The wait is over—Colliers’ Seattle Multifamily Team is thrilled to announce the release of our 2018 Seattle Neighborhood Apartment Market Study!

An encore to our market study released in February that focuses on buildings with 50+ units, the Neighborhood Market Study addresses 5-50 unit apartment buildings in urban King County. The data and insights on the fundamentals driving local growth are intended to guide wise and profitable investment decisions.

Whether you currently own a 5-50 unit building or not, this segment is worth watching as the current market cycle matures and 50+ unit buildings continue to feel the impact of a large supply pipeline after years of exponential growth.

In this post, we explore the opportunities that smaller, boutique buildings have to offer investors:

- Runway for rent growth and low vacancy rates

- Increasing sales prices with consistently low cap rates

- Predictions for sales and rent in urban King County’s neighborhoods

1. Rent & Vacancy: Bigger Isn’t Always Better

We made our feelings known earlier this year when we rebuked the misguided news articles about dropping rental rates during the annual winter leasing doldrums, but if you know anything about us, you know we like to get granular and continuously dig deeper to see where opportunities lie in the Seattle market.

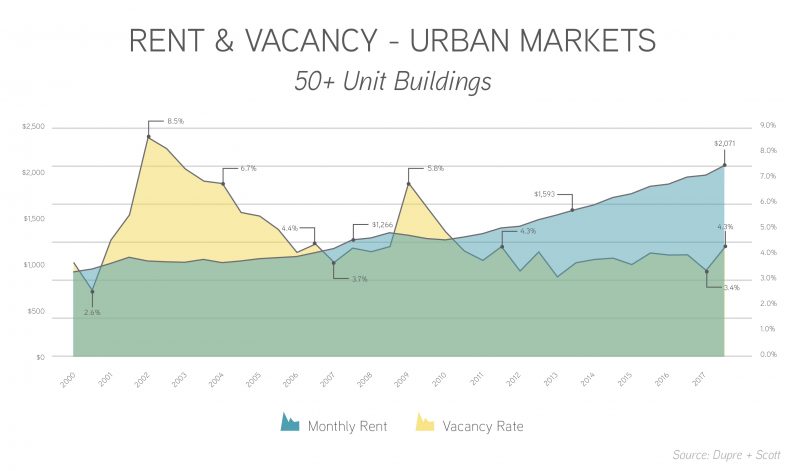

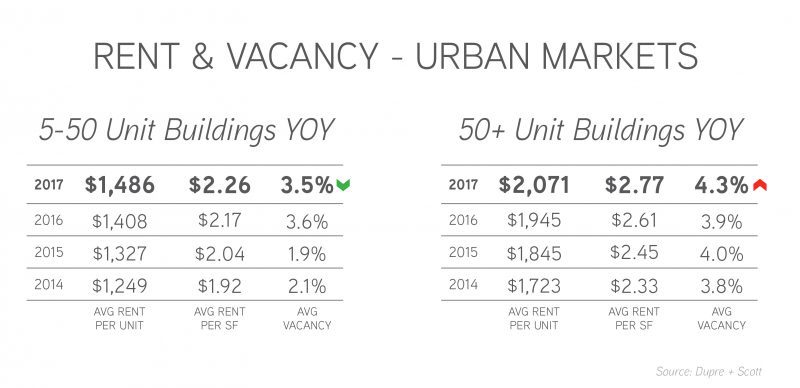

Rent growth is still moving in the right direction and is outpacing historical expectations. However, when you start to study the data of 50+ unit buildings in urban markets, you will see that year-over-year growth in this segment slowed—which shouldn’t come as a big surprise so late in the market cycle. It’s also important to note that the average rental rate for these larger buildings was over $2,000 per month in 2017.

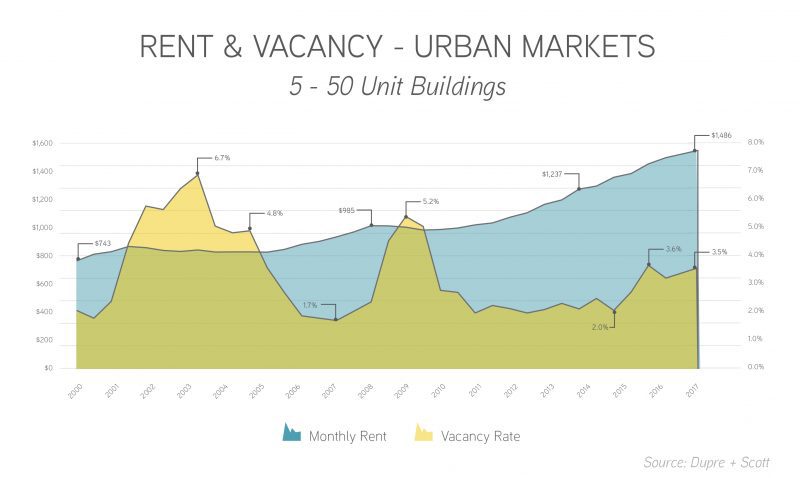

Currently, the most opportunity for growth lies with smaller 5-50 unit buildings. It has less to do with the size of the building than with the style of management by many owners. Small operators are prone to forego rent increases to keep their buildings full, which is good for renters, but artificially depresses rental rates.

As a result, average rents in boutique buildings remain a much more affordable option in Seattle, sheltering them from the hyper-supply of new class A apartments. With a $500 buffer in average rents, smaller apartment buildings will continue to outpace 50+ unit buildings in rent growth, with a long runway for upside.

The relative affordability of 5-50 unit buildings lead to a decrease in vacancy by 10 basis points in 2017, while vacancy in 50+ unit buildings increased 40 basis points year over year. The vacancy rate differential also shows that there is plenty of upside investing in boutique buildings.

When talking about affordability, it comes down to gross rents, not rent per square foot. No amount of amenities or modern finishes in new, large buildings will be able to offset the 40% difference in price. Boutique buildings are comfortably running the marathon and have no need to compete in the sprint.

2. Sales: The Next Frontier

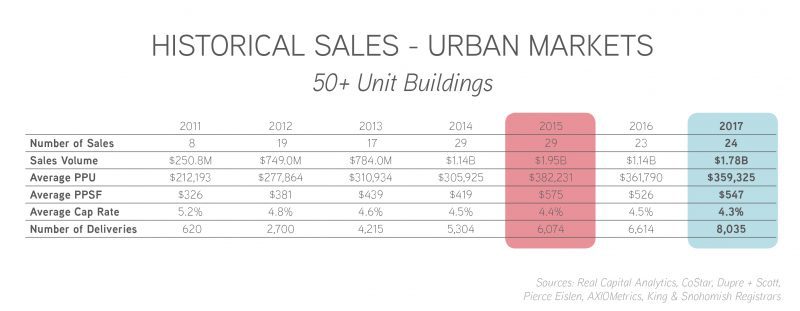

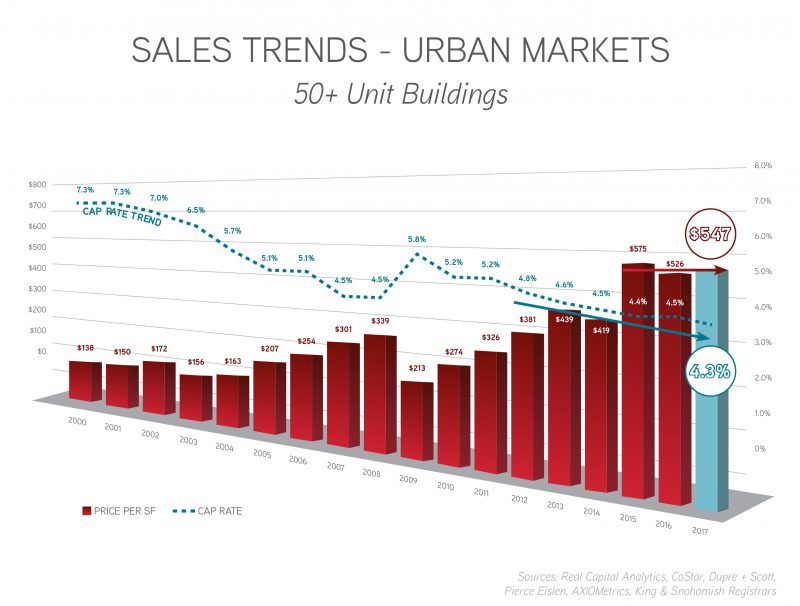

Cumulatively, 50+ unit buildings saw the peak of investor activity in 2015, and although there won’t be a huge drop off in value, there is more moderation in this market sector.

Price per square foot is still quite high, particularly for brand-new product, but without the astronomical growth we’ve experienced year over year. Additionally, 4%-range cap rates are great, but it remains to be seen how interest rate hikes will affect them.

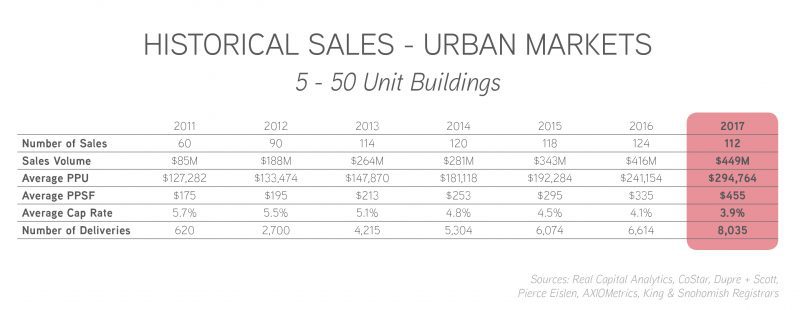

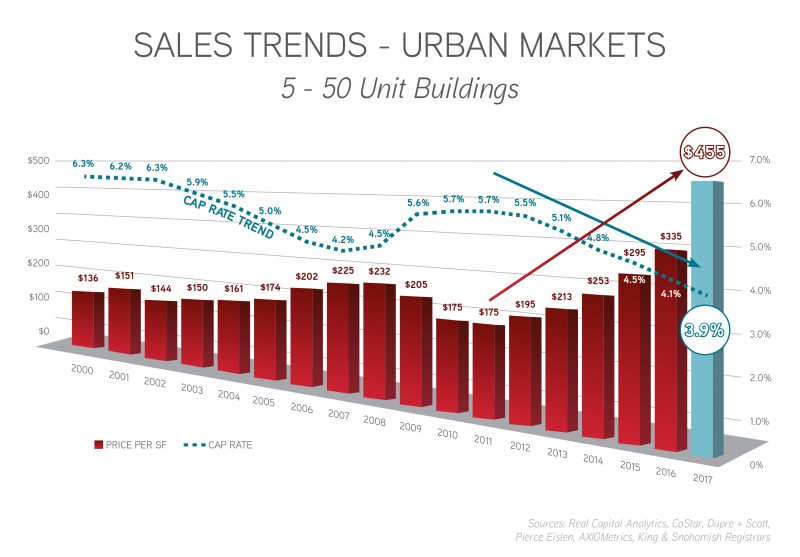

The smaller apartment building segment may not have peaked yet, having just posted the highest sales volume for this market cycle in 2017. This sales market is supply constrained, and owners considering a sale in 2018 will be rewarded for a timely exit.

Looking at trends in the data for this sector, there is no question that pricing of 5-50 unit buildings ramped up in 2017. Cap rates compressed even lower, while price per square foot rocketed up 38%. This is driven by multiple factors:

- Constrained supply of listings

- Record pricing for new developments

- Resale of value-added apartments

- Rent growth potential

3. Neighborhood Highlights: Playing Your Cards Right

Although the overall trends of 5-50 unit apartments in urban King County are impressive and important, understanding the dynamics of individual neighborhoods is crucial to making wise investment decisions.

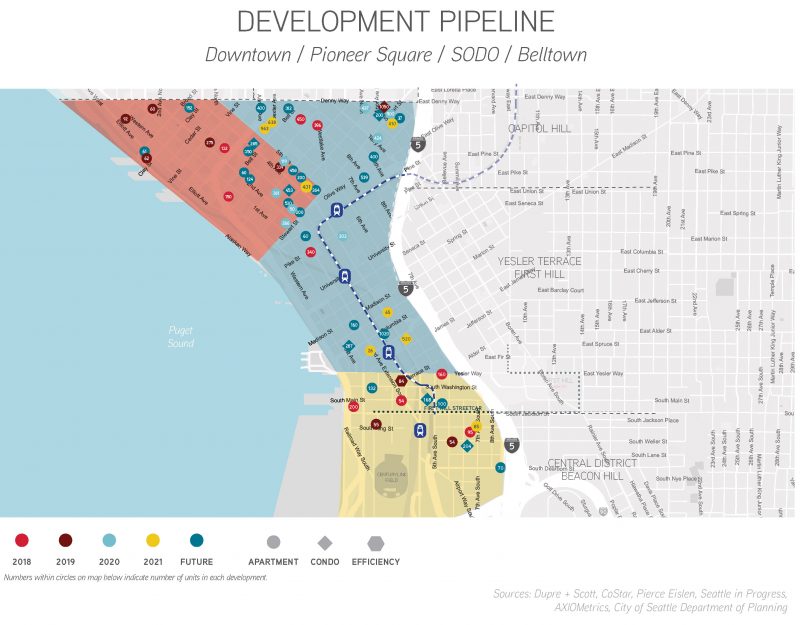

Downtown / Pioneer Square / SODO / Belltown: The supply and rental rates of new product escalated considerably, benefiting 5-50 unit buildings, which now boast the highest rent per square foot and second-lowest vacancy in urban King County. Owners in these markets continue to benefit from the abundance of investment capital and market growth as they draft off top-of-the-market apartment rents.

Capitol Hill: 5-50 unit investors have spoken—Capitol Hill is the most expensive neighborhood to invest in, posting a 3.6% average cap rate for sales in 2017. Owners in Capitol Hill continue to see a long runway for rent growth in vintage apartments, as they draft off peak rental pricing of newly-constructed apartments. In 2018, Capitol Hill will remain a strong sellers’ market with similar sales volume and pricing.

Queen Anne: Queen Anne was the top market for apartment sales volume in 2017. Investors and renters alike love this market, indicated by continued rent growth, steady sub-4% cap rate sales and a 20% increase in the development pipeline. In fact, even in the depths of the last downturn, Queen Anne never averaged above 5% vacancy—an impressive feat that speaks to the low volatility of this premier neighborhood.

Eastlake: Boutique buildings that sold in Eastlake in 2017 averaged seven units and were built in the ‘50s, but they rivaled brand-new construction pricing at an astounding +$400,000 per unit and +$500 per square foot. With South Lake Union growth pouring into the Eastlake market, owners will reap the rewards as their properties continue to outpace the market in appreciation and sales value.

Additional insights and granular data for every neighborhood in urban King County are available in our Neighborhood Market Study.

Join Us On the Leading Edge, It’s Where We Live

Without innovation, good things come to an end. Seattle’s commercial real estate market is changing, and it’s up to us to keep a close eye on where the next big opportunity is—finding runway in the apartment market this late in the cycle is promising for both our industry and our region as a whole. For a closer look at the data behind apartment buildings with 5-50 units, download the 2018 Seattle Neighborhood Apartment Market Study today!

Please give us a call to discuss your plans and goals in 2018. Whether you are considering selling your apartment building, buying more apartment buildings, or simply trying to optimize the portfolio of apartments you currently own, we can help.

Call us for a valuation and to discuss how we can work together.

Allow us to Turn Our Expertise into Your Profit!