We can’t lie—we’re still feeling the pain of Dupre and Scott closing shop earlier this year, especially now that market dynamics are starting to shift and there isn’t data readily available to clarify exactly what is happening (beyond the dramatic headlines popping up everywhere).

To answer that resounding question, we decided to use our annual Fall Investor Forum as an opportunity to crowdsource information from industry experts. We’d like to once again thank our presenters for openly sharing what they are currently experiencing in the market:

- Greg Inglin, Executive Vice President – Colliers International

- Walt Smith, CEO – Avenue5 Residential

- Jonathan Manheim, President – HAL Real Estate

- Chasten Fulbright, Principal – Blanton Turner

- Brian Runberg, Principal – Runberg Architecture Group

Impacts of The Puget Sound Office Market

There’s no better way to predict the future of the apartment market than to understand office and employment dynamics in the region, so we kicked off the Forum with an update on Seattle’s Office Market from Greg Inglin, whose team specializes in Institutional Office Landlord representation.

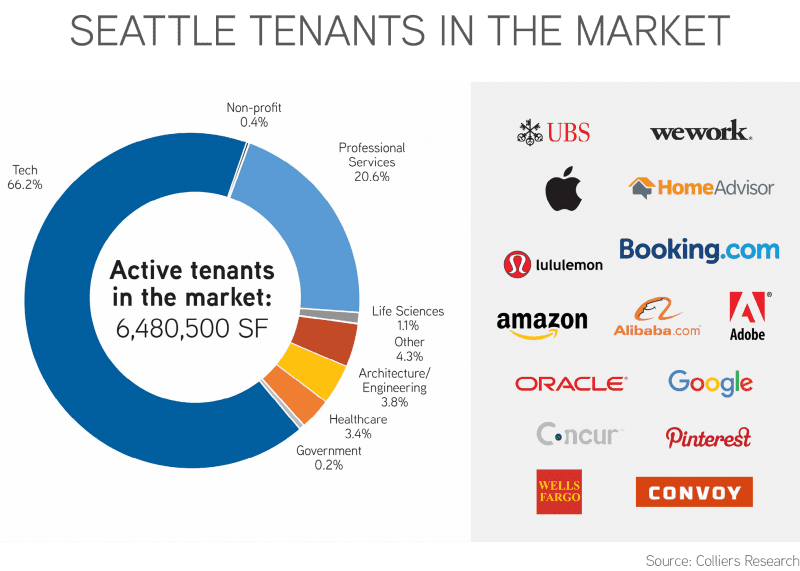

Demand Still Driven by Tech

Although the logos may change, demand for office space in Seattle is consistently driven by heavy tech, which accounts for 66% of demand today. This (of course) includes big tech, but over the last few years we’ve also seen demand growing from “maturing tech”: companies that have had some successful rounds of B or C funding, and might be a 10,0000 or 20,000 SF tenant ramping up to become a 40,000 or 50,000 SF tenant.

There’s a lot of home-grown talent, but there’s also a significant amount coming out of San Francisco and the Bay Area, as well as other tech hubs like New York and Boston. Even though Seattle office rents have climbed 13% since this time last year, our pricing still pales in comparison to San Francisco.

Are We Creating New Jobs?

Of the new leases that tenants are signing, many have not moved in yet, and some of the space is still being built. Although there will be some lateral movement among Seattle employees, of the 30,000 jobs that these new leases equate to, a significant number of them will be filled by new people moving to the Seattle area.

Current & Future Office Supply

In this market, we’ve already had 14 million SF developed, with six million SF currently under construction—of all this, 85% is already accounted for. The pipeline for office development is 1.7 million SF, and although just 6% of that is committed to, that’s typical for our market: we don’t do a lot of pre-leasing. We’re currently at 5% vacancy without any real product delivering until 2019, and the pipeline beyond that is a little slow. We’ll see some office developments delivering in 2021 and 2022, but rental rates are going to continue to rise on the office side.

Potential threats to the future of the Seattle office market include:

- Global economy

- Local political climate

- Transportation

- Cost of living

Multifamily Market Dynamics Panel

While we avoided the question of “Which inning are we in?” for the current market cycle, our panelists—Walt Smith, Jonathan Manheim, Chasten Fulbright, and Brian Runberg—analyzed what they are currently experiencing in the market (both good and bad), and how their strategies are changing compared to the last 5-7 years.

What’s Slowing Down, What’s Going Strong

Although newer neighborhoods that have been delivering a lot of product recently (South Lake Union, Westlake, Downtown) are facing longer lease-ups and flat effective net rents in A product, “character neighborhoods,” as described by Chasten, such as Ballard and Capitol Hill, are still strong.

For neighborhoods like South Lake Union and Westlake serving the tech sector and people moving from out of state, an incredible amount of high-rise and highly-amenitized product is coming online, making it hard for small or mid-sized buildings to keep up and maintain stabilization.

Contrast this with a boutique neighborhood like Eastlake that doesn’t have a lot of new product, and lease-ups are still currently possible without any concessions. Additionally, B and C product in the city is still experiencing 2-5% effective rent increases this year.

In suburban markets such as Everett, Kitsap County, and Kent, we are still seeing rent increases of 4-6% this year with moderate or no concessions—even without renovating the units.

Trends for Success: Flex Space for Residents

There’s a paradigm shift in how people are living—and working, as well—and whether residents are Millennials or not, people feel most fulfilled in environments that have a sense of authenticity.

Brian introduced a metric showing that the number of telecommuters in the US is equal to the number of people commuting by mass transit. In the last five years, the statistic increased by 5% and that number is going to continue to climb as the demands on our infrastructure grow. The lines of home and office have been blurred, and we need to re-think how we blend these uses in new buildings.

“I go into buildings now that look like I’m walking into WeWork,” expressed Walt.

The general panel consensus was that people are okay living in a small space as long as they have somewhere else to entertain or work. It’s crucial to incorporate spaces that match the lifestyle of the building’s micro-demographic.

While lighter remodels on ten-year-old product have been challenging because they can’t quite compete with A product from an amenities standpoint, some of the best opportunities still lie in turning a C asset into a B asset and seeing a 20%-30% return.

Trends for Success: Changing Demands in the ‘Burbs

There has been a huge paradigm shift as developers expand outside the core to areas where rent growth is still strong or follow the East Link Light Rail transit corridor.

Jonathan noted that people who live in the suburbs want most of the same things as people who live in the city. Suburban units may still be larger than what we develop in the core, but those who are leaving the city due to affordability want the same amenities and high-end finishes (condo specs are now the new high-end apartment spec—there is very little difference between them these days).

Additionally, the suburbs are still pet crazy—the city is as well, but you have more real estate out in the suburbs to put in dog parks, pet washing stations, etc. In the same vain, some developers are experimenting with fencing in some of the green space outside of first-floor units and charging more for the additional space.

Keep An Eye On…

- Proximity to transit (did anyone say East Link?)

- The impact of new buildings opening near stabilized buildings: you’re going to feel it a bit

- Staffing: labor shortage and growing salaries

- Construction costs outpacing rents and other expenses: as developers are analyzing new opportunities, architects are taking feasibility studies beyond just a test-fit, and are engaging contractors in real time to get immediate feedback and early pricing

The headlines we continue to see splashed across the front page of the Seattle Times about rent growth may make you feel like the sky is falling, but in a town full of tech startups, it should be clear that we’re just pivoting and there are numerous opportunities left in the Puget Sound apartment market. In the wise words of Walt, “We’ll go through a little pain Downtown, but outside of that, it feels like the next twelve months are still going to be pretty good.”

Please give us a call to discuss your plans and goals for 2019. Whether you are considering selling your apartment building, buying more apartment buildings, or simply trying to optimize the portfolio of apartments you currently own, we can help.

Call us for a valuation and to discuss how we can work together.

Allow us to Turn Our Expertise into Your Profit!