Not since 2008 have we seen more confusion in the financial sector than we have in the past two weeks. The stock market is a mess, the government is scrambling to address a health scare that is unprecedented in living memory, and coronavirus reporting is so relentless that not even Donald Trump’s Twitter account can manage a headline.

I spoke with dozens of our lending partners this week, and I am inspired by their proactive responses to the situation and their efforts to carry on business as usual.

My most important takeaways:

Price—most multifamily lenders have implemented pricing floors between 3.00% and 3.75%. We are currently going under application with new clients at the low end of this range.

Availability—LTV and DSC requirements remain mostly unchanged at 70-75% LTV and 1.20-1.30 DSC. Some lenders are being more cautious, with serious pullbacks are reserved for hospitality and retail. Construction financing remains available, and we have multiple construction loans in process.

Timing—Loans will probably take longer than usual to process because of a temporary surge in volumes in addition to some logistical challenges, but lenders and third-party vendors are doing everything they can to get deals done. Anticipate loans taking one to two weeks longer than normal, and make contingency plans in case a shelter-in-place order comes down from Olympia.

Multifamily Interest Rates in Volatile Times

The average pricing floor for a top-tier acquisition or refinance is 3.40% with no points, based on an informal survey of two dozen lending partners. For most lenders, floor pricing is commensurate with a stabilized building, minimum $2 million loan amount, and maximum LTV of 50-55%.

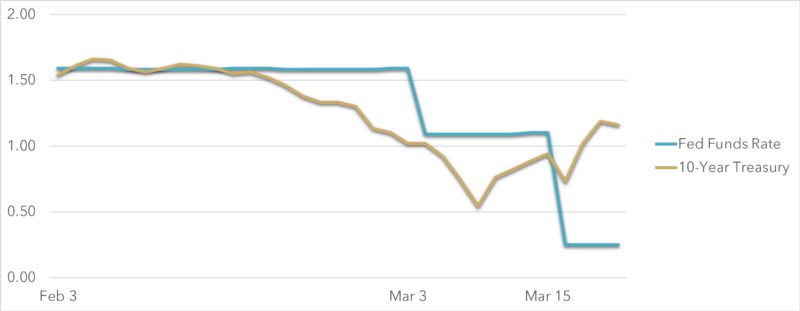

Pricing is slightly higher compared to February, which may surprise readers given the Fed’s aggressive actions and the change in the 10-year treasury this month:

Fed Target Rate & 10-Year Treasury Yield

February – March 2020

At the beginning of February, the 10-year treasury was at about 1.50% and a 3.25%-3.50% interest rate was widely achievable. It follows that multifamily rates should have been 2.25%-2.50% when the 10-year closed at 0.57% on March 9th.

Unfortunately, lenders don’t always move pricing in line with benchmarks. Upward pressure on interest rates is driven by:

- Surge in refinance volume—Fannie Mae and Freddie Mac were slammed with new requests this month, and many of our other lending partners are seeing an influx of applications. As a result, interest rate margins sharply increased while benchmarks like the 10-year treasury plummeted.

- Alternatives—AAA bond yields spiked this week from less than 3% to nearly 4%. This is particularly important for life companies, which typically don’t lend on real estate at higher rates than AAA bonds.

- Risk and cost of capital—The 10-year treasury is an important benchmark, but it doesn’t reflect lenders’ cost of funds. Lenders have fixed costs like any business, and the economic effects of coronavirus increase the risk of near-term defaults. Government policies limiting evictions and late fees for both residential and commercial tenants are also raising eyebrows.

We’re seeing pricing discipline at current levels, and we do not expect rates to go significantly lower in the near-term.

Reliably Obtaining New Loans

I spoke with two dozen lenders this week about new or planned policy changes, and only 25% expressed any immediate pullback in multifamily lending. In the cases where lenders are tightening their belts, the changes are incremental—the most common change is lowering LTV limits from 75% to 70% and raising DSC minimums from 1.20 to 1.25. Again, we are only seeing this happen on a limited basis.

Construction lenders continue to accept new applications for construction loans, including efficiency units. Policies can change quickly, but at this time we are not seeing lenders cut off funding for new projects.

Lenders’ positive outlook on multifamily stands in contrast to their outlook on hospitality and retail. There remains appetite for grocery-anchored retail, but most lenders are avoiding hospitality in the near term.

One dark spot is non-agency CMBS, with new issuance effectively halted as lenders wait for the bond market to settle. Multifamily is insulated from these problems because CMBS makes up only 3-4% of multifamily loans in the Puget Sound Region, which we highlighted in our latest Multifamily Lending Update.

Timing

I believe that the surge in application that we saw this month will affect turn times, but only temporarily. The biggest questions on timing boil down to physical logistics:

- How will appraisers inspect units and interview tenants?

- Will property managers be able to fill vacancies?

- Are loan processing staff able to work from home?

- Will lenders be receptive to creative solutions to these problems?

I’m seeing encouraging responses to these questions.

Appraisers are having success with exterior inspections and are interviewing tenants either by phone or from hallways. One property manager informed us that she is doing tours using FaceTime, with two new leases signed and five applications in process on a single property this week. Lenders, not normally known for being amenable to creative solutions, are successfully managing their workflows and accepting common-sense workarounds to sticking points like physical property inspections.

A Dose of Optimism

If I could sum up my conversations from this week, I would say that pricing remains near historic lows, competitive debt for multifamily properties is widely available, and logistical challenges to getting loans done that have been created by the coronavirus are an inconvenience, but not an obstruction.

We welcome the chance to talk with you about any challenges you’re facing in the current lending environment. Like our partners, we are open for business. Let us turn our expertise into your profit!

Want to keep up with our listings of buildings/land for sale, research, and industry updates throughout 2020? Subscribe to our investor newsletter and follow our team page on LinkedIn!