The first quarter of the year typically sets the pace for the rest of the year, and so far 2017 is on a great track! Once more Seattle and the Puget Sound region is outshining the nation economically –more cranes, higher apartment rent growth, and rapidly expanding economic conditions!

Nationally, 1Q GDP missed its mark, growing at an annual rate of only +0.7%, the slowest pace of expansion in three years. Consumer and government spending lapsed, and the Federal Reserve signaled that it would not raise interest rates in the short term, or at least until growth was more certain.

By contrast, the Puget Sound region reported sterling regional economic fundamentals during the first quarter of 2017. If you didn’t already believe that Seattle is a sweetheart apartment investment market, taking a snapshot of 2017 will certainly prove the case.

Here are 5 trends to watch as 2017 develops:

- Studio and one bedroom apartments leading in rental rate growth

- Vacancy rates tapering in 5-50 unit buildings

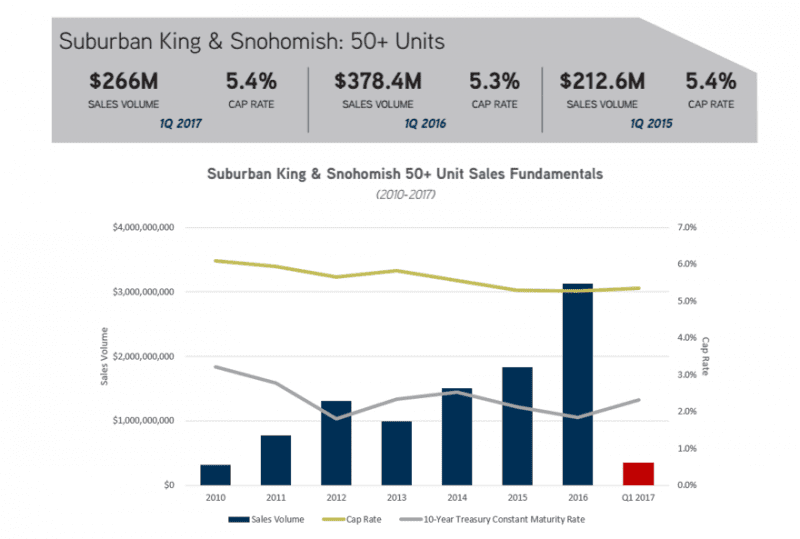

- Sales volume lower y-o-y in 50+ unit sales, but PPU increasing

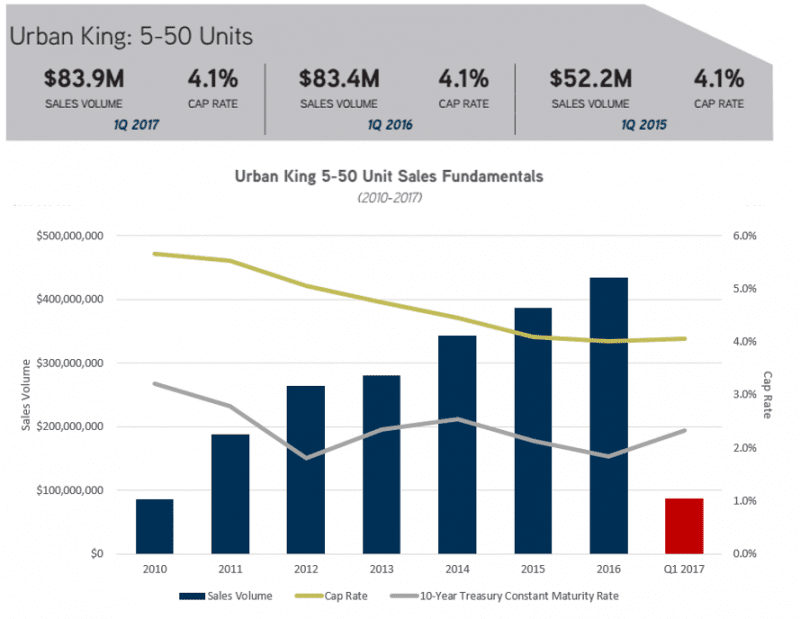

- 5-50 unit buildings poised for another banner year of sales

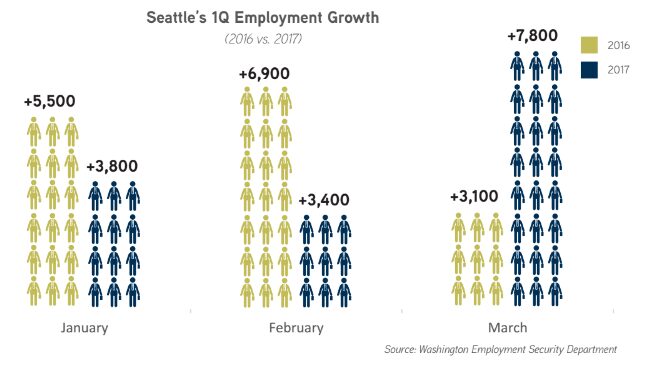

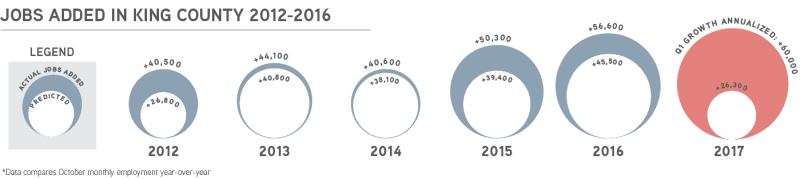

- Job gains off to a slow start, yet on pace with 2016

1. Studio and one bedroom apartments leading in rental rate growth

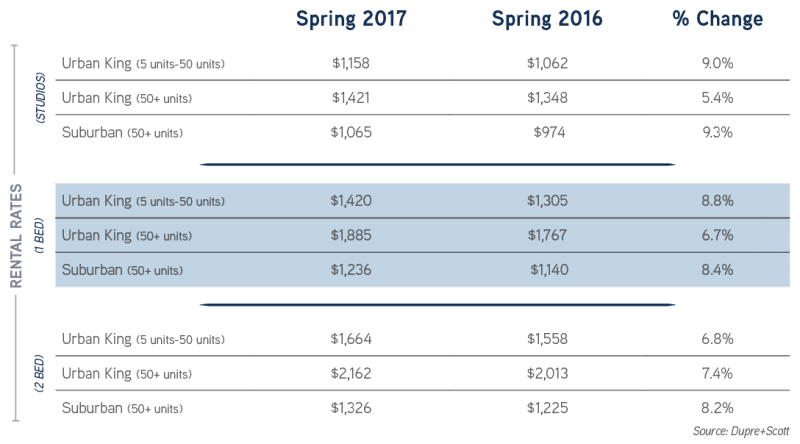

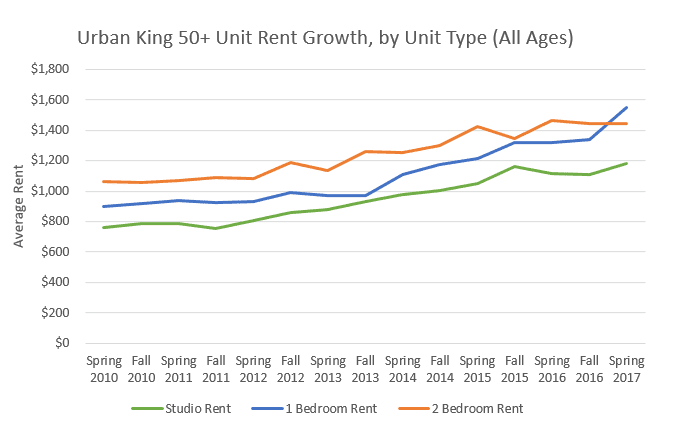

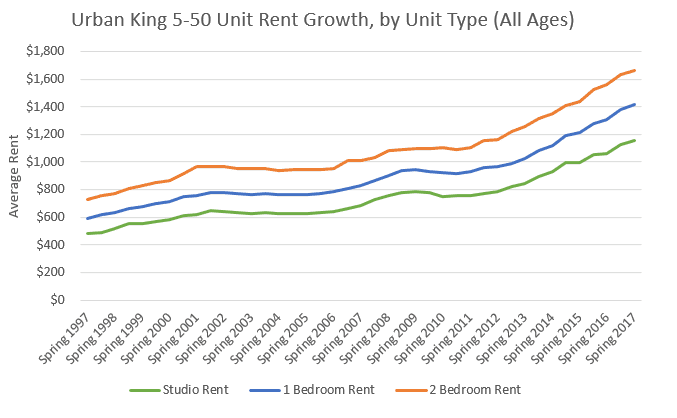

In the first quarter of 2017, studio and one bedroom units saw higher rental rate growth across all product sizes, urban and suburban. Studio units in 5-50 unit buildings in Urban King saw rental rates increase by 9.0% year over year, and one bedroom apartments increased by 8.8%, while 2 bedroom units only saw increases of 6.8%.

This rent growth could stem from true demographic shifts in the renting populace, but it’s more likely that it comes from the injection of new, higher-end studios and one bedroom units in newly delivered apartment buildings.

Developers building luxury apartments in South Lake Union and Downtown are more likely to target the stereotypical single Amazon techie with disposable income than families or roommates who need the extra bedroom. Comparing rent growth in 5-50 unit buildings vs 50+ unit buildings reveals that larger product is indeed driving this trend:

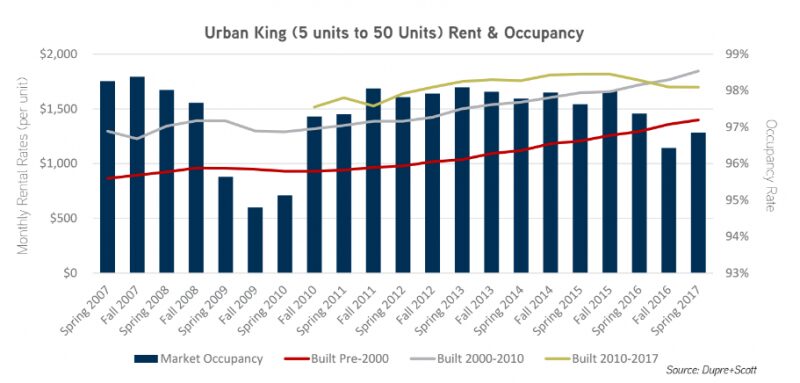

2. Vacancy rates increasing in 5-50 unit buildings

In smaller buildings, vacancy rates increased by 60 BP compared to Q1 2016, although at 3.2%, vacancy rates remain healthy for the market – especially considering the volume of new apartments delivered to the market in the last several years. Increased vacancy for this segment of the market is expected considering the rent gap between smaller, older buildings and the newer high-end product. Expect vacancy rates to rise in 2017 as landlords push rent rates in order to reckon with high property taxes.

3. Suburban sales continue to impress

While 2016 was truly a banner year for suburban sales volume (nearly $2B in annual sales volume) the market shows no signs of cooling down. While there were fewer total sales in 1Q 2017 and sales volume was lower, average price per square foot and price per unit increased year-over-year. The cap rate has remained steady over the past three years, keeping pace with treasury rates.

Investors are demanding yield, and the rising rental rates in the suburban markets will remain an attractive lure in 2017. The question is whether owners will choose to sell in 2017?

4. 5-50 unit buildings poised for another banner year of sales

5 to 50 unit buildings within Seattle’s urban core are still the quiet darlings of the market – 1Q sales volume is up 11% year-over-year, despite having half the total sales of 1Q 2016. Average pricing on a PPU basis topped $300,000, and the average PPSF headed north of $425 square foot.

These impressive sales metrics prove that we’re not the only people who have noticed the rising rents for older, smaller buildings – and higher rents means higher NOI, which is music to investors’ ears.

There is an extreme amount of capital in the market chasing opportunities to buy smaller buildings in Seattle’s urban core. Whereas institutional capital is more impacted by national sentiment and global uncertainty, private investors need to place capital. Expect pricing for smaller building to continue its escalation in 2017.

5. Job gains off to a slow start but on track with 2016

Employment growth was a bit sluggish to kick off the year, and it’s possible that many employers were pressing the pause button until they had a better sense of our new political and legislative climate before investing in new hires. In March, however, the greater Seattle area added 7,800 jobs, more than double last year’s March hiring.

Despite a slower 1Q, the region is still on pace to exceed 2016’s employment growth, and we’re still beating U.S. growth rates. Total Seattle employment grew 3.4% year-over-year in March, compared to only 1.5% at the national level for the same time period.

Seattle’s Cinderella story as an apartment investment market found its beginning by rapid job growth in the post Great Recession era. To the surprise and delight of economists and real estate investors/developers, such growth continues with no end in sight. Trees don’t grow to the sky, yet in a market powered by a company such as Amazon, maybe economic overgrowth IS the correct analogy!

To discover more 1Q trends & analysis, you can access our full 1Q SMT Report here. We are the experts in apartment brokerage in the Seattle & Puget Sound markets – call us with questions about the study, or to discuss the potential value of your property. Turn Our Expertise into Your Profit!