Today marks Day 10 of post-election new world order, both in the United States and the global stage of inquisitiveness and circumspection. Every four years the United States conducts an “unprecedented” election – we outperformed this go-round!

Setting aside monumental looming social uncertainties, a focus on near-term and long-ranging economic forecasting remains equally uncertain. Pundits far from agree on what a Trump presidency and GOP run Congress will bring. Not since 2009 – 2011 has the country experienced a Republican controlled Congress and Republican (elected) President.

In changing, frothy and uncertain economic times I often look to Sam Zell’s sentiment on the economy and commercial real estate. Not admittedly a voting Trump supporter, Zell believes that Trump may lead the US to +3% economic growth [CNBC Zell] – something not achieved through nearly a decade of low interest rates and $3.5T in quantitative easing.

Regardless, the fate of commercial real estate investments hinge on growth. The source and sustainability of growth is rooted in a litany of interrelated factors, some domestic and others foreign. Both intended and all too often unintended.

The question of the moment remains the actual direction of presidential policy on a wide swath of fronts – and the question of what was said on the campaign trail versus what will survive January 20th.

When it comes to the apartment investment market in Seattle and the Pacific Northwest, what can we expect?

Treasury Rates & Inflation

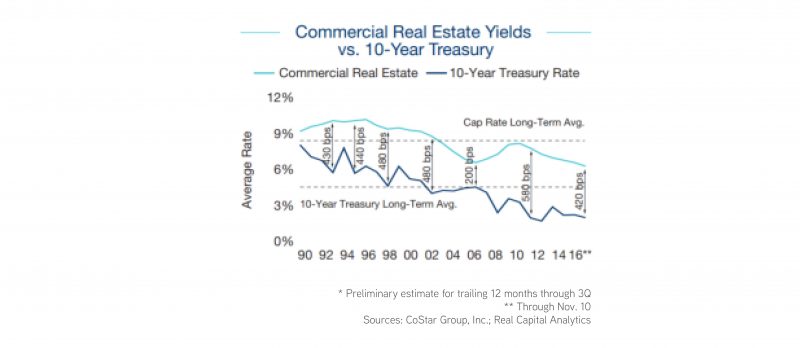

Commercial real estate likes few things less than uncertainty – and we are in uncertain times. In the last 60 days the 10 Year Treasure rate spiked 60 BP, hitting +2.30% as of this morning. The 10 Year Treasury average since 1962 is 6.3% — approximately 3x its current rate. Upward rate pressure, even if temporary, is pushing us closer to equilibrium.

We don’t have clear direction on Trump’s monetary policy, yet Yellen’s term expires within 12 months of when his begins. Considering a Republican bend towards fiscal conservatism, the dawn of slowly cranking interest rates may have arrived.

If growth ensures, terrific. Regardless, capitalization rates are likely to follow the upward trend of interest rates, as they often do.

Seattle and the PNW has and will likely continue to outpace the nation economically – especially when it comes to job growth and wage inflation. Even in a rising rate environment – and possibly commensurately rising capitalization rates – a tight apartment market ensures investor demand, which always places downward pressure on capitalization rates.

Immigration Policy

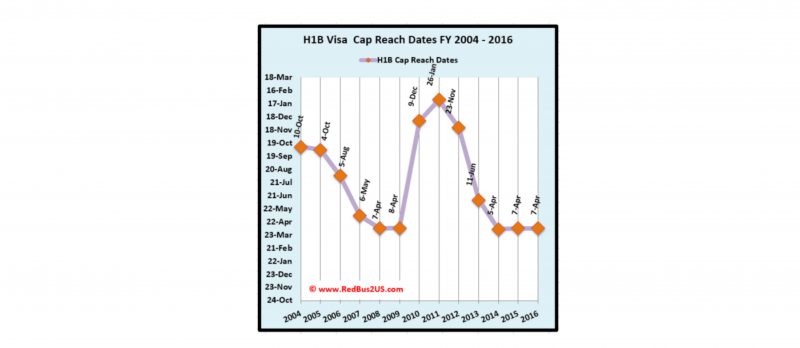

Employment growth in the Silicon Forest, as Seattle is often called, continues in rise in the technology sector – with other sectors rising in the technology tide. The labor pool is vast, and often not local – to the region or the country. Amazon, Microsoft and many other large US based technology companies rely heavily on the H1B Visa program to fill critical roles and continue to innovate. Each year the maximum limit on issuable visas is reached earlier in the year – showing increasing demand for foreign talent.

The result, hiring abroad – in our case it is Vancouver, BC. High wage jobs capable of being filled in the Seattle region are filling in Vancouver. Amazon, Microsoft, Facebook, Tableau and many others continue to grow their presence in Vancouver, and it’s not with home-grown Canadian talent.

SimplyHired shows 35,250 job openings in Seattle, over 2,500 of which are Amazon alone. The quicker we fill those jobs locally the sooner those employee rent, shop and eat in Seattle!

Trade Policy

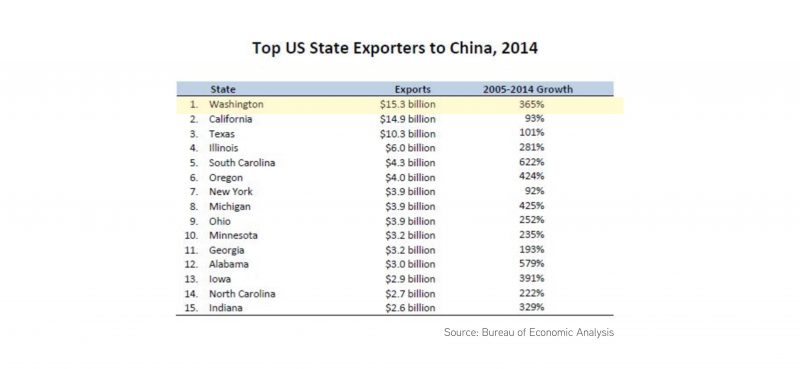

During the election cycle there was much talk about NAFTA and the Trans-Pacific-Partnership (TPP). Without providing commentary on the propriety of either, the fact remains that Washington State is the United States’ largest trade partner with China. The depth of these trade partnerships extend beyond China to many of the remainder of Asian Pacific Rim countries.

US trade policy taking a more protectionist tone may have a disproportionate impact on Seattle and the PNW, especially our thriving industrial ports and distribution centers.

Regulatory Policy

There is broad consensus that many domestic regulatory policies will be removed or greatly reduced. First on the chopping block is repeal of the Dodd Frank Act. Next are regulatory restrictions related to the EPA. Regardless of where one falls on the propriety of less regulation, the result is often more latitude for business and the opportunity for more growth.

When it comes for foreign regulation, there is a strong chance that foreign investment in the United States will become much more highly regulated. The Seattle Times recently reported that Seattle was named as the No. 5 city in the US for foreign investment, with over $4B invested in our market since 2015 [Source: Seattle Times].

Seattle’s economic vibrancy will continue to attract foreign investment, yet if the fundamentals of such investment are impinged by costly regulation, those dollars could subside.

Overall Sentiment

Day 10 simply does not provide enough information to accurately discern what the future of this administration will bring. Speculation is the only certainty at this point. Given that 67% of US GDP is derived from consumer spending – Cyber Monday and Black Friday may be our only near-term litmus test of the electorate’s economic mood!

Would you like to know more about us?

CLICK HERE TO LEARN MORE ABOUT THE TEAM

Understanding both current and future market dynamics is critically important in positioning both your assets and your capital for optimum returns. Our apartment investment sales team, comprised of five highly qualified professionals specializes in assisting apartment investors in maximizing returns.

We focus on representing apartment developers and buyers and sellers of apartment buildings from 5 units to 500 units. Please give me a call to discuss how we can turn our expertise into your profit. – Dylan