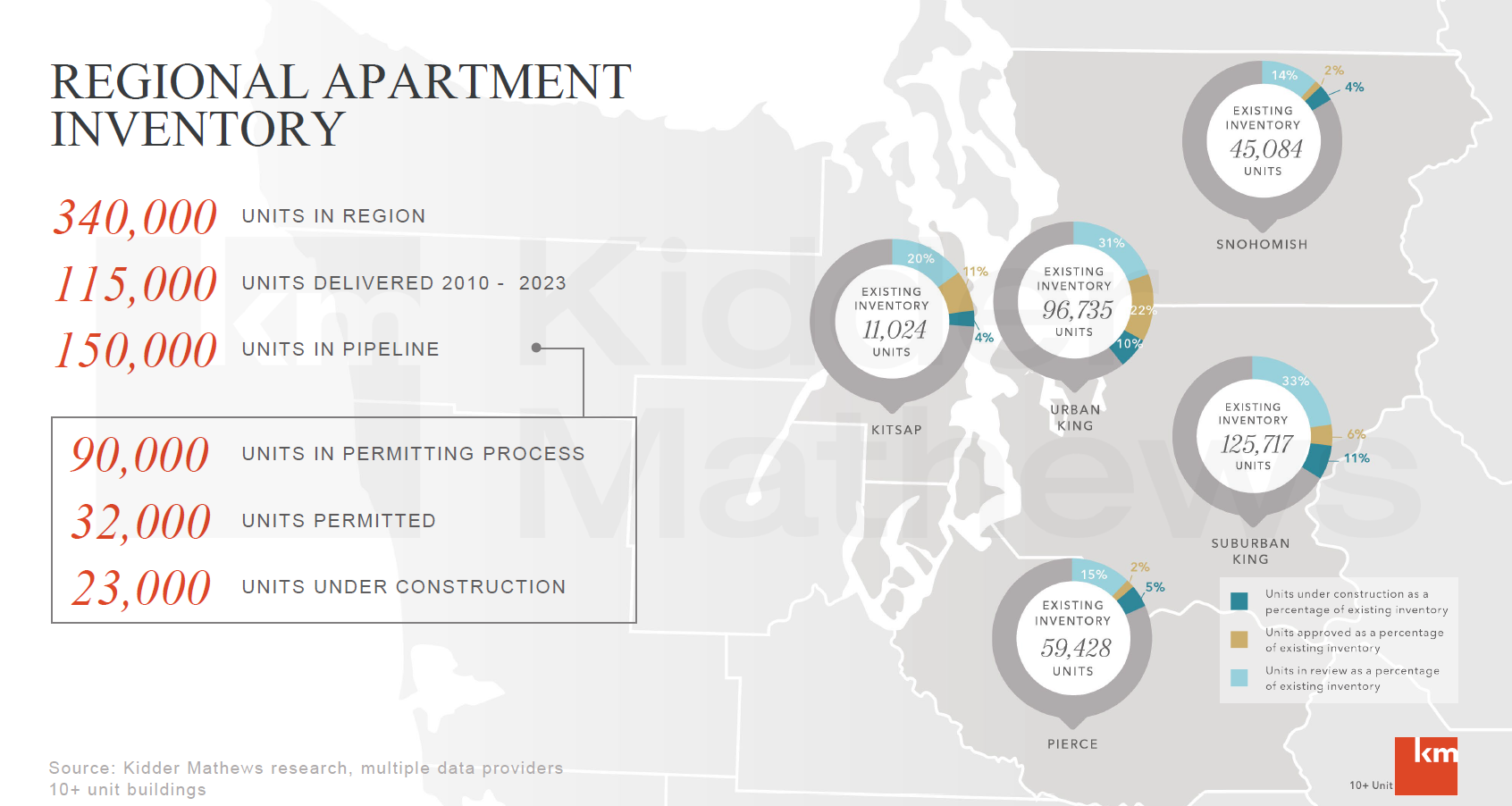

Seattle’s multifamily development pipeline is seeing a temporary slowdown as developers struggle to make new developments pencil. Between 2010 and 2023, over 115,000 units were delivered in the region. Currently, over 23,000 units are under construction, yet few developers are ready to break ground after these projects deliver from 2024 through 2026. This lull will assuredly result in increased rental rates and plummeting vacancy levels, resulting in a more favorable market for property owners and investors alike.

2. Construction Costs: Slight Decreases, Don’t Expect More

Although construction costs remain high compared to pre-pandemic levels, they have begun to decrease slightly – to the order of magnitude of 10% to 15% off peak levels experienced in 2022. Will construction cost fall further? According to local general contractors, likely not as labor markets remain tight and new projects will likely kick demand back into gear in 2025.

3. Rental Rates & Vacancy: Eastside Growth Outshines Seattle

Where do the Seattle metro area renters cluster? Eastside markets, especially Bellevue and Kirkland, are outpacing Seattle in rent growth. With the Eastside’s average rent rising by an impressive 23.8% since 2019, it’s clear that renters are choosing locations that are highly livable and “just close enough” to work should they get called into the office.

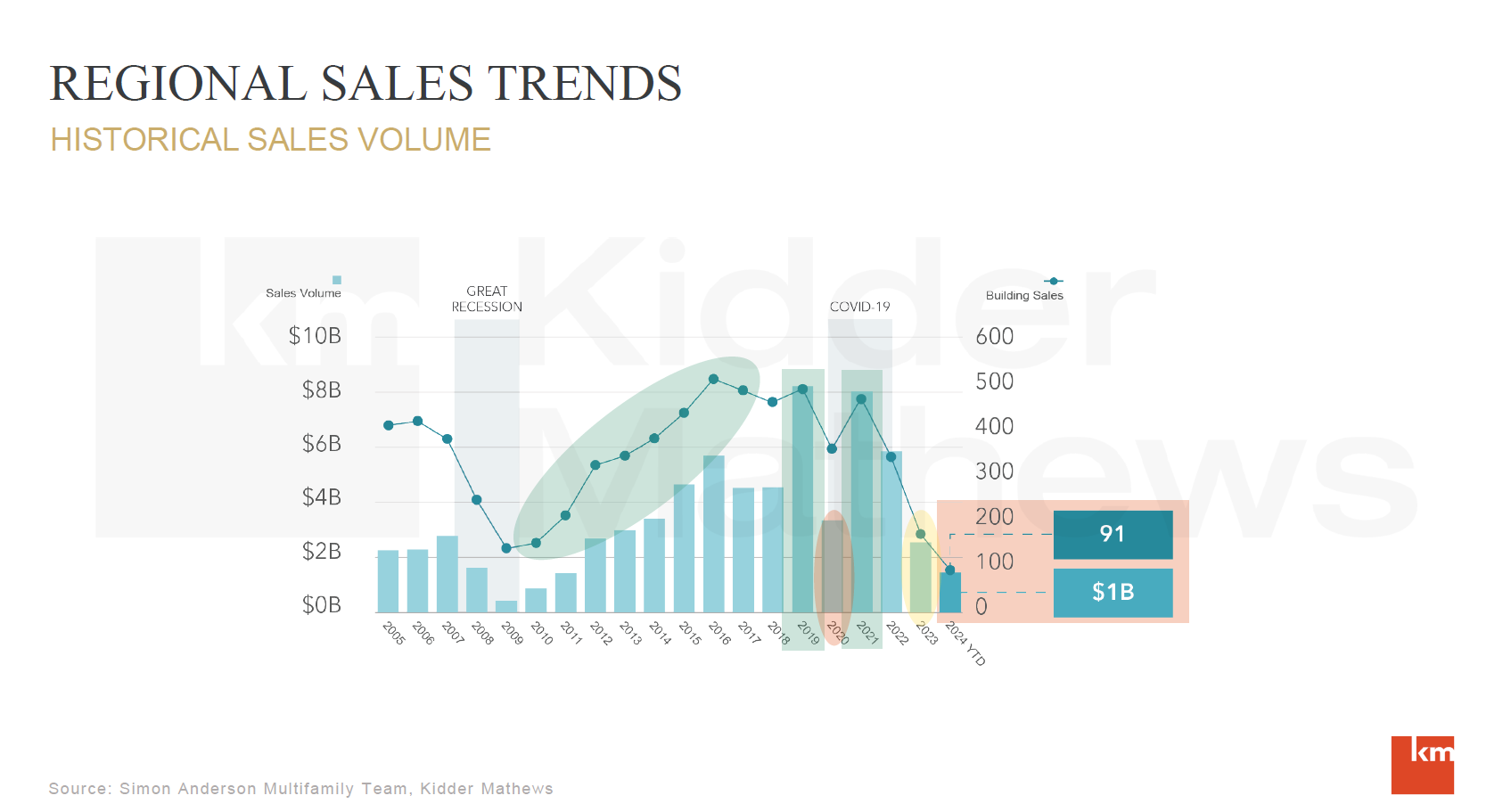

4. Capital Markets: Off the Bottom, Heading to a New Peak

The big question is: Are we at the bottom of the market? We are incredibly close, and early signs of recovery are already emerging. Despite ongoing uncertainties regarding interest rates, the potential for upside is evident for investors who are prepared to act. The market bottom is clearly behind us, and the only question now is how quickly we will see growth in rental rates and apartment values once again skyrocket.

5. Buyer Interest & Underwriting: Optimism is Back

After a few challenging years, the multifamily market is showing signs of recovery. Investors who had held off on acquisitions during the market bottom are returning, signaling renewed optimism. Sales volume, though down by as much as 75%, is expected to pick up rapidly. Expect both liquidity in capital markets and buyers ready to “lean into” the future when underwriting investment opportunities in 2025.

6. Cap Rates Gapping Out: Compression in the Core

Way, way back 12 months ago (circa-Q4 2023) we experienced the phenomenon of “universal cap rates” – nearly all investments were priced near a 6% cap rate due to the cost of capital and “risk-off” investor mentality. Cap rates are beginning their downward compression and are again gapping. Expect this “gapping out” of cap rates to continue. However, not all investors are keen to this change, creating an interesting (and profitable) asymmetry in the market. Call me to learn more!

7 .Work-from-Home: Shaping Rental Growth?

During “deep COVID” we saw renters and investors alike flee to suburban markets. Those same markets are now experiencing tepid-to-no rental rate growth and high delinquency rates. It’s too soon to tell the impact of Amazon’s required “5-days in the office” work week, yet the writing is on the wall that the WFH trends of 2020 through 2024 are now at risk as we move closer to 2025. As they say, “everything old is new again”!

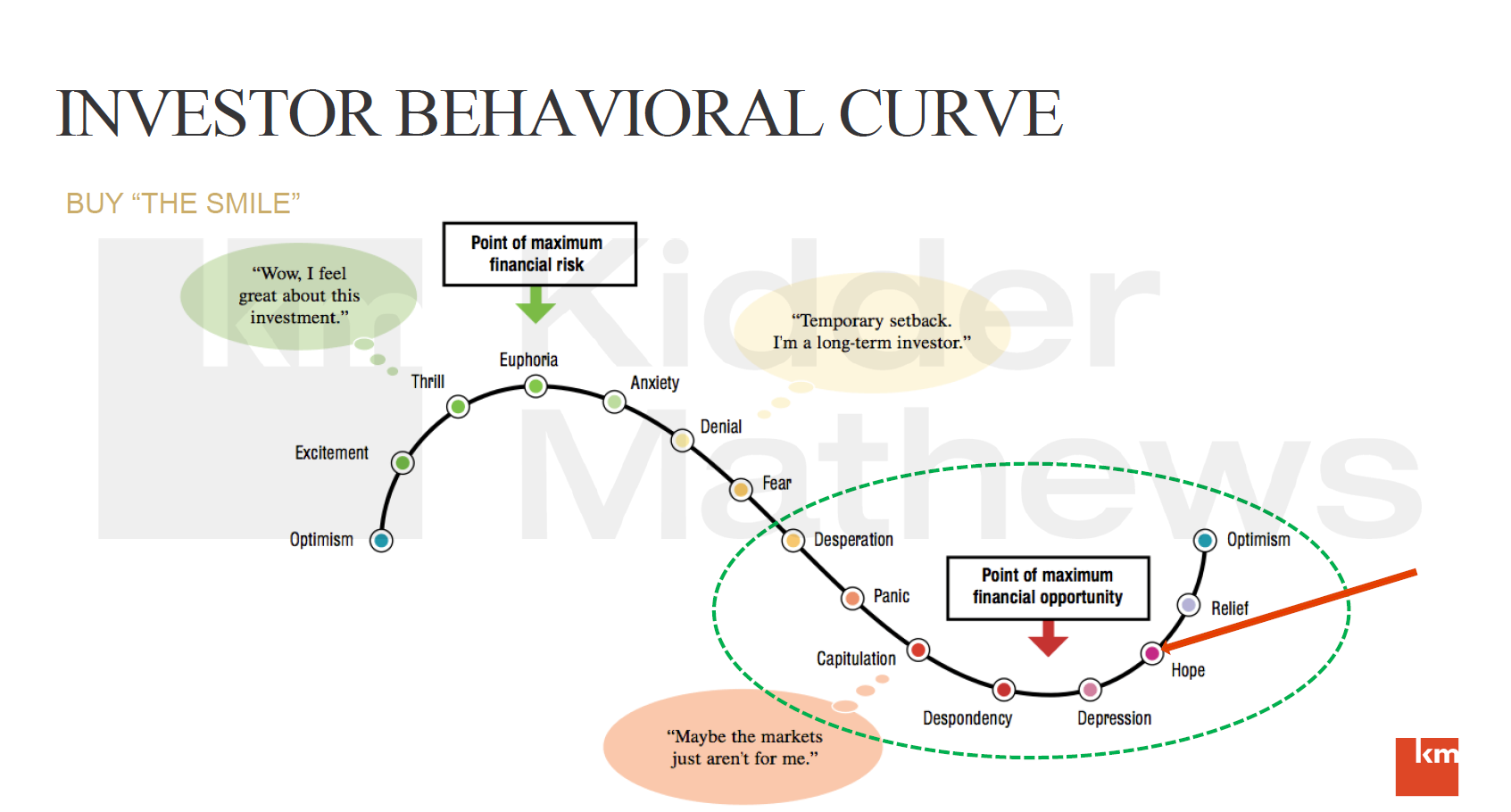

8. Investor Strategy: “Buy the Smile”

Investors—now’s your chance to “buy the smile” and ride the recovery curve to success. History shows that the best time to invest is when the market is on the upswing. As a buyer, remain sidelined at your peril. This strategy offers the potential for substantial gains as the multifamily sector recovers.

9. Long-Term Outlook: The PNW is Soaring Again

The PNW, led by Bellevue this cycle (versus Seattle in previous cycles), is back on top. Investors are beginning to flock to the PNW due to a renewed optimism in the market’s strong fundamentals, economic resilience, and obvious potential for future economic growth.

10. Seizing Opportunity:

Start Now. The Seattle/Bellevue/PNW multifamily market is on the verge of a strong rebound. With rents climbing and sales volumes on the rise, now is the time for investors to capitalize on favorable market dynamics. The market will return to a new peak before you have time to blink – and that peak in values will well outpace the previous peak. Don’t wait…

I’m always available to discuss the market and explore how I can assist you in maximizing your investment returns.

About Dylan Simon

I specialize in the sale of 50+ unit apartment buildings and apartment development land across Washington State. Our Team of 10 apartment sales professionals is dedicated to helping apartment owners and investors sell and buy apartment buildings and development land from $1 million to over $100 million.