Last week, we discussed how apartment investment sales in 2017 compared to previous years in our post Apartment Sales: How Did 2017 Stack Up? A few weeks prior, we looked back on both the apartment and office markets in Seattle and the Puget Sound over the previous decade, hypothesizing that In 2018, Seattle Will Prove Its Mettle. Beyond our opinions, and the facts and figures informing them, what do the experts say?

Our friends at Vulcan Real Estate are here to help!

Each year, they perform a Seattle Real Estate Investment Survey, diligently collecting survey responses from industry experts across multiple disciplines. The compilation of results is both quantitative in the form of polled responses, and qualitative in providing thoughts and opinions on the state of the Seattle commercial real estate market.

Seattle Apartment Investment Market

The Seattle apartment investment market is one of the most watched – and admired – markets in the nation. What do local experts say? They agree it’s a hot market with growth potential remaining on the horizon.

Regarding the health of the apartment market, a majority (82%) of responses fell into the category of “balanced” and “under-supplied.” This was a positive shift from 76% of respondents who selected those categories in 2017.

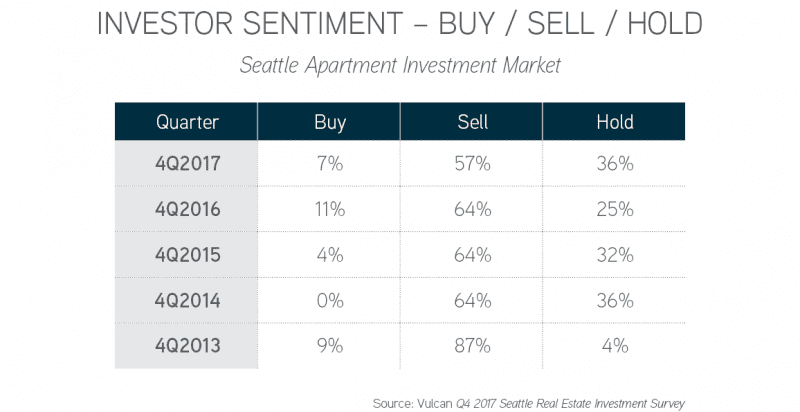

When it came to a decision of Buy / Sell / Hold, a majority of respondents chose a “Sell” strategy, which from the results of previous years shows an overwhelming number are net sellers.

However, a year-over-year shift from “Sell” to “Hold” proves stable, if not increased, investor confidence in the Seattle apartment market.

What are the expectations for sales metrics and how are investors modeling sales scenarios? Here is a quick summary of survey responses:

• 79% expect capitalization rates to remain constant

• 68% selected a 50-basis point spread between going-in capitalization rates and terminal capitalization rates

• 1% to 5% is the expectation for year-over-year rental rate growth (down from last year)

Overall, results from survey responses lean towards stability in the apartment market, with a near split between sell versus buy / hold strategies. Looking at the last four years of survey results demonstrates a definite trend of confidence in the Seattle apartment market.

Seattle Office Investment Market

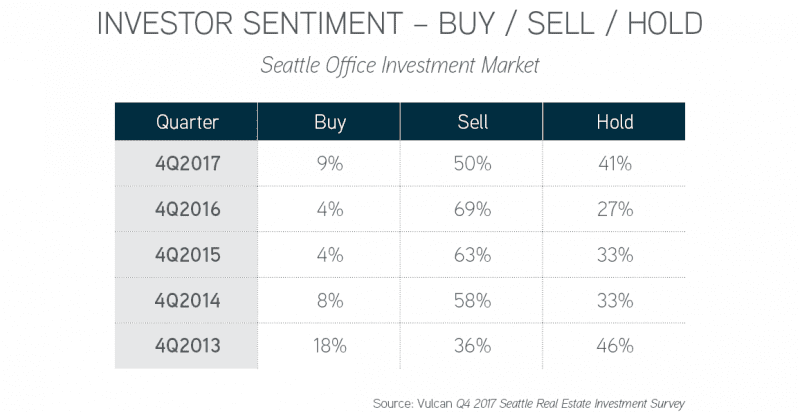

Survey responses on questions related to the Seattle office investment market evidence even more balance. As the table below demonstrates, for the first time in the last four years, there is an exactly even split between sell and buy / hold strategies.

The majority of survey respondents (61%) view the office market as balanced, 29% view it as “under-supplied” and only 10% view it as “oversupplied.”

The last four years of survey results indicate a broad spectrum – and deviation – of confidence in the office market year over year. There is a caveat in the publication of survey results: responses were collected prior to Amazon publicizing a hiring freeze in December 2017. However, given the overall strength in hiring, as well as extremely strong absorption of office space in the downtown Seattle and Bellevue markets, an increasing confidence in the office investment market is not surprising.

What Is on the Horizon

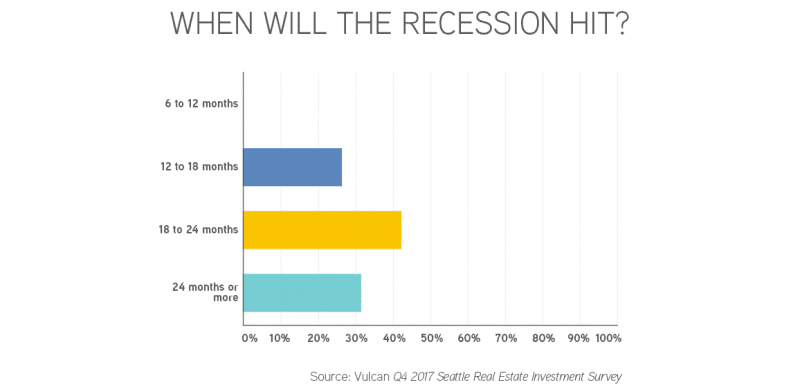

There is no question that the industry has grown tired of the analogy comparing the duration of market cycles to innings in a baseball game. The question of a market adjustment is now asked as more of a quantification of time in which we can expect a shift in market dynamics.

This past week, local economist Chris Mefford suggested that Seattle may buck the boom-bust cycle this time. Those who know Chris understand that his analysis is much more granular than a binary result of yes / no to economic cycles – especially for commercial real estate. Similarly, those in the commercial real estate industry may just be too pragmatic to ignore market cycle analysis.

According to respondents to Vulcan’s survey, although a recession is not imminent, nearly 70% are forecasting that one will arrive by 2020. The most optimistic set of respondents forecast a market adjustment will occur no earlier than two years from now.

A special thanks to Vulcan for permission to summarize survey results and for providing valuable industry insights.

Our Crystal Ball

We too are hard at work analyzing both the economy and the Seattle / Puget Sound commercial real estate market. We are currently putting the final touches on a volume of research on the local economy and the Seattle / Puget Sound apartment market, which will be published shortly.

In the interim, please give us a call to discuss your plans and goals in 2018. Whether you are considering selling your apartment building, buying more apartment buildings, or simply trying to optimize the portfolio of apartments you currently own, we can help.

Call us for a valuation and to discuss how we can work together.

Allow us to Turn Our Expertise into Your Profit!

Post Script: I would like to provide a very special thanks to Lori Mason Curran of Vulcan Real Estate for her diligence in preparing Vulcan’s survey year after year, and for the privilege of participation.