We all generally read the same headlines – “The Market is Booming” and “Rents Are Skyrocketing” – almost immediately followed by, “The Sky is Falling” and “Rents are Plummeting”. In a truly rational world, little of what journalists (most of whom are inexperienced in any aspect of investing and/or economic analysis) write would matter.

Yet, in true Keynesian fashion, the animal spirits guiding investors find themselves in an ever-self-referencing feedback loop. Accordingly, investors who chase the market up are often the same investors who chase the market down.

Well, today we find ourselves in a New Ballgame.

For the past 6 years, an ebullient Seattle market, buoyed by nothing but positive press and across-the-board rising rents, provided investors confidence that the entire pack continued to run in the same direction. With each passing symposium, panelists agreed that either we were in extra innings of a never-ending ballgame or that we were safely no further than the 7th inning, with time left to grab one more beer!

I submit that not only are we not in the late innings of the game – we are simply in a New Ballgame!

A Recession is Imminent

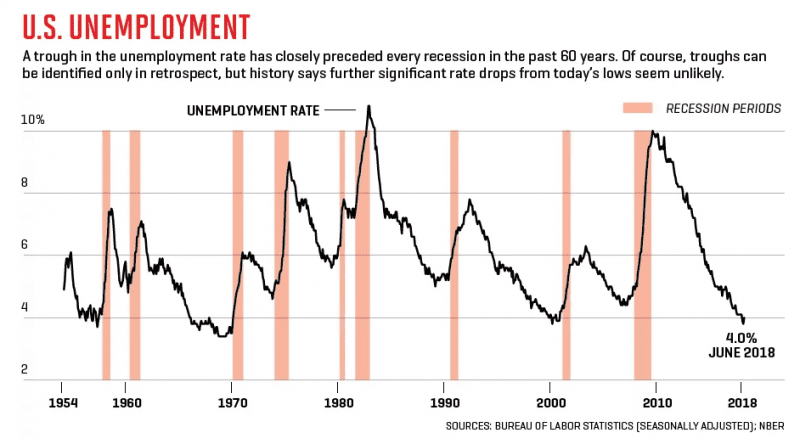

Hunting for consensus in investment markets can be difficult, especially in the age of information overload. However, in 2018 you can’t swing a dead cat and not hit an economist predicting the imminence of a recession.

To best understand the “A Recession is Imminent” viewpoint, I recommend reading an excellent piece recently published in Fortune Magazine by Geoff Colvin: The End is Near For the Economic Boom.

Mr. Colvin takes a broad view of both the current economy and economic history, concluding that upon the basis of multiple factors and indices, we are on the eve of a recession.

I not only read this piece, I’ve sent it to numerous clients and friends alike. I largely agree with both the thesis and conclusions, most of which apply to the equity and debt markets; however, I don’t agree that it will produce the same conclusions in certain real estate markets.

A Secure Apartment Investment Market

Zillow reported this week that rents declined annually over the past year, for the first time since 2012.

Cue investor pandemonium!

Yet, that same article reported that rent appreciation peaked in Q2 2015.

Yes…the “peak” of the apartment rental market is already more than three years behind us. I submit to you [again]: we are in a New Ballgame.

What does this ballgame look like? Slow and steady.

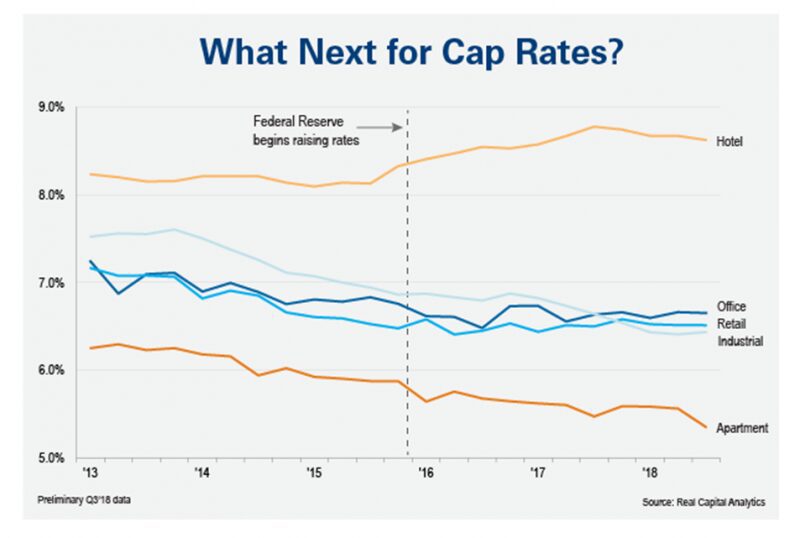

Despite concern in the market, capitalization rates across the county remain steady, if not still compressed, year over year. Faith in the apartment asset class bellies the growth in treasury rates that began over two years ago.

But how are investors reacting today to both an increase in treasury rates and how journalists opine on market data? Well, generally erratically.

What we are seeing is that many investors are basing decisions on both (1) what was happening in the market last year (stronger rent growth than today), and (2) what other investors are doing (worrying).

Historically speaking, investing based on yesterday and investing based on the pack have both proven ill-advised strategies.

We continue to see the smart money – experienced and educated investors – sticking to the fundamentals of their underwriting, spotting opportunities and continuing to invest in our very strong market.

Considering an upward rising cost of capital and little abatement of capitalization rates, smart money knows that now may be the best time to invest. With a segment of investors running to the hills, and a 10-year treasury rate still requiring well over 125 basis points of expansion to hit its mean, now is the time to spot and secure the right investment.

Seattle Will Remain Resilient

Whether you fall into the “dooms-day, headline-following” cohort, or have not yet made a decision on where the market is headed, remains largely immaterial to Seattle’s future. The groundwork for our market’s future continues its upward ascendancy nonetheless.

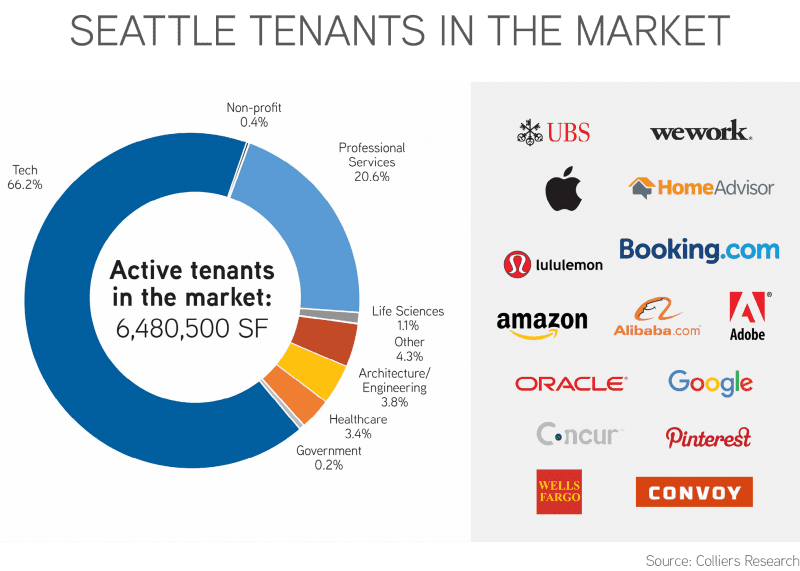

Nearly 6,500,000 square feet of Class A office space demand currently circles our market. This represents demand for over 30,000 “information-worker/STEM/FIRE” jobs and another 120,000 workers supporting those jobs.

Looking Ahead

Nationally and locally, real estate markets will remain dynamic as we enter 2019. Our advice is to ignore the headlines and focus on the fundamentals. Choose to work with educated partners and advisers, study validated data and historical trends in the market, and continue to invest as you always have – smartly.

Look out for more data and insights from our team, and give us a call to discuss your plans and goals for 2019. Whether you are considering selling your apartment building, buying more apartment buildings, or simply trying to optimize the portfolio of apartments you currently own, we can help.

Call us for a valuation and to discuss how we can work together.

Allow us to Turn Our Expertise into Your Profit!