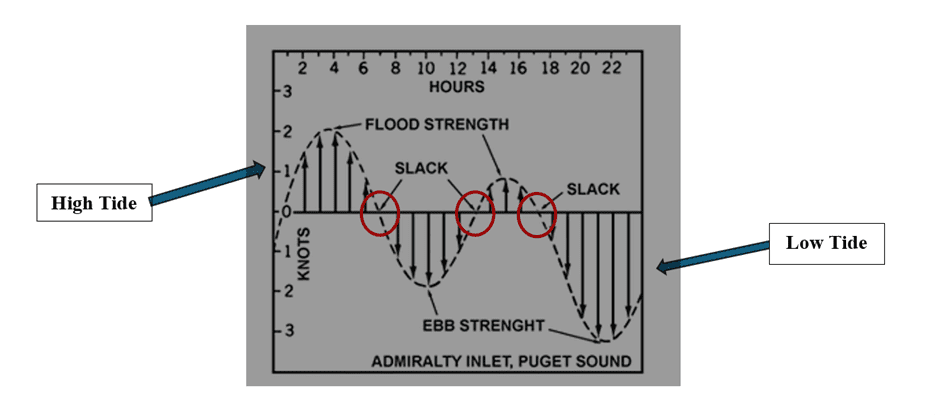

Only a handful of people know that I studied marine engineering, and worked as a merchant marine for a short stint to pay for law school. Well, old habits die hard and when it comes to market cycle analysis, it’s just too appropriate to skip the obvious comparison to tidal cycles.

In the aftermath of COVID-19 and governmental response, apartment values – and prices – spiked amidst massive rental rate growth and historically low borrowing rates: “high tide”.

By July 2022 in a whipsaw of directional force change, apartment values plummeted: “low tide”.

For the last 24 months, apartment investors were hesitant to make a move. Sellers didn’t want to sell into a low tide market and buyers didn’t want to buy into uncertainty of when the tides would change.

Reversing Tidal Currents – Puget Sound

Yesterday’s Apartment Pricing

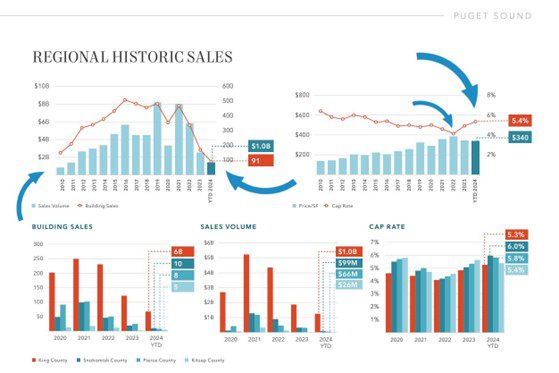

Last week, we published our latest apartment market research: Q3 2024 Puget Sound Apartment Market Dynamics Research. This research demonstrates both the “low tide” in apartment transaction volume, as well as pricing.

Source: Simon | Anderson Multifamily Team Research

When analyzing any commercial real estate research, it’s important to consider that sales data is relevant to investor sentiment at least 90 days to 120 days prior – when those sales were negotiated, not consummated.

In this time, the tide shifted.

Three Reasons Why “Low Tide” is Well Behind Us

What explains such an abrupt tidal shift?

- Intrinsic value (cost basis) re-appeared as a buying metric.

- Investors (finally) gained confidence in near-term economic growth.

- Capital is growing impatient – and looking for a home.

Apartment investors are back – and they are funded by an unprecedented amount of capital that wants (and needs) to get put to work.

𝐖𝐡𝐞𝐫𝐞 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 𝐢𝐬 𝐇𝐞𝐚𝐝𝐞𝐝

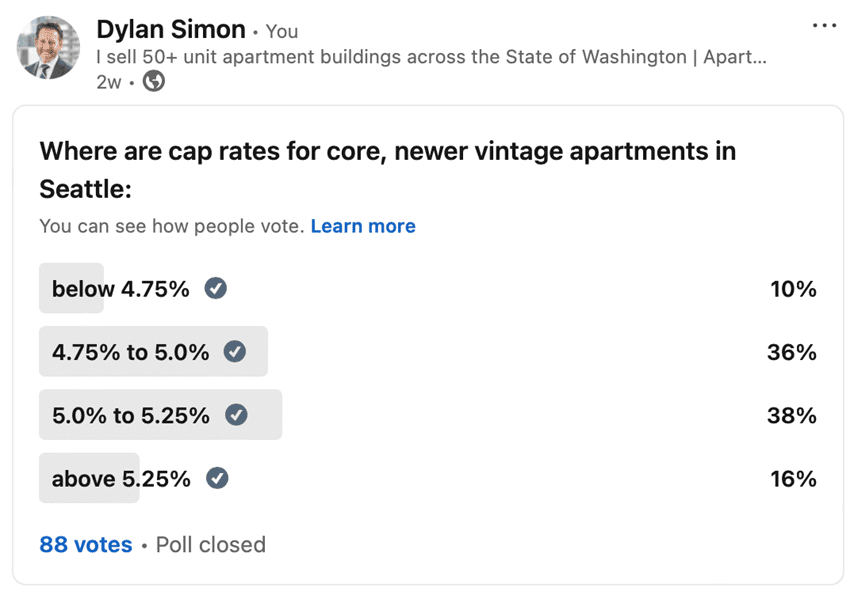

Back in July 2024 we conducted a poll and nearly 75% of respondents believed cap rates for core apartment buildings are at or below 5.25%. This is a downward shift – compression – in cap rates from our research that demonstrated higher cap rates for the first half of 2024.

Today, my conversations about my listings and other properties on the market are focused on cap rates below 5%.

Just like tides, cap rates are rarely constant, they trend up, or in this case down, over time.

Now is the time to act!

If you are an apartment owner looking for the right time to sell your building, now is an excellent time to come to market. With far fewer listings available, massive investor demand, and rapidly compressing cap rates, it’s an opportune moment to capitalize on favorable conditions.

As always, I invite you to reach out to me to discuss the market and how I can help you maximize investment returns.

About Dylan Simon

I specialize in the sale of 50+ unit apartment buildings and apartment development land across Washington State. Our Team of 10 apartment sales professionals is dedicated to helping apartment owners and investors sell and buy apartment buildings and development land from $1 million to over $100 million.