For those of you closely following news headlines, earlier this week you woke to the startling headline “Apartment vacancies climb in Seattle and the Puget Sound”. Dupre + Scott published its latest bi-annual rent and vacancy data and journalists took to their keyboards decrying a seven-year spike in vacancy!

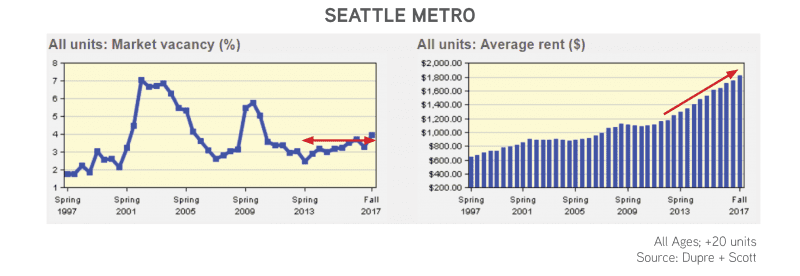

To show the heralded carnage in the rental market, take a look at the following graphical representation:

In Seattle, our great spike in vacancy was coupled with 7.3% year-over-year rent growth – bringing cumulative total rent appreciation for the last 6 years to 57% — an average of 9.5% year-over-year. Concurrently, developers added nearly 29,000 units to Seattle’s inventory – an inventory gain of 58%. I think we can all take a collective breathe and again pinch ourselves that we are in Seattle!

As with the analysis of all data, it is best to take a granular approach and measure that which is most important to the task at hand, and apropos of conclusions one is attempting to discern. To that end, the following series of analysis explores the following rent versus vacancy dynamics:

- New Construction in Seattle

- Older Stock of Buildings in Seattle

- Older Buildings outside of Seattle

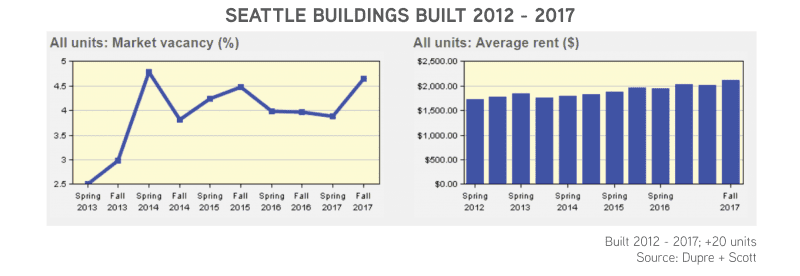

1. New Construction in Seattle

In the current expansion cycle, 2012 truly marked the start of our most modern, new apartment buildings. The following analysis measures the performance of buildings delivered to the market between 2012 and 2017.

Rental rates for this cohort of buildings actually dropped in each of the previous two periods of spring that were measured (2016 and 2017, respectively) – yet rose each of the following fall periods measured. Because these buildings are so new, and thereby directly compete with other new buildings, there is much more volatility in vacancy rates.

Overall, rental rates rose over the last 5 years by a cumulative amount of 23.9% — yet, keep in mind that rental rates for new buildings started at a nearly $400/month premium (or 30% higher) than the existing stock of buildings at that time. Year-over-year, rental rates grew 4.6% (compared to 7.3% for the overall market).

It again bears consideration that this modern subset of buildings not only are sustaining a sub-5% vacancy rate, they collectively grew rents year-over-year while competing with a deluge of additional high-end, modern units.

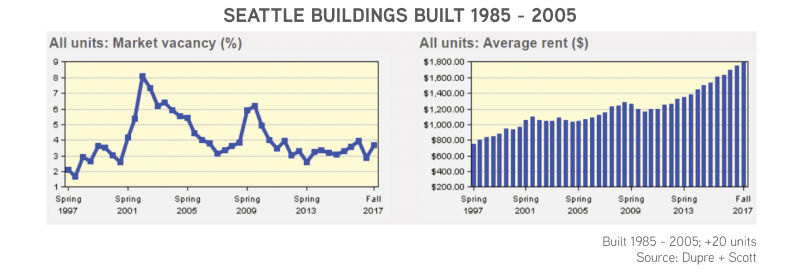

2. Older Stock of Buildings in Seattle

Shifting our analysis to a cohort of older buildings in Seattle produces an entirely different set of data, however, the results in performance are not staggeringly different.

In this data set, vacancy grew at a cumulative pace of 34.7% over the last 5 years – equating to overage rent appreciation of 6.9% year-over-year. Yet, measuring the last year of growth shows only 5.5% growth – pretty close to that of newer buildings.

What conclusions can be drawn from such analysis? Primarily, a homogenization of rent appreciation is occurring across all ages of buildings. As more and more owners are raising rental rates (whether based on upgrades, or trying to keep pace with expenses), the capacity for growth is hitting a point of equilibrium (at least for now).

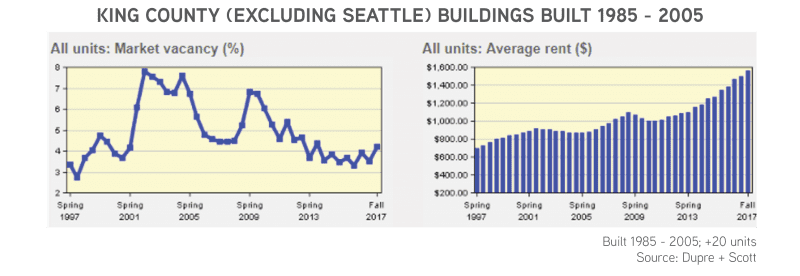

3. Older Buildings outside Seattle

Finally, we took a look at the same age cohort for older buildings (1985 – 2005) and measured growth across King County, yet outside of Seattle.

Proving that not all markets are yet homogenized in growth, this cohort of buildings experienced cumulative 5-year rental rate growth of 43.8% — which equates to 8.9% year-over-year (for 5 straight years!). Over the course of the last year, growth slowed a bit, to 6.0%, showing that this market segment is not immune to years after year of massive appreciation.

Across all of these market segments, vacancy is still just a touch over 4% — proving a very healthy market.

A Look Towards the Future

As the current market cycle continues to mature, taking a granular analysis of rental rates versus vacancy rates – and including supply considerations – will prove essential to staying ahead of the market. Look for further updates from us in the coming months and give us a call to discuss your specific investments and investment goals.

Allow us to Turn Our Expertise into Your Profit!