The topic of apartments permeates Seattle news headlines these days. One article espouses that the boom is soon-to-be-over with escalating vacancy rates, while the next day the Seattle Times reports record absorption of new apartment units newly delivered to the market.

Which way is up? Or more importantly, where should I invest?

It is in times like these I turn to one of my favorite quotes popularized to the great Mark Twain (yet truly coined by British Prime Minister Benjamin Disraeli), “There are three kinds of lies: lies, damn lies and statistics.”

News headlines and statistics are great. Yet, what I truly prefer is targeted, granular research!

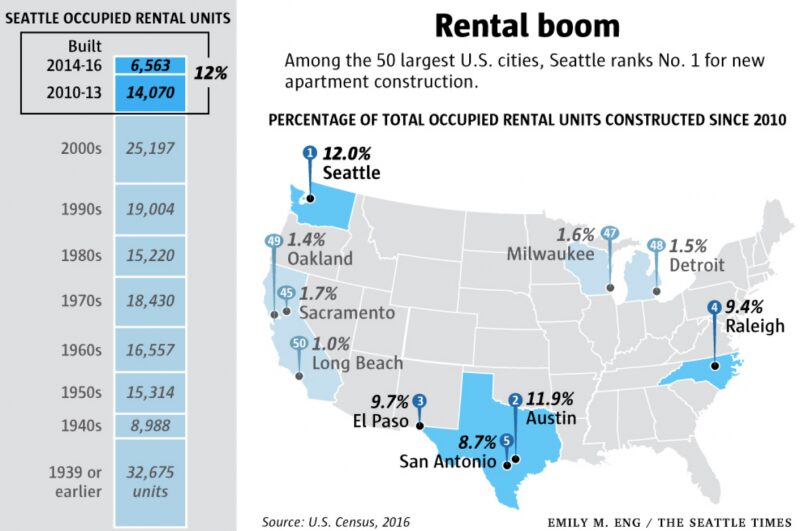

Yes, it is true that the Seattle/Puget Sound area is in the midst of one of largest apartment development cycles in the last three decades. The market experienced the delivery of over 45,000 rental units since 2011 – all with the prospect of over 55,000 more apartment units slated for delivery in the next 5 years. Such growth earned Seattle the ranking of #1 in the nation for new apartment development.

This distinguished honor is coupled with recent reports that also highlight rising vacancy rates across the region.

Is the boom over? Will vacancy lead to falling rental rates?

I contend that not all vacancy is created equal.

Real estate is a local business – and discussing generalities in Puget Sound (or even Seattle alone), is not granular enough. Amidst the development boom – and decries of rising vacancy rates – are markets nearly unscathed from new development and spikes in vacancy rates. The wise investor must take a more granular look at each market.

Moderate Rent Growth, Moderate Vacancy Increases

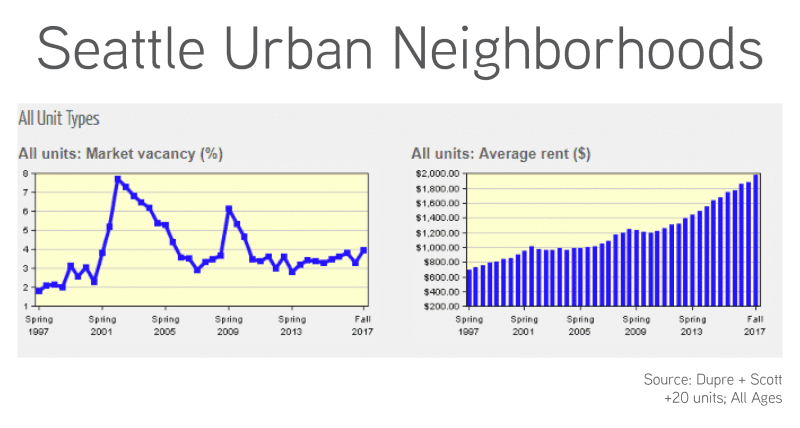

Since the beginning of the current economic expansion cycle, headlines focused on the urban-core of Seattle. As a darling market since 2012, Seattle’s urban neighborhoods continue to grow rental rates while maintaining sub-4% vacancy year-over-year since 2010.

Yet, as these markets touch 4% vacancy, journalists and pontificators pile-on to the zeitgeist of late-innings market cycle fear mongering. Yes, rent growth moderated to 6.5% growth year-over-year in these neighborhoods. Considering cumulative growth of 61.6% since 2010, I’d say we are still living in bull-run territory.

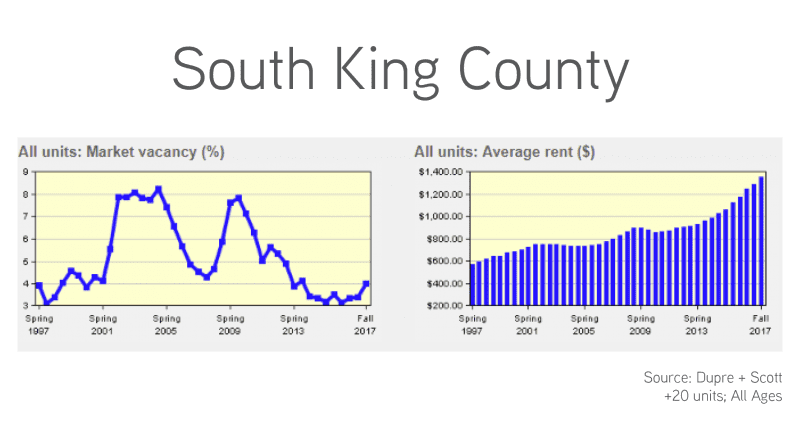

High Rent Growth, Moderate Vacancy Increases

The entire South-end markets of King County continue to perform exceptionally well. These markets are not quite touching 4% vacancy (3.99% to be exact), yet year-over-year rent growth from Fall 2016 to Fall 2017 is 9.2% — which is remarkable.

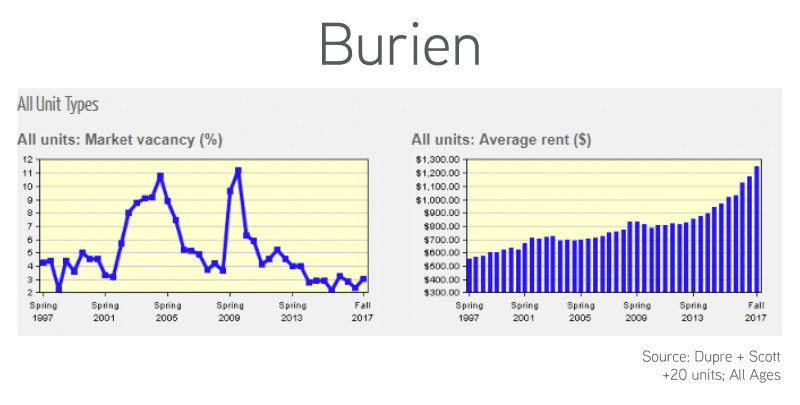

High[er] Rent Growth, Sustained Low Vacancy Rates

For those readers thinking that the direction of this post is highlighting the market least affected by slowing regional growth, you couldn’t be more wrong. There are markets truly bucking any trend of a slow-down.

Admittedly not a contender for capturing much of any apartment-related headlines in the last 5 years, Burien remains a truly stellar market. It’s vacancy rate rests at 3.1%, with year-over-year rent growth of 11.1%.

Its spectacular that annual rent growth in Burien is nearly double that of more popularized neighborhoods throughout Seattle. Additionally, with an average rental rate of $1,250 (36.8% lower than other urban neighborhoods) there is a terrific amount of room for sustained rental rate growth.

Rocket-Ship Rent Growth, Rock-Bottom Low Vacancy Rates

Can you guess which market defeats all others for investment dynamics? With a current vacancy rate of 2.2% and 14.3% rental rate growth year-over-year, Beacon Hill is one of the best investment markets in the region.

Beacon Hill had sub-1% vacancy 3x in the last 7 years and sub-2% vacancy 6x in that same period. Rental rate growth was a bit slower to take-off in the market cycle, yet that punctuates the current opportunity awaiting investors focused on Beacon Hill.

![]()

How to Invest in 2018 and Beyond

The best investors I know follow neither headlines nor the pack. They follow both instinct and granular, supportable research. Investment without instinct is like life without art – less enjoyable and truly lacking inspiration. Granular research is equally important, yet neither research nor gut are effective in isolation.

There is no doubt that the real estate market cycle is growing long-in-the-tooth. As 2018 arrives, we are reaching the 2nd longest expansion cycle the United States ever experienced.

Although most will believe that such conditions minimize opportunity, the pack is both equally right and equally wrong. As others metaphorically “run for the hills”, now is the time for the prescient investor to seize opportunity. Give us a call and allow us to Turn Our Expertise into Your Profit!